Typically, when deciding to invest in apartments for rent, investors prioritize completed apartments with ownership certificates so they can obtain bank loans. In the case of buying a new apartment, there are more considerations involved; perhaps prioritizing transferring the deposit to generate profit before considering renting it out and waiting for price appreciation.

Ms. Cao Thi Thanh Huong, Senior Research Manager at Savills Ho Chi Minh City, stated: "This is an opportune time to invest in rental apartments because, over the next 3-5 years, the supply of apartments in Ho Chi Minh City's inner districts will remain scarce due to limited land available for project development. Therefore, after a period of rental income, investors can sell to profit from price appreciation over time, while also generating additional rental income."

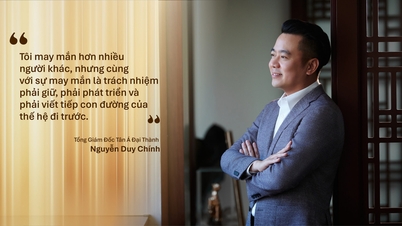

Over the next 3-5 years, the supply of inner-city apartments in Ho Chi Minh City will remain scarce due to the limited land available for project development. (Photo: ST)

Currently, access to apartment housing is becoming increasingly difficult for people as income growth lags behind rising housing prices. In the future, primary apartment projects will have higher prices because developers will have to optimize profits as input costs increase. This partly explains the current trend of many young families renting. However, for investors, carefully considering whether to buy a property to wait for price increases or to rent it out at this time is also necessary.

Currently, developers offer very good sales policies, but homebuyers need to be mindful of the developer's reputation. Offering attractive policies is one thing, but actually fulfilling them is another. In reality, there are many cases where, for various reasons, project developers abandon their projects midway and are unable to fulfill all their commitments to homebuyers.

The next issue to consider is the selling price of the apartments. During the sales process, apartments sold in later phases are usually priced higher than those in earlier phases. Therefore, developers often offer more incentives and a wider variety of payment methods. Buyers need to carefully compare and check prices to decide whether to purchase a product from an earlier or later phase.

"Buying products in the earlier stages will offer better prices, but the payment terms will be shorter, so you need to prepare your finances in advance. In the later stages, although the prices are higher, the payment schedule will be longer, so the financial pressure will be reduced," Ms. Huong said.

Finally, regarding the use of financial leverage from banks to buy a house, according to Savills experts, banks typically offer loan packages with preferential interest rates for a fixed period (2-3 years), after which the interest rate will become variable. Therefore, investors must carefully consider their financial situation, avoiding borrowing too much which leads to a heavy debt burden. Because if they borrow and cannot repay, they will have to sell at a loss, or they will break their commitment to the bank. At this point, the loan will be added to the bad credit list, affecting future borrowing.

"Investors should carefully consider their loan limits because no bank or developer can commit to a long-term loan of 15-20 years. Therefore, a loan amount of around 50% of the product value is appropriate, while loans exceeding 70% carry high risk," Ms. Huong said.

Source: https://www.congluan.vn/hien-nay-la-thoi-diem-tot-de-dau-tu-can-ho-xong-cho-thue-lai-post296153.html

Comment (0)