From July 1, 2023, business households only need to submit 1 set of documents through the Business Registration and Tax Registration Interconnection System to be granted a Business Registration Certificate and a Business Tax Code...

Connecting business registration and tax registration for business households helps simplify procedures, saving time and costs for people. Connecting business registration and tax registration for business households helps simplify procedures, saving time and costs for people.

Continuing the success of the coordination work in the past time, the Ministry of Planning and Investment and the Ministry of Finance continue to closely coordinate and implement reforms in business household registration through the development and completion of the legal framework and information technology infrastructure for interconnection. In terms of law, on April 18, 2023, the Minister of Planning and Investment signed and issued Circular No. 02/2023/TT-BKHĐT dated April 18, 2023 amending and supplementing a number of articles of Circular No. 01/2021/TT-BKHĐT dated March 16, 2021 guiding business registration.

The Circular officially takes effect from July 1, 2023, aiming at the following main objectives: Supplementing legal regulations for the connection of two procedures: business registration and tax registration for business households; creating a legal basis for building an electronic interconnection information technology application between the Business Household Registration Information System and the Tax Registration Information System; issuing a system of business household registration forms to serve the connection.

|

To implement synchronously nationwide, on June 28, the Department of Business Registration Management (Ministry of Planning and Investment) and the General Department of Taxation (Ministry of Finance) held an online conference to train and guide business and tax registration officers in 700 districts, towns and 63 provinces and cities nationwide. In addition, the two sectors have upgraded information technology applications to be deployed from July 1, 2023.

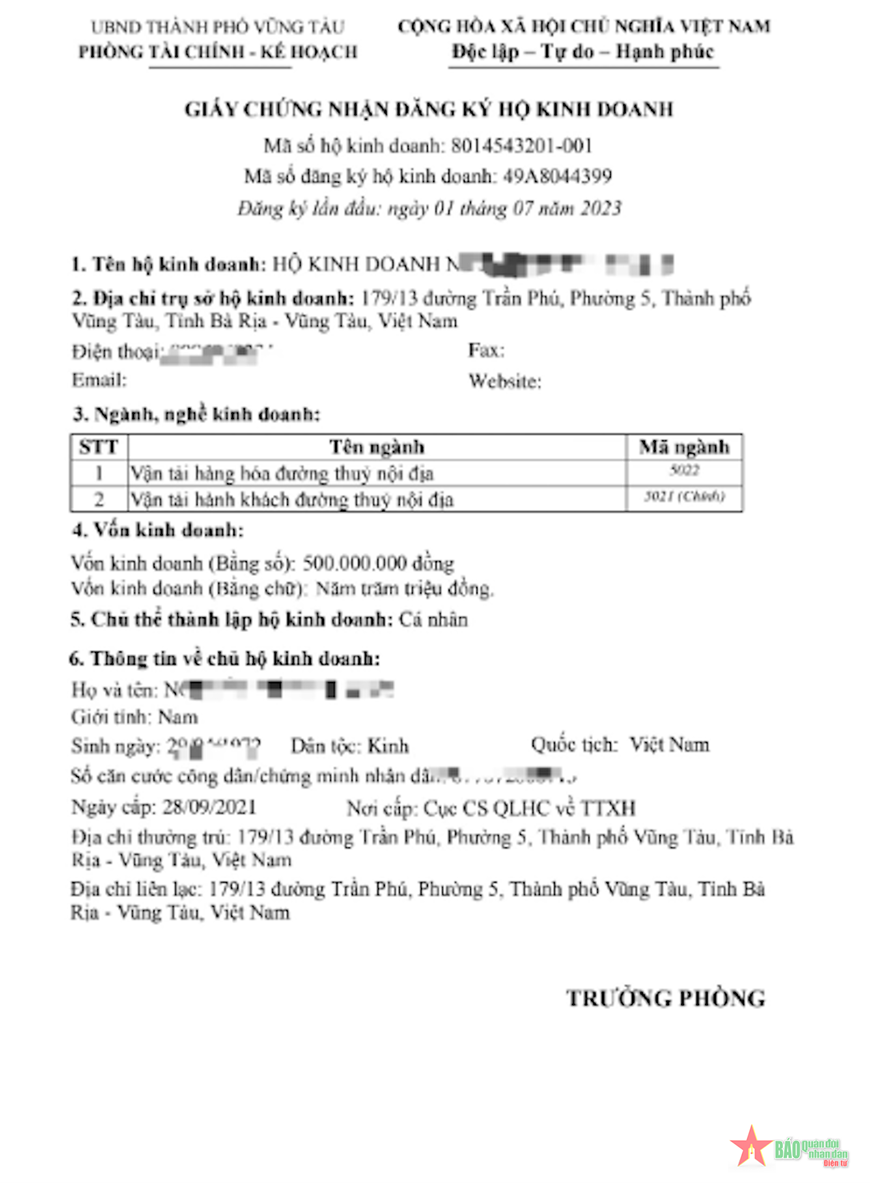

According to the System's records, on the first day of Circular No. 02/2023/TT-BKHĐT taking effect, 4 business households were successfully granted on July 1 through the Business Registration and Tax Registration Interconnection System. Of which, 3 business households were granted new establishment (1 business household in Vung Tau city, 1 business household in Phan Rang town, Ninh Thuan province and 1 business household in Chau Thanh district, Tien Giang province), and 1 business household was granted change registration in Chau Thanh district, Tien Giang province.

From July 1, 2023, the issuance of Business Registration Certificates for business households will be carried out through the Business Registration and Tax Registration Interconnection System. Accordingly, the person establishing a business household only needs to submit 1 set of documents (including business registration and tax registration contents as prescribed) and receive the results of administrative procedure settlement at a single administrative agency, which is the district-level business registration agency (Finance and Planning Department under the District People's Committee).

The new business registration certificate will also be the tax registration certificate for the business household, and the tax code of the business household will also be the business code. This helps simplify procedures, save time and costs for people, and significantly reduce the workload for state administrative agencies.

The connection of business registration and tax registration for business households has been completed as required, meeting the time schedule that the Government has assigned to the Ministry of Planning and Investment and the Ministry of Finance in the past.

Over the past 13 years, the coordination between the two sectors of tax and business registration has increasingly achieved many encouraging marks, creating breakthroughs in administrative reform, having a spillover effect, strongly promoting the implementation of e-Government construction.

According to the World Bank's rankings from 2010 to 2020, Vietnam has increased 23 places in terms of ease of doing business. Vietnam is also the top choice for businesses in countries such as Korea, Japan, Singapore... as an investment location.

Favorable business environment and administrative procedure reform for enterprises and cooperatives are important driving forces to promote growth of the private economic sector and contribute to increasing state budget revenue each year.

VU DUNG

Source

![[Photo] Prime Minister Pham Minh Chinh chairs a meeting of the Steering Committee for key projects in the transport sector.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/0f4a774f29ce4699b015316413a1d09e)

Comment (0)