Stock Market Perspective Week 8-12/7: There will be "shakes" at the resistance zone of 1,280 - 1,300 points

In July 2024, a 5% volatility of the VN-Index could result in a large difference in return performance for portfolios with different stock weights.

The market last week had an upward trend throughout 5 sessions. However, liquidity in the market has not shown any signs of returning. This increase mainly came from large-cap and fragmented stocks such as FPT, MWG, LPB, etc.

VN-Index ended the week at 1,283.04 points, up 37.72 points (+3.03%) compared to the previous week.

Liquidity on both exchanges this week decreased compared to the previous trading week when the matched volume was -26.8% at HoSE and -29% at HNX. Foreign investors continued to net sell this week with VND 2,308,962 billion at HoSE, focusing on VRE (-728.4 billion), and FPT (-463.1 billion), VHM (-422.2 billion) and HPG (-214 billion)... On the other hand, net buying was at DSE (+206.4 billion), NLG (+194.4 billion), BID (+188.2 billion)...

|

| Source SSI. |

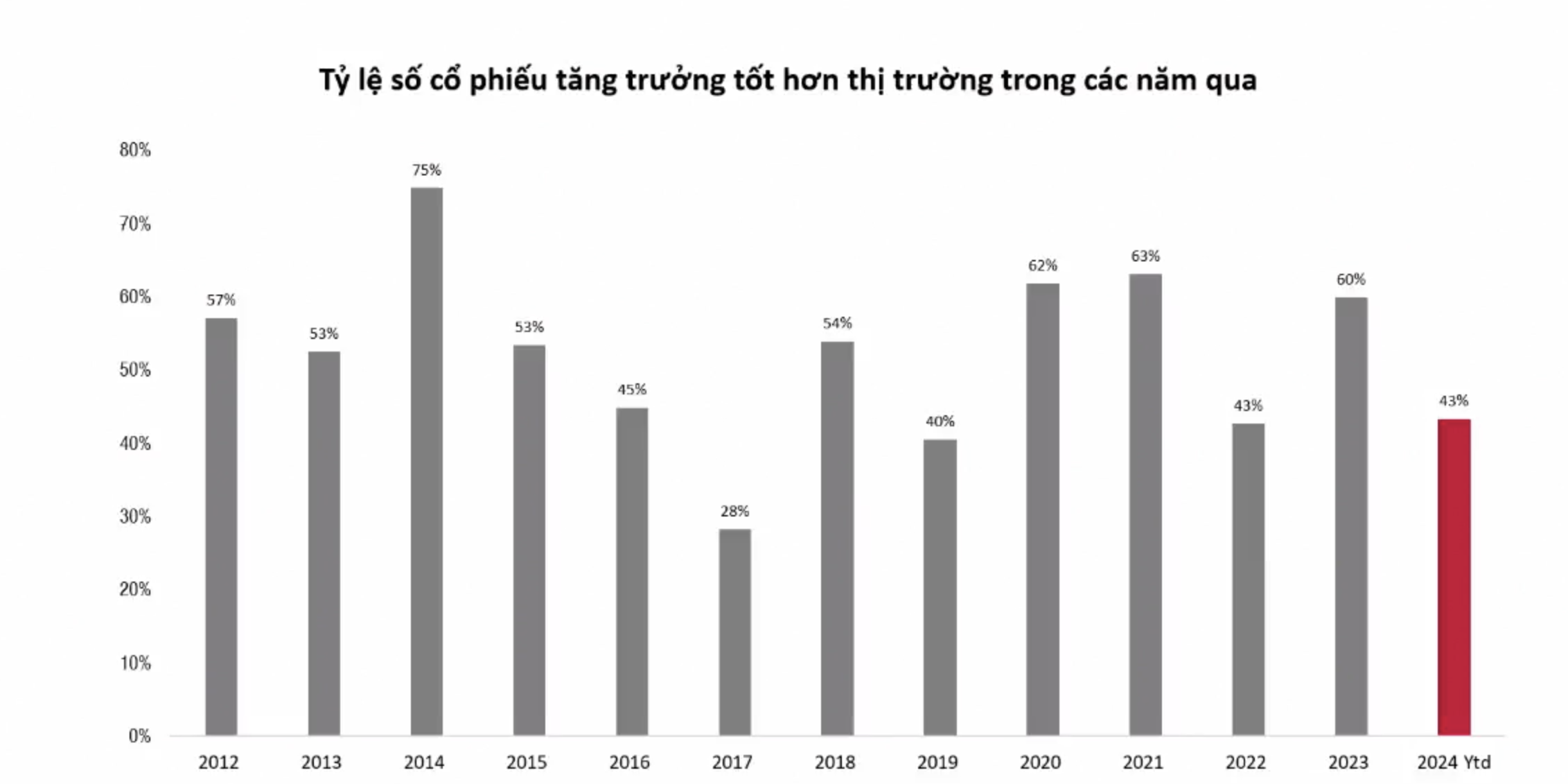

Mr. Ho Huu Tuan Hieu, Investment Strategy expert of SSI Securities Company, said that the context of low liquidity is not too new to the market from 2023 to now, the market's declines have seen the market breadth and liquidity narrow, thereby limiting the number of stocks with growth.

In the context of 2024, the score increased by about 13%, equal to the whole of 2023, but looking at the rate of stocks growing better than the market in recent years, the number of stocks that are better than the market in 2024 is much more limited than the whole previous year. In 2017, only a few pillar stocks such as VIC, MSN, GAS... increased strongly, helping the VN-Index increase, while most other stocks lagged behind.

In years of very low liquidity like 2019, the number of outstanding stocks is also very small, in 2022, the market declines sharply in points (down 25% - 30% in indexes), creating difficulties in choosing stocks.

According to Mr. Hieu's observation, from the beginning of 2024 until now, although the market has increased, the picture is quite similar to the past difficult years, there is a very high differentiation between industry groups, the number of stocks increasing in price is low, there is no successive increase in price between stocks in the industry - similar to the 2023 industry wave, although the score did not increase too strongly, choosing stocks is much easier.

In this picture, it means that, although the score increases, there is stock differentiation, the main story of the market is stock selection, but at this time, stock selection has a lower probability than previous years, position, short-term surfing at the present time will therefore be more difficult.

The return of liquidity will bring more positive things, picking stocks will have a higher probability of being correct. In conclusion, not only the score, but also breadth and liquidity are important links for making short-term decisions.

The hopeful point in July 2024 is that the second quarter business results season may bring a more positive sentiment.

Ms. Nguyen Thi Phuong Lam, Head of Strategy Department of Rong Viet Securities Company, said that the second quarter business results reporting season will bring excitement to the stock market, continuing to follow the positive trend of economic growth and credit growth rate gradually improving from the end of the first quarter of 2024.

According to Dragon Viet's estimates, total market revenue will begin to recover compared to the previous quarter, although the increase may be lower than the same period last year. Meanwhile, after-tax profit growth is estimated at 13% compared to the same period last year, implying an improvement in net profit margins of listed companies compared to the same period last year.

On the other hand, exchange rate pressure and thus interest rate issues will still be a burden on the market. Statistics show that mobilization interest rates have increased by 30-50 points compared to the end of March 2024, but are still lower than the end of 2023. Prolonged exchange rate pressure due to the strength of the USD and increased foreign currency demand makes the risk of the State Bank adjusting the operating interest rate higher in the third quarter of 2024 possible.

At the same time, Rong Viet expects the economy's capital absorption capacity to gradually increase again, especially in the final stage of the year, causing interest rates in the economy to continue to increase during this period.

Ms. Lam noted that a 5% fluctuation of the VN-Index could result in a large difference in the return performance of portfolios with different stock weights. Therefore, it is recommended that investors limit the use of excessive leverage and always have purchasing power for opportunities in major corrections.

Returning to the investment strategy for next week, according to SSI experts, VN-Index is gradually entering the important resistance zone of 1,280 - 1,300 points in the short term. Liquidity has not really returned as investor sentiment is still quite cautious. It is likely that the market next week will have "shakes" at the above resistance zone, then accumulate more to form a new bullish structure.

Short-term investors are recommended to take partial profits from profitable positions and wait for opportunities to increase when the market has a pullback or convincingly overcomes resistance. The industries to watch include retail - consumer goods, food, export, banking, steel, etc.

With a long-term vision, investors can apply a partial accumulation strategy during corrections with good fundamental stocks and positive prospects for business results .

Current recommended stock weight is 60%/NAV.

Source: https://baodautu.vn/goc-nhin-ttck-tuan-8-127-se-co-rung-lac-tai-vung-khang-cu-1280---1300-diem-d219477.html

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

![[Photo] Prime Minister Pham Minh Chinh starts construction of vital highway through Thai Binh and Nam Dinh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/52d98584ccea4c8dbf7c7f7484433af5)

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

Comment (0)