Restricting individual investors, what to do to avoid "blockage" of capital flow into bonds?

It is necessary to review the restrictions on investment in corporate bonds by institutional investors soon so that the market can maintain continuity and avoid disruption due to the impact of new regulations.

|

Corporate bond issuance will be more active in the fourth quarter

According to data compiled by the Vietnam Bond Market Association (VBMA) from HNX and the State Securities Commission, as of the information announcement date of September 30, 2024, there were 24 private corporate bond issuances worth VND 22,333 billion and 1 public issuance worth VND 1,467 billion in September 2024.

Since the beginning of the year, there have been 268 private issuances worth VND250,396 billion and 15 public issuances worth VND27,054 billion. In September, businesses bought back VND11,749 billion of bonds before maturity, up 2% over the same period in 2023.

In the remainder of 2024, it is estimated that there will be about VND79,858 billion of bonds maturing, of which the majority are real estate bonds with VND35,137 billion, equivalent to 44%. Regarding the situation of unusual information disclosure, there are 26 new late interest payment bond codes with a total value of VND239.4 billion and 2 late principal payment bond codes worth VND550.4 billion.

In the secondary market, the total value of individual bond transactions in September reached VND87,768 billion, an average of VND4,619 billion/session, an increase of 40.2% compared to the average in August.

Banks are still the group with the highest issuance value in the recent period. According to data from MBS, banks are the industry group with the highest issuance value with about 245,400 billion, up 188% over the same period, accounting for 74%. Banks with the largest issuance value since the beginning of the year include:ACB (29,800 billion VND), Techcombank (26,700 billion VND), OCB (24,700 billion VND). The banking group is expected to continue to promote bond issuance to supplement capital to meet lending and credit demand, which is forecast to accelerate in the last months of the year following the strong recovery of production, export and services.

The analysis team at MBS also forecasts that corporate bond issuance activities will be more active in the fourth quarter due to the recovery in capital demand of enterprises in the context of the real estate market starting to warm up as well as the need to expand production and business activities following the economic recovery.

Avoid "blockage" of capital flow into the bond market

In the recent period, the Draft Law on Securities amended with new policies related to the corporate bond market has attracted many opposing opinions, especially regarding the policy of restricting individual investors.

Discussing the new policy draft, FiinRatings said that due to the high risk level of individual corporate bonds, the policy of restricting individual investors is reasonable, however, it is necessary to loosen current regulations on restricting institutional investors to open up demand for corporate bonds.

Looking at countries in the region, in China, individual investors hardly participate in direct ownership of corporate bonds. Instead, they invest through trust and purchase fund certificates managed by fund management companies. In addition, in Thailand, the participation rate of individual investors is high due to the application of the definition of wealthy investors "High-net-worth investors" (with net assets of 30 million baht or about 22 billion VND or more; annual income of at least 2.2 billion VND or total securities portfolio of 8 million baht, or about 6 billion VND).

|

Structure of investors holding corporate bonds in some Asian countries, December 31, 2023. Source: FiinRatings, HNX, ThaiBMA, KSEI, CCDC & ABO. (For Vietnam, only individual bonds are counted). |

However, to avoid capital flow being "blocked" when individual investors are restricted from participating in the market, it is necessary to promptly review the restrictions on investment in corporate bonds by institutional investors such as insurance companies, investment funds, etc. so that the market can maintain continuity and avoid disruption due to the impact of new regulations.

Regarding the provision of adding professional securities investors including foreign institutional and individual investors, FiinRatings assesses that this policy is necessary because the potential for market expansion from this investment group is very high.

The participation of foreign investors in the Vietnamese corporate bond market is still very limited. By the end of 2023, the corporate bond holding ratio of foreign investors was only about 3% of the total value of outstanding bonds. Foreign investors mainly invest in bonds of large enterprises. However, the potential for market expansion from this group of investors is huge, because foreign investors often have investment experience, financial potential and high risk tolerance, foreign investment funds have much larger resources and scale than domestic organizations.

In addition to recognizing this group of investors as professional securities investors, it is necessary to enhance the confidence of this group by improving market transparency and the quality of information disclosure, such as promoting the application of credit ratings, developing databases on yield curves and late payment history, etc., thereby creating conditions for investors to access information and price bonds conveniently and effectively.

At the same time, this organization also proposed to consider applying credit ratings to bonds and maintaining them throughout the life cycle of the bonds instead of only requiring credit ratings for the issuer. According to current regulations, while Decree 155/2020/ND-CP mentions bond credit ratings, Decree 65/2022/ND-CP, which applies to privately issued corporate bonds, only stipulates credit ratings for the issuer without mentioning ratings for bonds.

Source: https://baodautu.vn/han-che-nha-dau-tu-ca-nhan-lam-gi-de-tranh-nghen-dong-von-vao-trai-phieu-d227554.html

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

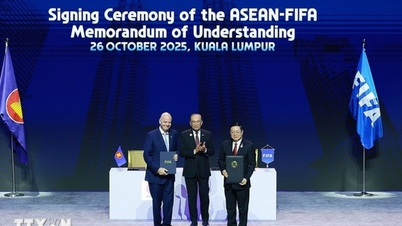

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)