SCB Bank interest rates for online savings deposits in March 2024.

According to observations by reporters from Lao Dong Newspaper, SCB's online savings interest rates in mid-March 2024 ranged from 1.75% to 4.05%.

Of these, SCB offers the highest interest rate at 4.05%, applicable to deposit terms of 12 months or more up to 36 months.

SCB offers an interest rate of 3.05% for terms from 7 to 11 months. For terms from 3 to 6 months, the savings interest rate is 2.05%.

SCB offers the lowest interest rates for customers depositing savings for 1 or 2 months.

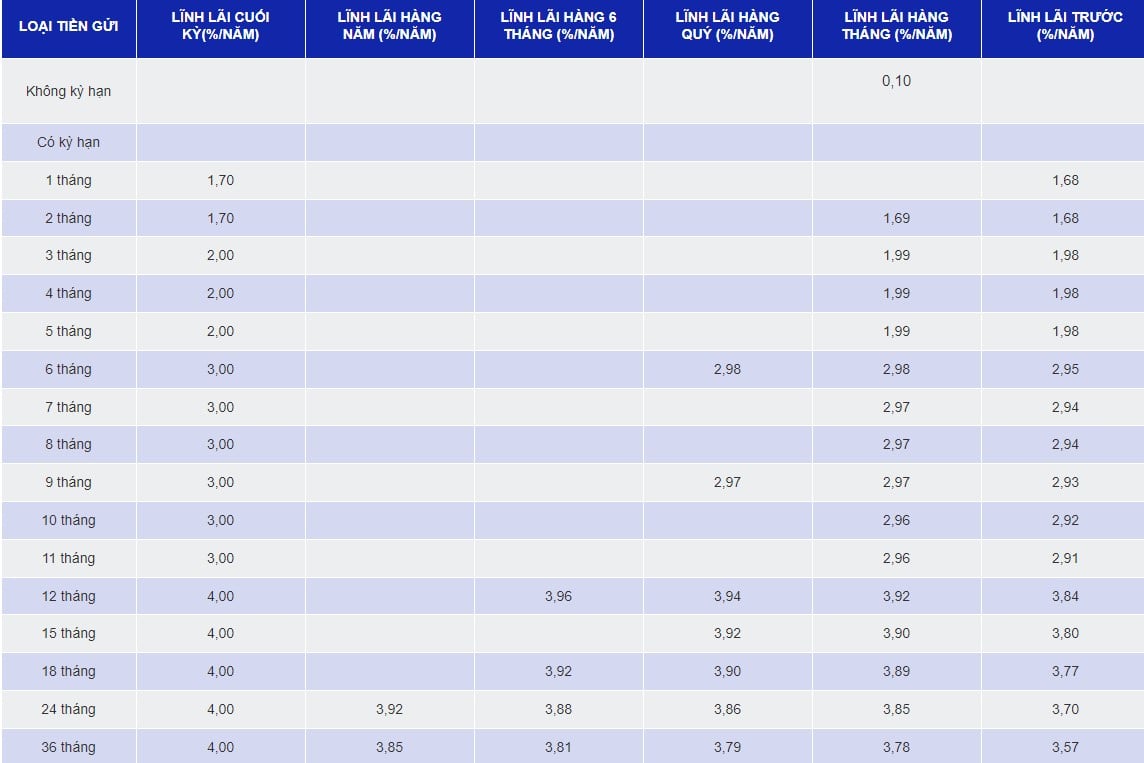

Latest SCB bank savings interest rates

Customers who deposit regular savings at SCB enjoy interest rates of 1.7% - 4.0%.

Specifically, SCB offers the highest deposit interest rate at 4.0%, applicable to deposit terms from 12 months to 36 months.

Next is an interest rate of 3.0%, applicable to deposit terms from 6 months to 11 months.

For deposit terms of 3 months, 4 months, and 5 months, the savings interest rate is 2.0%. For terms of 1 month and 2 months, SCB offers the lowest interest rate at 1.7%.

If I deposit 200 million VND into SCB, how much interest will I receive after one year?

Formula for calculating interest on bank savings deposits:

Interest = Deposit amount x interest rate (%)/12 months x number of months deposited.

For example, if you deposit 200 million VND into an online savings account at SCB, earning an interest rate of 4.05% for a 12-month term, the amount of interest you can receive after 1 year is:

Interest = 200 million x 4.05%/12 x 12 months = 8.1 million VND.

+ If you have 200 million VND in a regular savings account at SCB, earning an interest rate of 4.0% for a 12-month term, the amount of interest you can receive after 1 year is:

Interest = 200 million x 4.0%/12 x 12 months = 8 million VND.

Additionally, readers can refer to the following articles about bank interest rates:

- Latest MB Bank interest rates for March 2024: Here

- Latest Agribank interest rates for March 2024: Here

- Latest NCB bank interest rates for March 2024: Here

Interest rate information is for reference only and may change from time to time. Please contact your nearest bank branch or hotline for specific advice.

Source

Comment (0)