SGGP

In its quarterly report to the South Korean National Assembly , the Bank of Korea (BOK) noted that the ratio of house prices to income is at 26%.

This means that the average worker would need to save their entire salary for 26 years to buy a 90m² house. This rate has steadily increased from 17.4% in 2020, to 23.6% in 2021 and 29.4% in 2022.

According to the Bank of Korea (BOK), when compared to basic economic conditions, housing prices in South Korea remain high, regardless of income.

Starting in April of this year, household loans issued by banks have steadily increased to worrying levels. As of August, the amount lent had increased by more than 25 trillion won (US$18.8 billion) in just five months, with home mortgage loans driving up the total loan volume.

The BOK report noted that South Korea's household debt has been steadily increasing, to a level that could threaten financial stability and the microeconomic system.

Source

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

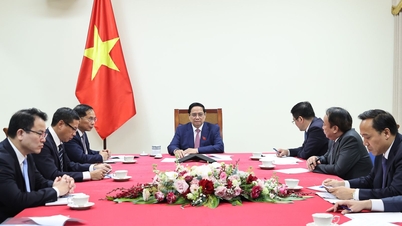

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)