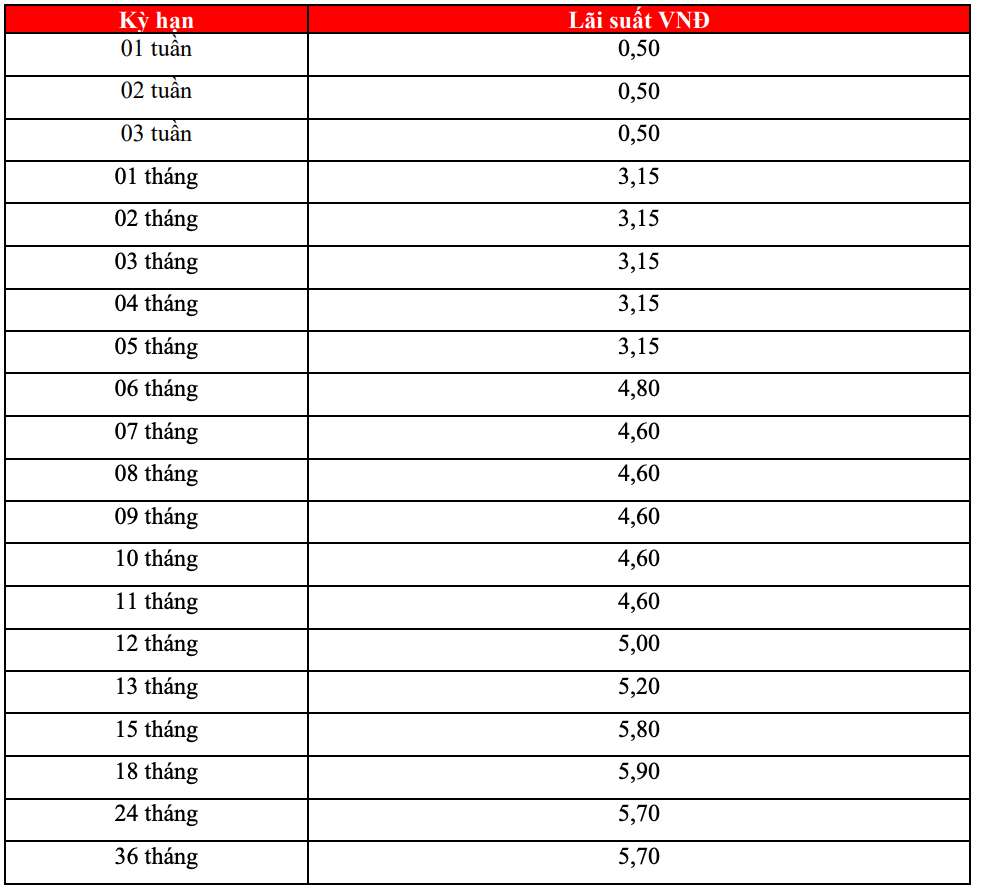

According to a survey conducted by reporters from Lao Dong Newspaper at nearly 30 banks in the system, interest rates for 6-month term savings deposits are fluctuating around 3.25 - 5.5% per year.

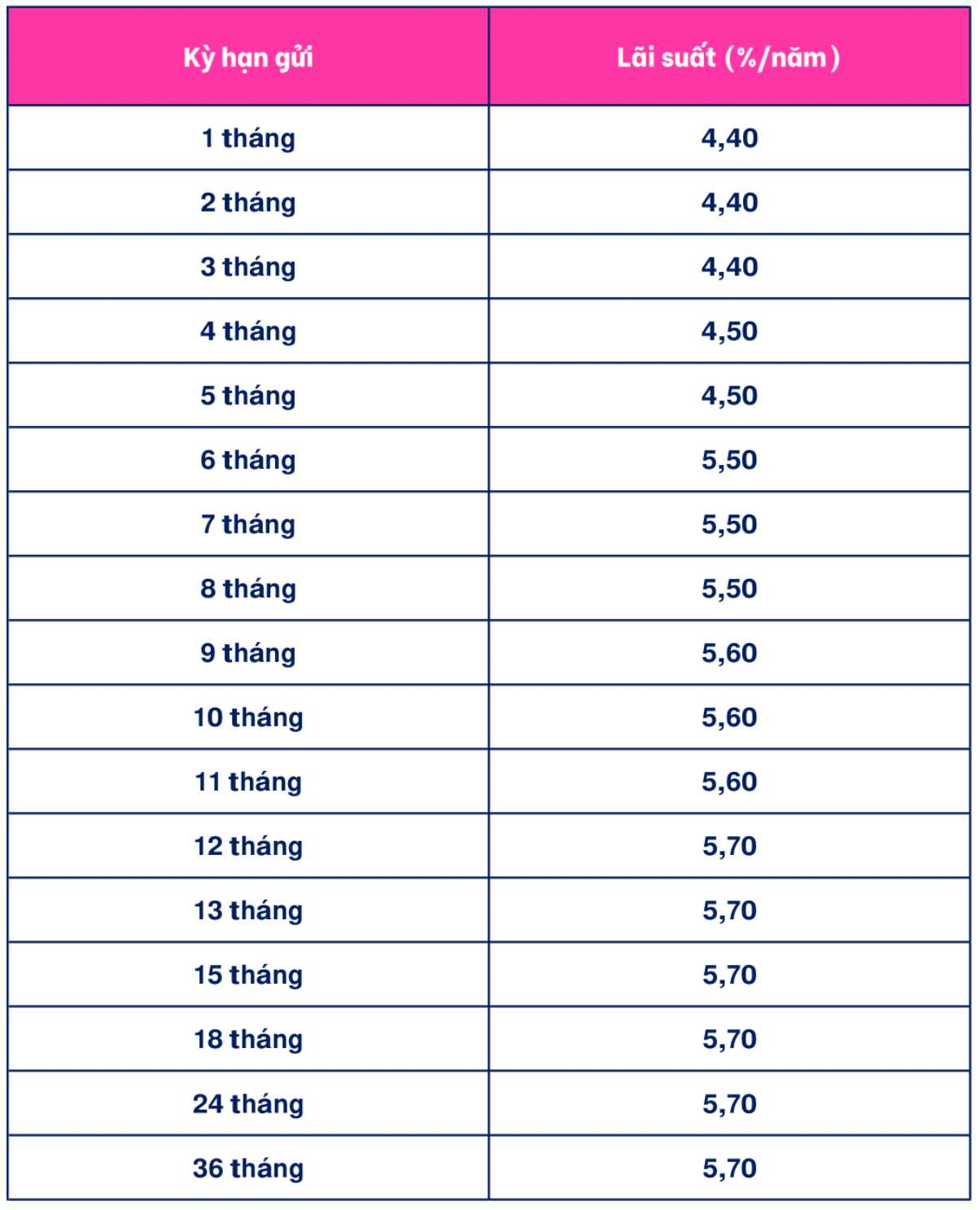

Leading the way is Caky by VPBank , which is offering a 6-month term deposit interest rate of 5.5% per year for customers who deposit money for a fixed term and receive interest at the end of the term. In addition, this bank is offering the highest interest rate at 5.7% per year for customers who deposit money for 12-36 months, also receiving interest at the end of the term.

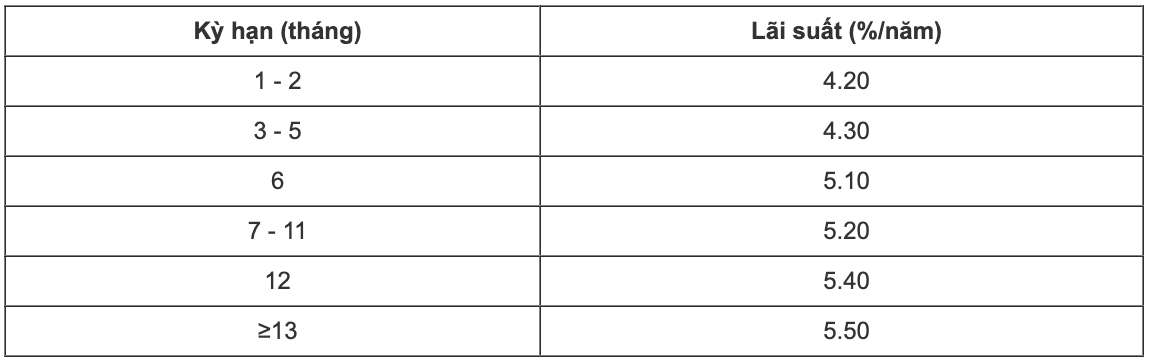

CBBank offers the highest interest rate for a 6-month term at 5.1% per annum when customers deposit money online and receive interest at the end of the term.

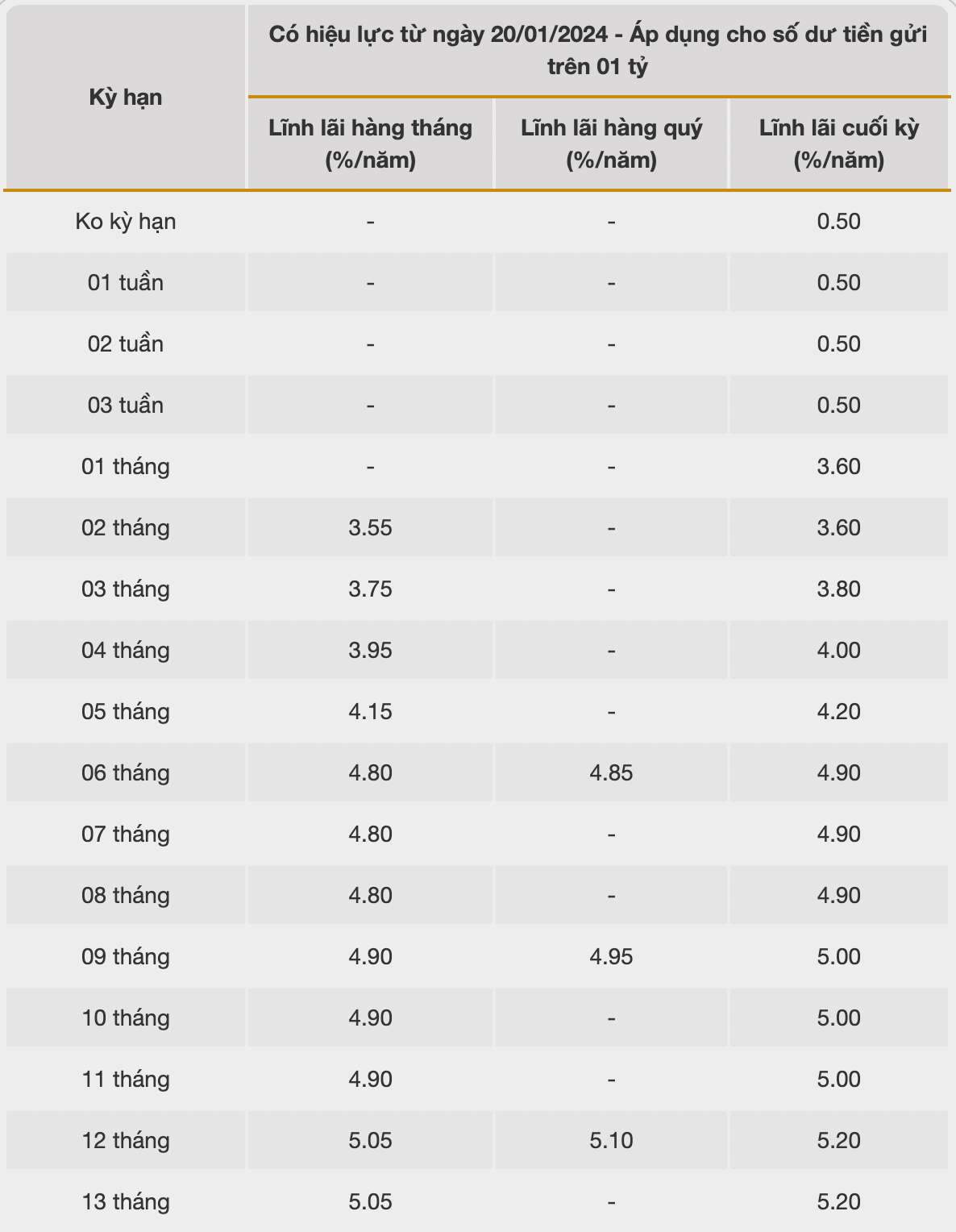

BacABank lists the interest rate for a 6-month term at 4.9%/year when customers receive interest at the end of the term. Customers who receive interest monthly only receive an interest rate of 4.8%/year.

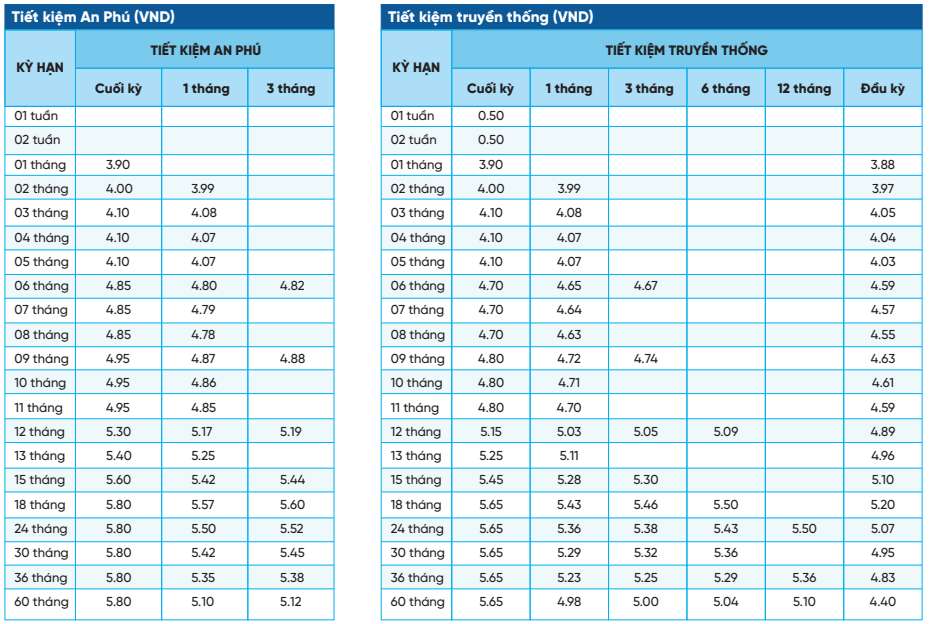

Following closely behind, NCB lists the highest interest rate of 4.85%/year for 6-month term deposits at An Phu Savings. Customers using traditional deposit methods receive a lower interest rate of 4.7%/year.

HDBank is currently offering the highest interest rate of 4.8% per annum for 6-month deposits made online. Additionally, the highest interest rate offered by HDBank for 18-month online deposits under regular conditions is 5.9% per annum.

If I deposit 1 billion VND for a 6-month term, what interest will I receive?

You can quickly calculate bank deposit interest using the following formula:

Interest = Deposit amount x interest rate (%)/12 months x number of months deposited

For example, you deposit 1 billion VND into Bank A, with an interest rate of 5.5% for a 6-month term. The interest you will receive is estimated to be:

1 billion VND x 5.5%/12 x 6 months = 27.5 million VND.

Therefore, before depositing your savings, you should compare savings interest rates between different banks and between different terms to earn the highest possible interest.

* Interest rate information is for reference only and may change from time to time. Please contact your nearest bank branch or hotline for specific advice.

Readers can find more articles about interest rates HERE.

Source

![[Photo] Closing Ceremony of the 10th Session of the 15th National Assembly](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765448959967_image-1437-jpg.webp&w=3840&q=75)

![[Photo] Prime Minister Pham Minh Chinh holds a phone call with the CEO of Russia's Rosatom Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F11%2F1765464552365_dsc-5295-jpg.webp&w=3840&q=75)

![[OFFICIAL] MISA GROUP ANNOUNCES ITS PIONEERING BRAND POSITIONING IN BUILDING AGENTIC AI FOR BUSINESSES, HOUSEHOLDS, AND THE GOVERNMENT](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/11/1765444754256_agentic-ai_postfb-scaled.png)

Comment (0)