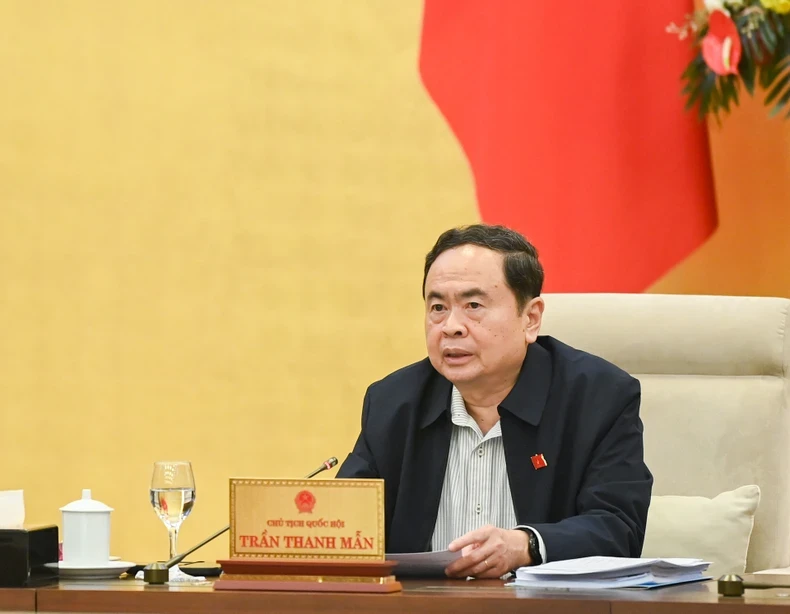

This afternoon, December 24, National Assembly Chairman Tran Thanh Man chaired an additional meeting of the National Assembly Standing Committee to consider and decide on a number of budget issues within its authority.

Under the direction of Vice Chairwoman of the National Assembly Nguyen Thi Thanh, the National Assembly Standing Committee considered and decided on: targeted supplementation from the central budget for localities to implement social security policies issued by the Central Government for the years 2023-2024 and support payment of benefits for the number of additional teacher positions for the school year 2022-2023; targeted supplementation from central budget for localities to implement the Project on Strengthening Management of Land Originated from State-Owned Farms and Forestry Enterprises currently used by agricultural companies, other forestry companies, households and individuals; Environmental Protection Tax Rate for Gasoline, Oil and Lubricants in 2025.

Commenting on these contents, the members of the National Assembly Standing Committee basically agreed to supplement the central budget to localities with a target of VND 5,834,437 million to implement social security policies for the years 2023-2024 and support payment of benefits for the number of additional teachers for the school years 2022-2023 and 2023-2024; issue a resolution of the National Assembly Standing Committee on environmental protection tax rates for gasoline, oil, and grease according to the Government's Submissions.

Speaking at the discussion, National Assembly Chairman Tran Thanh Man basically agreed with the need to supplement resources from the central budget to local budgets to carry out urgent tasks, as well as apply appropriate environmental protection tax on gasoline, oil, and lubricants in 2025 to support people and businesses, creating more momentum for socio-economic development.

The National Assembly Chairman emphasized that "the issue of applying environmental protection tax on gasoline, oil, and grease for people and businesses is very necessary", and suggested: The Government, relevant ministries and branches need to learn from experience to act soon, avoiding the situation of only discussing this issue at the end of the year.

The National Assembly Chairman requested a report clarifying the reasons for the insufficient budget allocation and the delay in proposing additional budgets for these tasks, especially tasks arising from 2023; and noted that "we do not lack money to spend, but the important thing is how to ensure timely, correct and sufficient spending".

Regarding the application of environmental protection tax on gasoline, oil, and grease, the National Assembly Chairman suggested that the Government consider a roadmap to gradually increase the environmental protection tax rate to apply the tax rate prescribed in Resolution 579/2018/UBTVQH14 of the National Assembly Standing Committee; ensuring consistency with the nature and principles of environmental protection tax, consistent with forecast developments in crude oil prices on the world market as well as implementing Vietnam's international commitments.

Regarding the central budget supplement for localities, Chairman of the Law Committee Hoang Thanh Tung suggested that the Government should urge and remind localities to promptly submit to the People's Council to assign additional staff, to avoid delays in completing related processes and procedures and failing to promptly implement policies and regimes for teachers.

Concluding on this content, Vice Chairwoman of the National Assembly Nguyen Thi Thanh stated: The National Assembly Standing Committee agreed to present two additional targeted contents from the central budget to localities to implement social security policies issued by the Central Government for the years 2023-2024 and support payment of regimes for the number of additional teacher positions for the school year 2022-2023; implementing the Project on Strengthening Management of Land Originated from State-owned Farms and Forestry Farms currently used by agricultural companies, other forestry companies, households and individuals in one Resolution.

The National Assembly Standing Committee requests the Government to take responsibility for the legal basis of the proposed contents, the accuracy, completeness and validity of the data; comply with the spending regime and additional conditions. At the same time, assign the budget in accordance with the provisions of the law; manage, use and settle the allocated funds to supplement the budget in accordance with the provisions of the State Budget Law and relevant laws; ensure timeliness, efficiency, and proper purposes, and prevent loss, waste and negativity.

Regarding the application of environmental protection tax on gasoline, oil, and grease, the Vice Chairman of the National Assembly suggested that the Government have solutions to forecast the situation, respond more quickly, accurately, and promptly, and be proactive in policy making; ensure time, order, and procedures for agencies to conduct inspections, the National Assembly Standing Committee to consider, decide, or give opinions; organize policy implementation to ensure the set goals...

At the meeting, with 100% of the attending members in agreement, the National Assembly Standing Committee voted to pass the Resolution on targeted supplementation from the central budget in 2024 for localities and the Resolution on applying environmental protection tax rates on gasoline, oil, and grease.

Presenting the Government's Proposal, Minister of Finance Nguyen Van Thang said that, based on Clause 10, Article 3 of Resolution No. 105/2023/QH15 of the National Assembly on central budget allocation in 2024, the Government submitted to the National Assembly Standing Committee for consideration and decision. targeted supplement from the central budget for the local budget in 2024 with a total amount of VND 5,834,437 million from the remaining expenditure areas of the central budget in 2024 decided by the National Assembly but not yet allocated in Resolution No. 105/2023/QH15 of the National Assembly to implement social security policies for the years 2023-2024 and support payment of benefits for the number of additional teacher positions for the school year 2022-2023 and the school year 2023-2024.

In particular, according to the Minister of Finance, the total central budget must be supplemented with a target in 2024 to support localities in paying the regime for 2023 and 2024 for the number of additional teacher positions in the 2022-2023 school year and the 2023-2024 school year is 2,150,912 million VND.

At the same time, the Government also submitted to the National Assembly Standing Committee for consideration and decision on a targeted supplement from the central budget to the local budget in 2024 with a total amount of VND 600 billion from the remaining expenditure areas of the central budget in 2024 that have been decided by the National Assembly but not yet allocated in Resolution No. 105/2023/QH15 of the National Assembly to implement the Project on strengthening management of land originating from state-owned agricultural and forestry farms.

According to the Minister of Finance, when the environmental protection tax on gasoline, oil, and grease increases to the ceiling level in the Tax Schedule from January 1, 2025, it will have a negative impact on the economy. Because the environmental protection tax on gasoline, oil, and grease will increase the retail price of these items; create pressure to increase inflation, thereby causing disadvantages in achieving economic growth targets.

Therefore, to contribute to controlling inflation, stabilizing the macro-economy, and reducing difficulties for businesses and people, the Government proposed that the National Assembly Standing Committee issue a resolution on environmental protection tax rates for gasoline, oil, and lubricants to be applied in 2025 as stipulated in Resolution No. 42/2023/UBTVQH15. Specifically, gasoline, excluding ethanol, is 2,000 VND/liter; jet fuel, diesel, fuel oil, and lubricants are 1,000 VND/liter; lubricants are 1,000 VND/liter; and kerosene is 600 VND/liter.

Presenting the Verification Report, Chairman of the Finance and Budget Committee Le Quang Manh said that the Government's submission to the National Assembly Standing Committee to supplement the 2024 state budget estimate for these tasks is necessary due to the legal basis prescribed in Resolution 105 of the National Assembly; meeting the requirements for performing tasks arising in 2024 but not yet arranged in the state budget estimate assigned at the beginning of the year, including the task of ensuring pensions and ensuring social security according to the regime as stated in the Government's Submissions.

The Chairman of the Finance and Budget Committee emphasized that the Government is responsible for the content and proposed data, ensuring compliance with legal regulations, accuracy of reported information and data; ensuring compliance with standards, norms, and spending regimes according to legal regulations; organizing effective implementation, and at the same time, reporting to the National Assembly on the addition of this budget at the 9th Session of the 15th National Assembly.

Regarding the environmental protection tax rate for gasoline, oil, and grease in 2025, Minister of Finance Nguyen Van Thang said that according to the provisions of Section 1, Clause 1, Article 1 of Resolution 579/2018/UBTVQH14, from January 1, 2025, the new environmental protection tax rate for gasoline, oil, and grease will be applied. Specifically, the environmental protection tax rate for gasoline, excluding ethanol, is VND 4,000/liter; jet fuel is VND 3,000/liter; diesel is VND 2,000/liter; kerosene is VND 1,000/liter; fuel oil is VND 2,000/liter; lubricants are VND 2,000/liter; grease is VND 2,000/kg. |

Unified level of deduction for social insurance and unemployment insurance management costs

The Standing Committee of the National Assembly considers and decides to allow the extension of the implementation period of Resolution No. 09/2021/UBTVQH15 on social insurance and unemployment insurance management costs for the 2022-2024 period.

After discussion, the National Assembly Standing Committee unanimously issued a Resolution allowing the extension of the implementation period of Resolution No. 09/2021/UBTVQH15 on social insurance and unemployment insurance management costs for the 2022-2024 period, with a temporary maximum cost level of 1.44% of the estimated revenue and expenditure for social insurance and unemployment insurance. The implementation period of Resolution No. 09 is extended until June 30, 2025.

The National Assembly Standing Committee noted that this is a temporary solution to ensure the operation of social insurance management in the context of not having a new resolution and implementing the streamlining and organization of the Vietnam Social Security apparatus according to Resolution 18.

The National Assembly Standing Committee requested the Government to continue to urgently direct, complete reports, assessments and soon submit a draft resolution on costs of organizing and operating social insurance, unemployment insurance and health insurance for the period 2025-2027 with the goal of striving to have a new resolution before the Social Insurance Law 2024 takes effect from July 1, 2025.

In addition, the Government and relevant agencies shall review and be responsible for the accuracy and reasonableness of all data and information, explanations on the implementation status of the 2022-2024 period, as well as the basis for proposing to continue extending the implementation period of Resolution No. 09 in the draft resolution dossier.

With 100% of delegates present in agreement, the National Assembly Standing Committee passed a Resolution allowing the extension of the implementation period of Resolution No. 09/2021/UBTVQH15 on social insurance and unemployment insurance management costs for the 2022-2024 period.

With 100% of the attending members in agreement, the National Assembly Standing Committee voted to approve the plan to allocate the estimated operating budget of the National Assembly delegations in 2025.

In the context of the current restructuring of the apparatus, National Assembly Chairman Tran Thanh Man noted: the allocation of the budget needs to anticipate changes in the apparatus to come up with appropriate plans, thereby proactively implementing, closely following the operation of the National Assembly, and preparing for any arising situations.

According to the plan to arrange and organize the apparatus, the National Assembly must amend and supplement a number of articles in the Law on Organization of the National Assembly, the Law on Organization of the Government, the Law on Organization of Local Government, and many related specialized laws.

Therefore, the Office of the National Assembly needs to carefully review to have a realistic budget allocation for the National Assembly delegations, ensuring flexible and timely decentralization of authority to meet the operational requirements of the National Assembly delegations.

"The Head of the National Assembly Office must urgently complete the budget allocation for units, ensuring objectivity, fairness, and rationality, in the spirit of thrift, but what is worth spending on must be spent on" - the National Assembly Chairman stated.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)