In a new report, Goldman Sachs cut the chances of an early recession in the US, saying the possibility is now just 20%.

|

| Sustained growth would make the US economy more like other G10 economies, where the Sahm Rule holds only about 70%. (Source: Medium) |

On August 2, the US Department of Labor released a report showing that the number of new non- agricultural jobs in the US economy reached only 114,000 jobs last month, much lower than the adjusted figure of 179,000 new jobs in June and the forecast of 185,000 new jobs given by economists in a survey by Dow Jones news agency.

The July jobs report raised concerns about the health of the US economy, leading to a sharp but brief sell-off in the stock market.

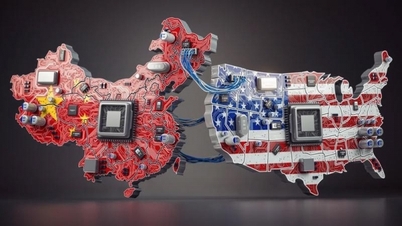

Investors at that time believed that the US Federal Reserve (Fed) had kept interest rates too high for too long, putting the economy at risk of a "hard landing" - fighting inflation but resulting in economic recession.

Previously, the unemployment rate in July increased to 4.3% from 4.1%, also triggering the "Sahm Rule" - an indicator of an economy entering a recession when the 3-month moving average of the US unemployment rate is at least half a percentage point higher than the low in the most recent 12-month period.

After the report was published, Goldman Sachs raised the possibility of the US economy falling into recession from 15% to 25%.

However, over the weekend, the bank changed its mind again, reducing the probability to 20%, based on the assessment that economic data released since August 2 until now “shows no signs of recession”.

Among them was a July retail sales report showing growth of 1%, compared with forecasts for a 0.3% increase; and a weekly initial jobless claims report showing fewer people than expected.

The figures helped improve sentiment in financial markets, sending stock prices on Wall Street and many other markets up sharply last week.

“Sustained growth would make the US economy more like other G10 economies, where the Sahm Rule holds only about 70% of the time,” the Goldman Sachs report said.

Smaller developed economies than the US - such as Canada - have seen unemployment rates rise sharply this economic cycle, but have not yet fallen into recession, the report said.

Claudia Sahm, chief economist at New Century Advisors and the author of the Sahm Rule, doesn't believe the U.S. economy is currently in recession. However, she said, "A continued deterioration in the job market could tip the economy into recession."

Source: https://baoquocte.vn/goldman-sachs-quay-xe-khang-dinh-kinh-te-my-khong-thay-dau-hieu-suy-thoai-283268.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)