Accordingly, with the new interface, users will find it more convenient to search and use functions such as: tax registration, tax payment function groups, personal income tax settlement support, and tax obligation lookup. These functions have been grouped reasonably, helping taxpayers easily navigate and perform necessary transactions right on their mobile phones.

According to the General Department of Taxation, one of the important improvements is the addition of the “Forgot account (tax code)” function, which allows taxpayers to look up their tax code using only their Citizen Identification Card or National Identity Card information. This is especially useful for those who often forget their tax code or do not remember their login information.

The “Register for an account” and “Login” functions have also been upgraded not only to improve user experience but also to ensure higher security, strictly complying with new regulations under Decree No. 69/2024/ND-CP of the Government regulating electronic identification and authentication.

In this new version, users can log in completely with their VneID account, the system will check the account's identification level. If the account has been granted level 2 electronic identification, users can access the system safely.

In case the account only reaches level 1 identification, the user needs to go to the authorities to upgrade to level 2 electronic identification to use the application's features. Therefore, the user needs to ensure that his VneID account has reached level 2 identification to avoid interruption when accessing the application.

Another notable feature is the “Pay taxes on behalf” feature, which allows users to scan QR-Code or pay taxes on behalf of others in an easy, safe and transparent way, convenient for cases where they need to pay taxes on behalf of relatives without having to perform many complicated operations.

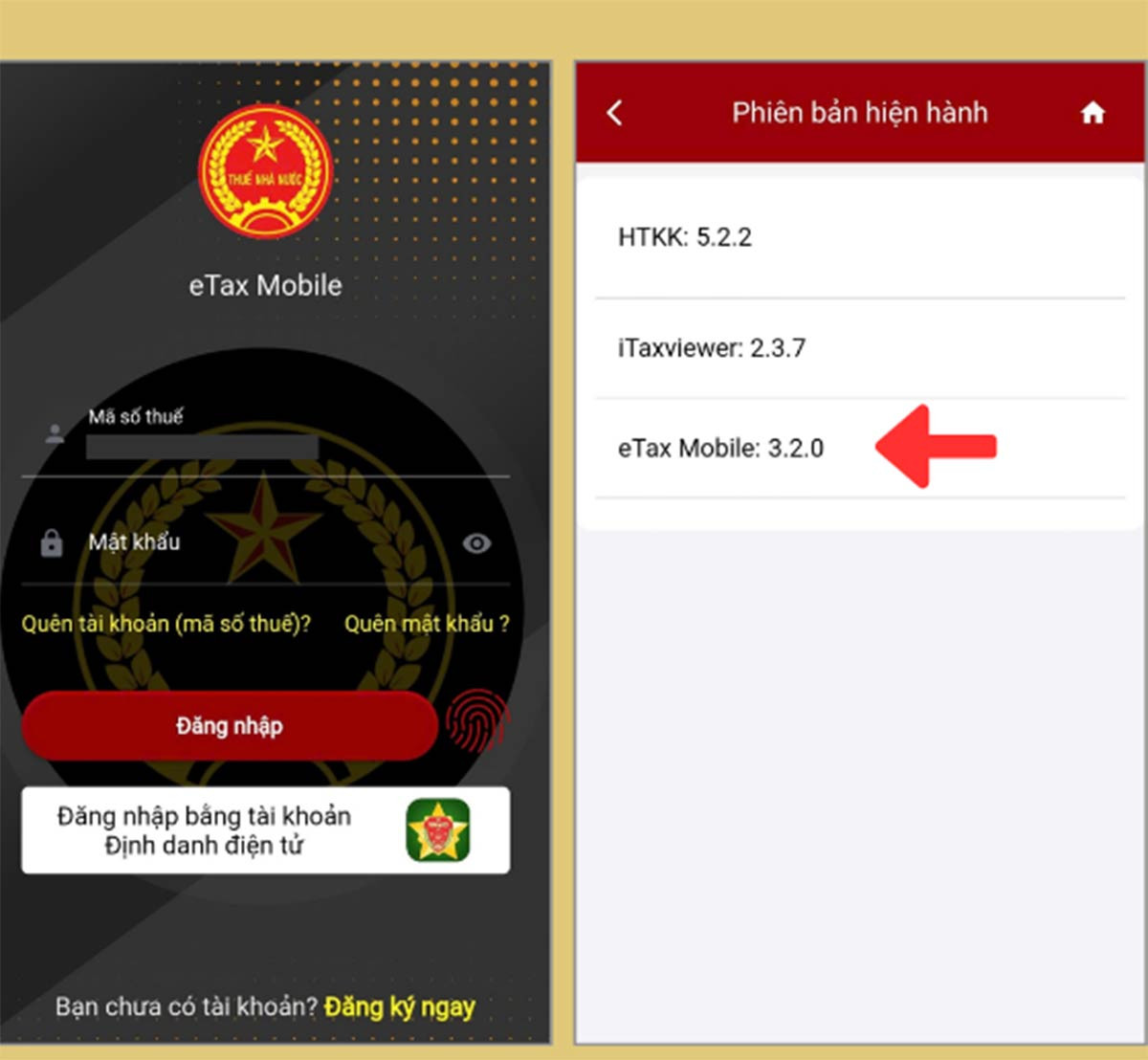

In particular, eTax Mobile version 3.2.0 has upgraded the "Tax payment" function, supporting taxpayers to create a list of automatic payment slips from selecting the tax payable or the tax amount to be paid according to the provisions of Clause 2, Article 57 of the Tax Administration Law 38/2019/QH14, requiring payment in order of compulsory taxes, tax debts, and arising taxes, and supporting the creation of Qr-Codes for payment slips for arising amounts.

The representative of the General Department of Taxation assessed that with these significant upgrades and changes, eTax Mobile 3.2.0 not only helps taxpayers save time but also enhances convenience and security in fulfilling tax obligations. The new version is available on iOS and Android operating systems, ready to serve users from August 26, 2024.

Quoc Tuan

Source: https://vietnamnet.vn/ho-tro-nop-thue-nhanh-voi-phien-ban-etax-mobile-moi-2317146.html

Comment (0)