Regarding trade defense (TDF), in addition to traditional investigations, in the past 3 years, the United States has seen a marked increase in anti-TDF tax evasion investigations conducted by the US Department of Commerce and investigations into origin fraud and forced labor enforcement conducted by the US Customs.

In addition, in the context of the global economy being in difficulty and at risk of falling into recession, Vietnamese export enterprises are facing an increase in many fraudulent tricks, especially international payment terms... According to information at the online forum "Things to note when exporting to the US market" recently organized by the Department of European - American Markets (Ministry of Industry and Trade), Mr. Nguyen Thang Vuong, Department of European - American Markets (Ministry of Industry and Trade) said: "The US is a market that implements many trade remedies measures , accounting for 24% of the total number of trade remedies cases in Vietnam, with 55/231 cases. The products are diverse, from those with large export turnover that Vietnam has strengths in (wood and wood products, solar panels...), to those with small export turnover (honey, paper bags...)".

According to Mr. Vuong, the developments in applying defense measures from this market require appropriate policy responses, bringing benefits to businesses and export industries.

In addition, data from the General Statistics Office for the first 10 months of 2023 shows that the United States is Vietnam's largest export market with a turnover of 78.6 billion USD, down more than 17% over the same period. In 2022 alone, the United States initiated 12 new investigations, mainly anti-dumping tax evasion investigations (11 cases). The investigated items include steel products, solar panels, wooden cabinets, staples, steel wire, etc.

At the same time, the United States also reviewed a number of previously applied trade remedies, such as administrative reviews of countervailing duties (CTC) on tires and administrative reviews of anti-dumping duties (CBPG) on tra and basa fish.

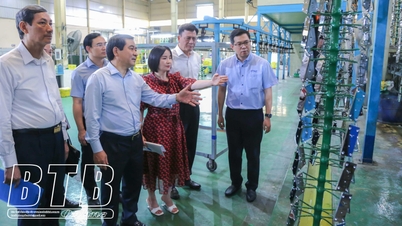

|

| The United States has just received a petition for an anti-subsidy investigation into frozen warm-water shrimp imported from Vietnam - Photo: VNA |

According to Lawyer Nguyen Thi Phuong Thao, Deputy Head of ID Vietnam Law Firm, potential difficulties for Vietnamese enterprises exporting to the United States are increasing, in addition to challenges regarding origin, food hygiene and safety, and defense measures used more by the United States, due to trade remedies being permitted by law.

"The reason why Vietnamese goods face trade remedies is because the volume of exported goods has increased dramatically, creating competitive pressure with domestic goods due to low production costs in Vietnam, or because similar Chinese goods are being taxed," said Ms. Nguyen Thi Phuong Thao.

Currently, the United States is a major export market for Vietnam. To do long-term business, businesses should pay attention to learning and updating US legal regulations, especially regulations that have a significant impact on market access such as regulations on trade remedies, hygiene and epidemic prevention, technical standards, origin or regulations related to labor standards...

At the same time, to minimize risks in the export process to this market, in the process of trading with the United States, businesses need to be careful in finding partners and negotiating contracts; need to use legal consulting services to have quality information to assess the financial situation and reliability of US partners; limit third-party payments (brokers)... Although export goods are increasingly sued in the United States, thanks to coordination and timely provision of information, in many cases, Vietnamese businesses have escaped the application of defense measures.

For example, thanks to the efforts of businesses, the support of the Ministry of Industry and Trade and related ministries and branches, in the case of anti-tax evasion investigation on solar panels, up to 98% of solar panel export turnover from Vietnam is not subject to tax or can use the self-certification mechanism to be exempted from tax.

Or for the case of anti-evasion investigation on steel wire, the US preliminarily concluded that Vietnam did not evade taxes; The case of administrative review of anti-dumping tax on tra and basa fish: About 10 Vietnamese tra and basa fish exporting enterprises were not subject to anti-dumping tax, including a number of large exporting enterprises such as: Vinh Hoan Joint Stock Company, Nam Viet Joint Stock Company, Nha Trang Seafood Joint Stock Company.

From the success of these cases, the Ministry of Industry and Trade noted that businesses need to closely coordinate with the Trade Remedies Authority and industry associations in monitoring, updating, sharing information and preparing steps in the response process. At the same time, the Early Warning System collects and analyzes information on the growth rate of export turnover and Vietnam's market share in the import market, thereby assessing the risk of investigation and application of trade remediation measures, which is being continuously updated to inform exporting businesses.

Regarding PVTM issues, in addition to traditional investigations, in the past 3 years, the United States has seen a marked increase in anti-circumvention investigations conducted by the US Department of Commerce and investigations into origin fraud and forced labor by US Customs.

Along with that, in the context of the global economy being in difficulty and at risk of falling into recession, Vietnamese export enterprises are facing an increase in many fraudulent tricks, especially international payment terms... Therefore, Vietnamese export enterprises need to pay attention to learn and update US legal regulations, especially regulations that have a significant impact on market access such as regulations on trade remedies, hygiene and epidemic prevention, technical standards, origin or regulations related to labor standards...

For bankruptcy cases in particular, Vietnamese enterprises need to proactively seek information about the case early through available information channels as well as seek and negotiate with lawyers to avoid falling into a passive position, having little time to prepare for the lawsuit and affecting the final outcome.

The Department of Trade Protection (Ministry of Industry and Trade) said that the US Department of Commerce (DOC) has received a request for an anti-dumping and anti-subsidy investigation into frozen warm-water shrimp imported from Ecuador, India, Indonesia and Vietnam under the codes: HS 0306.17, 1605.21 and 1605.29. Of these, Vietnam is only subject to an anti-subsidy investigation because Vietnamese shrimp products have been subject to anti-dumping duties by the US since 2004. |

Source link

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)