(Dan Tri) - Shark Louis Nguyen joined the board of directors of An Gia Real Estate Investment and Development Joint Stock Company from mid-May 2024. Last year, the company paid him an income of 187.5 million VND.

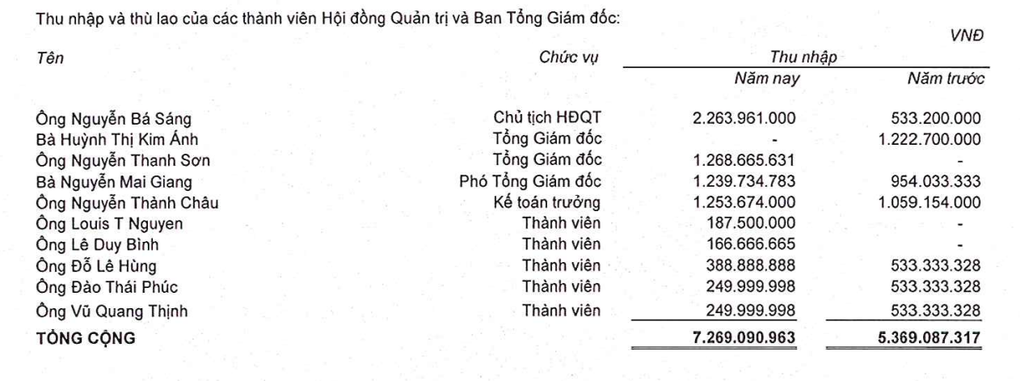

An Gia Real Estate Investment and Development Joint Stock Company (stock code: AGG) has just announced its consolidated financial report for the fourth quarter of 2024. In addition to business results, the company also announced the income and remuneration of members of the Board of Directors and the Board of Management.

Chairman of the Board of Directors Nguyen Ba Sang received an income of 2.3 billion VND, 4.2 times higher than in 2023.

Mr. Louis Nguyen - Member of the Board of Directors - received an income of 187.5 million VND. Mr. Louis Nguyen joined the Board of Directors of An Gia Real Estate Investment and Development Joint Stock Company from May 2024, term 2024-2025. Thus, his average income is 25 million VND/month.

Income and remuneration of the board of directors of An Gia Real Estate Investment and Development Joint Stock Company (Photo: Financial statements).

Mr. Louis Nguyen (Nguyen The Lu) is known as one of the "sharks" participating in a TV show about startups. This businessman also holds the position of Chairman and General Director of Saigon Asset Management Company (SAM).

Shark Louis Nguyen becomes a member of An Gia's Board of Directors (Photo: Shark Tank Vietnam).

He has also held many positions in large US corporations such as KPMG, Apple, Osprey Ventures Venture Capital Fund, Intelligent Capital Investment Bank and managed investment funds in Vietnam such as IDG Ventures Vietnam and VinaCapital and Vietnam Equity Holding.

Before joining An Gia's Board of Directors, Mr. Louis Nguyen held a similar position at LDG Investment Joint Stock Company from 2022. However, he resigned in 2023.

Regarding production and business activities, in the last quarter of this year, An Gia Real Estate Investment and Development Joint Stock Company achieved net revenue of 163 billion VND, down 7.5% compared to the same period last year.

In the last quarter, the company's financial expenses skyrocketed to nearly VND159 billion, five times higher than the same period last year. Sales management expenses were nearly VND30 billion, down more than 41%. Business management expenses were more than VND15 billion, down nearly 22%.

After deducting expenses, the company's after-tax profit reached more than VND 21 billion, down nearly 81% compared to the fourth quarter of 2023.

In the whole year of 2024, this real estate company achieved net revenue of more than 1,913 billion VND, down 51% compared to 2023. Profit after tax was at 261 billion VND, down more than 43%.

At the end of 2024, the company's total assets reached VND 7,043 billion, down more than 24% compared to the beginning of the year. Of which, idle money decreased from VND 772 billion to just over VND 167 billion. Cash equivalents were only VND 4.5 billion compared to VND 600 billion at the beginning of the year. This item is savings deposits with terms of no more than 3 months.

Source: https://dantri.com.vn/bat-dong-san/he-lo-thu-nhap-cua-shark-louis-nguyen-tai-mot-cong-ty-bat-dong-san-20250126101003058.htm

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)