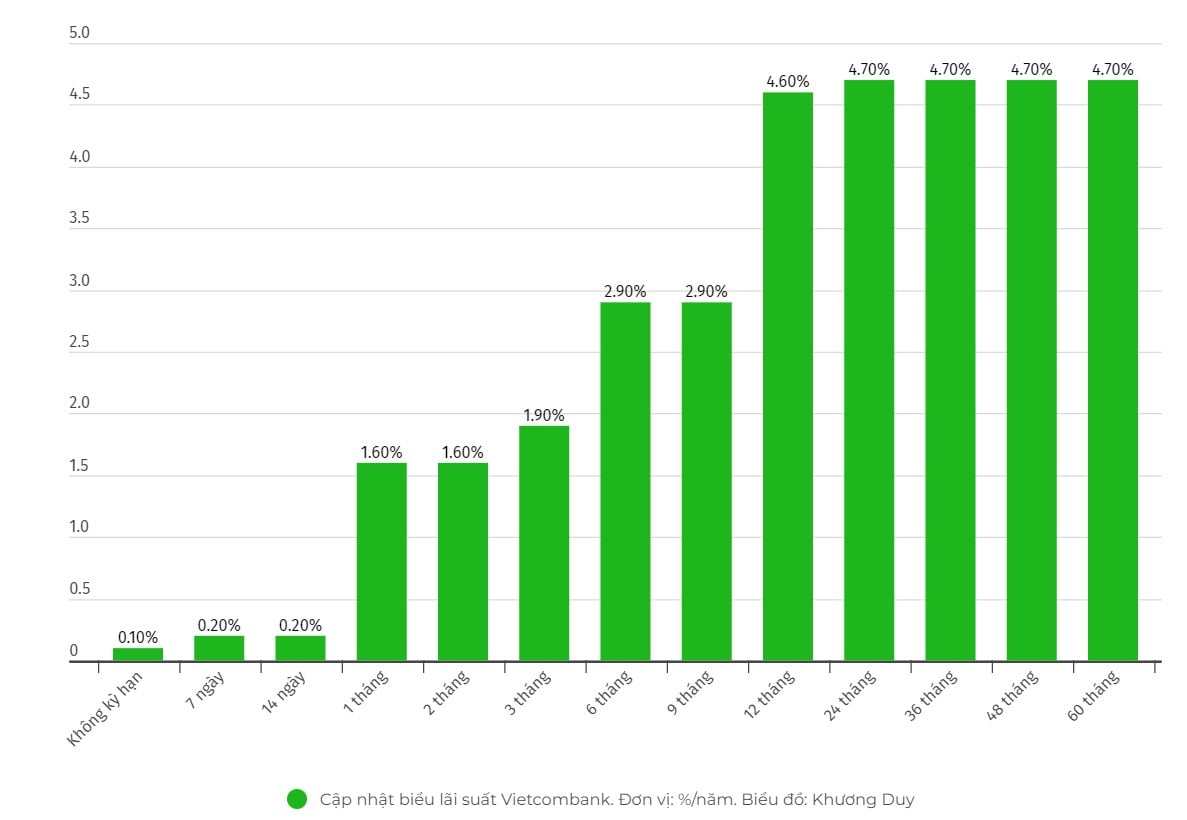

Full set of current Vietcombank interest rates

Savings interest rates at Vietcombank currently fluctuate around 1.6 - 4.7%.

Of which, Vietcombank listed interest rates for 24-month, 36-month, 48-month and 60-month deposits at 4.7%.

The interest rate for 12-month deposits is lower at 4.6%. Meanwhile, for 6-month and 9-month deposits, Vietcombank's interest rate is 2.9%.

3-month deposit term, lower interest rate at 1.9% and 1-month, 2-month term interest rate is 1.6%.

Currently, Vietcombank's lowest non-term interest rate is 0.1%.

Comparing Vietcombank's interest rates with Big4 groups such as: Agribank, VietinBank, BIDV, it can be seen that Vietcombank's interest rates are lower in many terms.

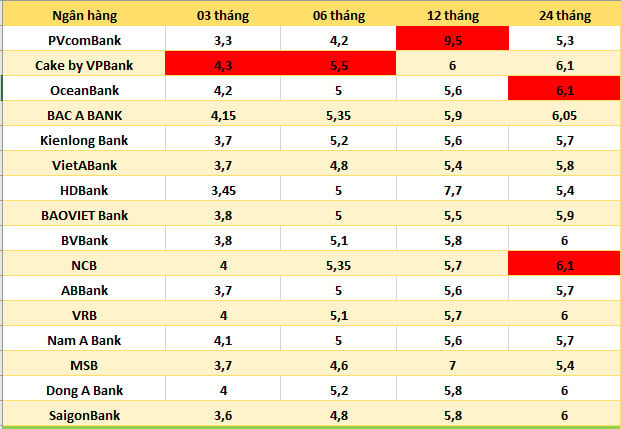

In addition, readers can update interest rates of other banks through the table below:

Bank interest rates have been increasing steadily since the beginning of September. Accordingly, OCB increased deposit interest rates for all terms by 0.1-0.2% per year, interest rates for terms from 1-8 months were adjusted up by 0.2% per year; and for terms from 9-11 months, they increased by 0.1% per year.

After adjustment, the online mobilization interest rate table for 1-month term is listed at 3.9%/year, 2-month term is 4%/year, 3-4 months is 4.1%/year, and 5-month term is 4.5%/year, 6-8 month term is listed at 5.1%/year, 9-11 month term is up to 5.1%/year.

Since the beginning of September, the market has recorded 8 banks increasing interest rates, namely NCB, Agribank, GPBank, VietBank, OceanBank and Dong A Bank, Bac A Bank and OCB. Of which, on September 13, NCB's interest rate reached a new peak for the 18-36 month term with a listed interest rate of up to 6.15%/year. In addition, Agribank and VietBank also increased quite strongly, with an increase of up to 0.3%/year.

Previously, in August, the market recorded 17 banks increasing savings interest rates, including: Eximbank, ACB, Agribank, Sacombank, Saigonbank, VietBank, TPBank, CBBank, VIB, Dong A Bank, VPBank, Techcombank, SHB, VietBank, PVCombank, Nam A Bank, HDBank.

Currently, PvcomBank's interest rate is at its highest level, up to 9.5% for a 12-month term, with conditions applied to a minimum deposit of VND 2,000 billion.

Next is HDBank with a fairly high interest rate, 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. This bank also applies a 6% interest rate for an 18-month term.

MSB also applies quite high interest rates with interest rates at bank counters up to 8%/year for 13-month term and 7% for 12-month term. The applicable conditions are that new savings books or savings books opened from January 1, 2018 automatically renew with a term of 12 months, 13 months and a deposit amount of 500 billion VND or more.

Dong A Bank has a deposit interest rate, term of 13 months or more, end-of-term interest with deposits of 200 billion VND or more, applying an interest rate of 7.5%/year.

NCB applies an interest rate of 6.15% for a 24-month term; Cake by VPBank applies an interest rate of 6.1% for a 12-month term; OceanBank applies an interest rate of 6.1% for a 24-month term. Bac A Bank applies an interest rate of 6.05% for a 24-month term.

BVBank and Cake by VPBank also apply 6% interest rate for 24-month and 12-month terms; VRB and Dong A Bank apply 6% interest rate for 24-month terms; SaigonBank applies 6% interest rate for 13, 18 and 24-month terms, 6.1% for 36-month terms.

How to receive interest if saving 200 million VND at Vietcombank?

Formula for calculating bank deposit interest:

Interest = Deposit x interest rate (%)/12 months x deposit term.

For example, you deposit 200 million VND in Vietcombank, depending on the deposit term with different interest rates, the interest you receive is as follows:

+ 3-month term: 950,000 VND.

+ 6 month term: 2.9 million VND.

+ 9-month term: 4.35 million VND.

+ 12-month term: 9.2 million VND.

+ 24-month term: 18.8 million VND.

+ 36-month term: 28.2 million VND.

+ 48-month term: 37.6 million VND.

+ 60-month term: 47 million VND.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Source: https://laodong.vn/tien-te-dau-tu/lai-suat-vietcombank-cao-nhat-gui-200-trieu-nhan-47-trieu-1393438.ldo

![[Photo] Hanoi is brightly decorated to celebrate the 50th anniversary of National Reunification Day](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/ad75eff9e4e14ac2af4e6636843a6b53)

![[Photo] Demonstration aircraft and helicopters flying the Party flag and the national flag took off from Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/b3b28c18f9a7424f9e2b87b0ad581d05)

![[Photo] Ho Chi Minh City residents "stay up all night" waiting for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/560e44ae9dad47669cbc4415766deccf)

![[Photo] Ho Chi Minh City: People are willing to stay up all night to watch the parade](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/cf71fdfd4d814022ac35377a7f34dfd1)

![[Photo] General Secretary attends special art program "Spring of Unification"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/e90c8902ae5c4958b79e26b20700a980)

Comment (0)