According to banks, long-term savings, especially terms of 24 months or more, have many advantages such as: Safety. When making long-term savings, the deposit amount will be guaranteed safe by the bank for a certain period of time.

Another advantage of long-term savings is the attractive interest rate, higher than short-term savings. Thanks to that, depositors receive high profits from idle money. At the same time, long-term savings at banks help increase the efficiency of financial management: When saving money for a long time, customers limit uncontrolled spending. In addition, customers can also reserve a certain amount of money for investment, building a house, buying high-value items or preventing illness...

|

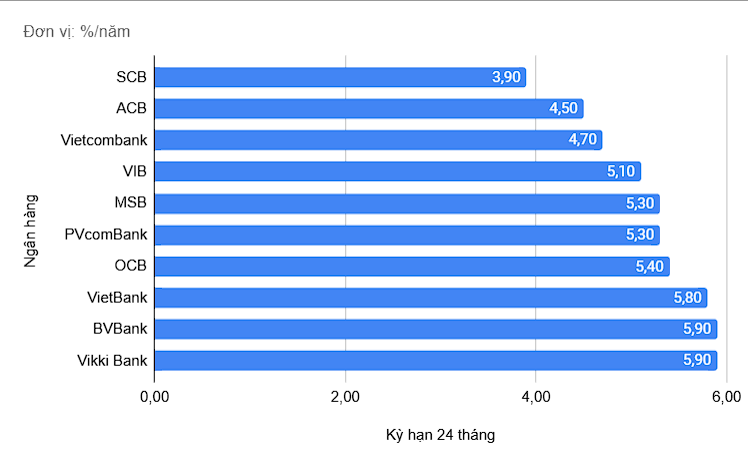

| Reference interest rates when depositing savings at the counter, 24-month term at some banks |

Another advantage of long-term savings is that there is less risk. When making long-term savings, customers will receive a fixed interest rate. Therefore, this deposit is not subject to financial fluctuations for a certain period of time.

Currently, with a 24-month term (deposited at the counter), according to statistics, interest rates at banks range from 4.5% - 5.8%/year, many banks list 5%/year or more for this term. Two banks, BVBank and Vikki Bank, currently list the highest interest rates on the market, up to 5.9%/year.

|

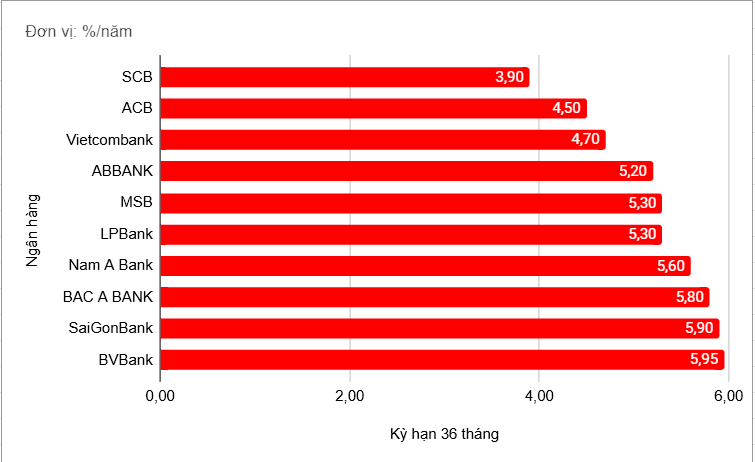

| Reference interest rates when depositing savings at the counter, 36-month term at some banks |

For the 36-month term, the interest rate at banks fluctuates similarly to the 24-month term. BVBank continues to have the highest interest rate, up to 5.95%/year for this term. The lowest is SCB, which only lists 3.9%/year for this term, and this figure is also applied to the 24-month term.

Source: https://thoibaonganhang.vn/gui-tien-ky-han-dai-o-cac-ngan-hang-se-duoc-huong-muc-lai-suat-ra-sao-163108.html

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)