Banking sector plays an important role in promoting financial inclusion

This strategy aims to ensure that all people and businesses have safe and convenient access to and use of financial products and services that meet their needs at reasonable costs from licensed organizations that provide them responsibly and sustainably. The implementation of the strategy will contribute to improving people's living standards, promoting savings and investment. Thereby, bringing great benefits, supporting economic growth, reducing inequality, stabilizing finance, and achieving social progress and justice in accordance with the direction of the Party and the State.

In line with the Party and State's policies and orientations, as the standing agency of the National Steering Committee on Financial Inclusion, in recent times, the State Bank of Vietnam (SBV) has worked with ministries and branches to develop many solutions to promote the goals stated in the strategy. Thanks to that, Vietnam has made great strides in promoting financial inclusion, ranking 3rd in the ASEAN region (after Singapore and Thailand), and 14th in the world , in the 2024 Global Financial Inclusion Index of Principal Financial Group. According to the SBV's report, currently about 87% of adults have payment accounts, nearly 3 times higher than the 31% rate in the 2015-2017 period.

|

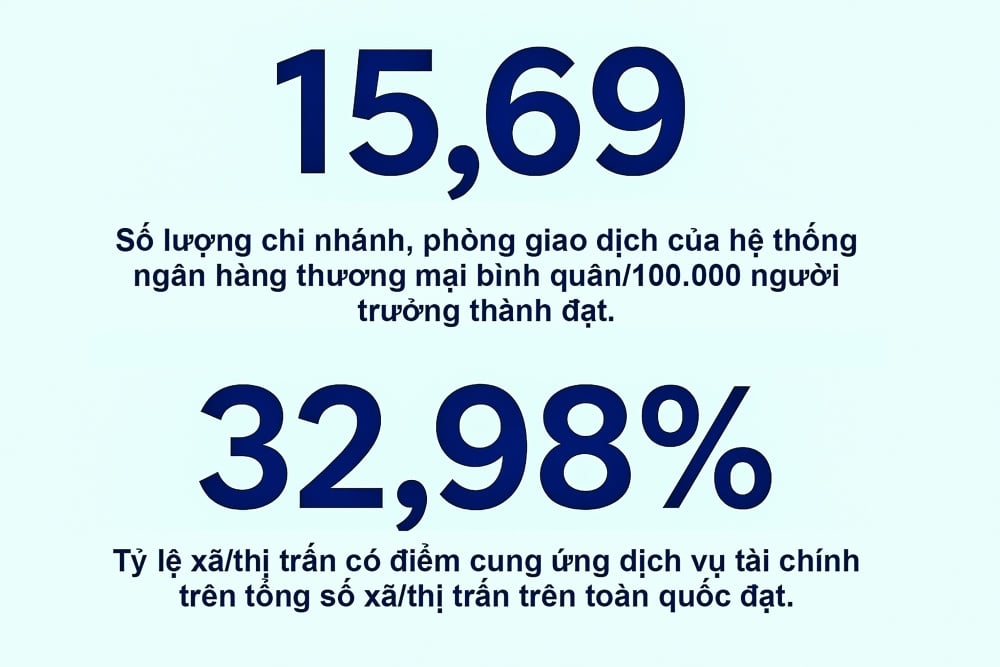

With the efforts of the banking sector, the system of organizations providing financial products and services in the market has developed quite diversely, present in most provinces and cities across the country, targeting rural areas, remote areas. The average number of branches and transaction offices of the commercial banking system per 100,000 adults reached 15.69 units; the rate of communes/towns with financial service points out of the total number of communes/towns nationwide reached 32.98%.

In particular, credit institutions have been implementing digital transformation strategies in their operations; proactively researching and developing digital banking products and services; improving customer convenience and experience through increased connectivity with other sectors and fields, helping people in remote areas access services quickly, safely and conveniently.

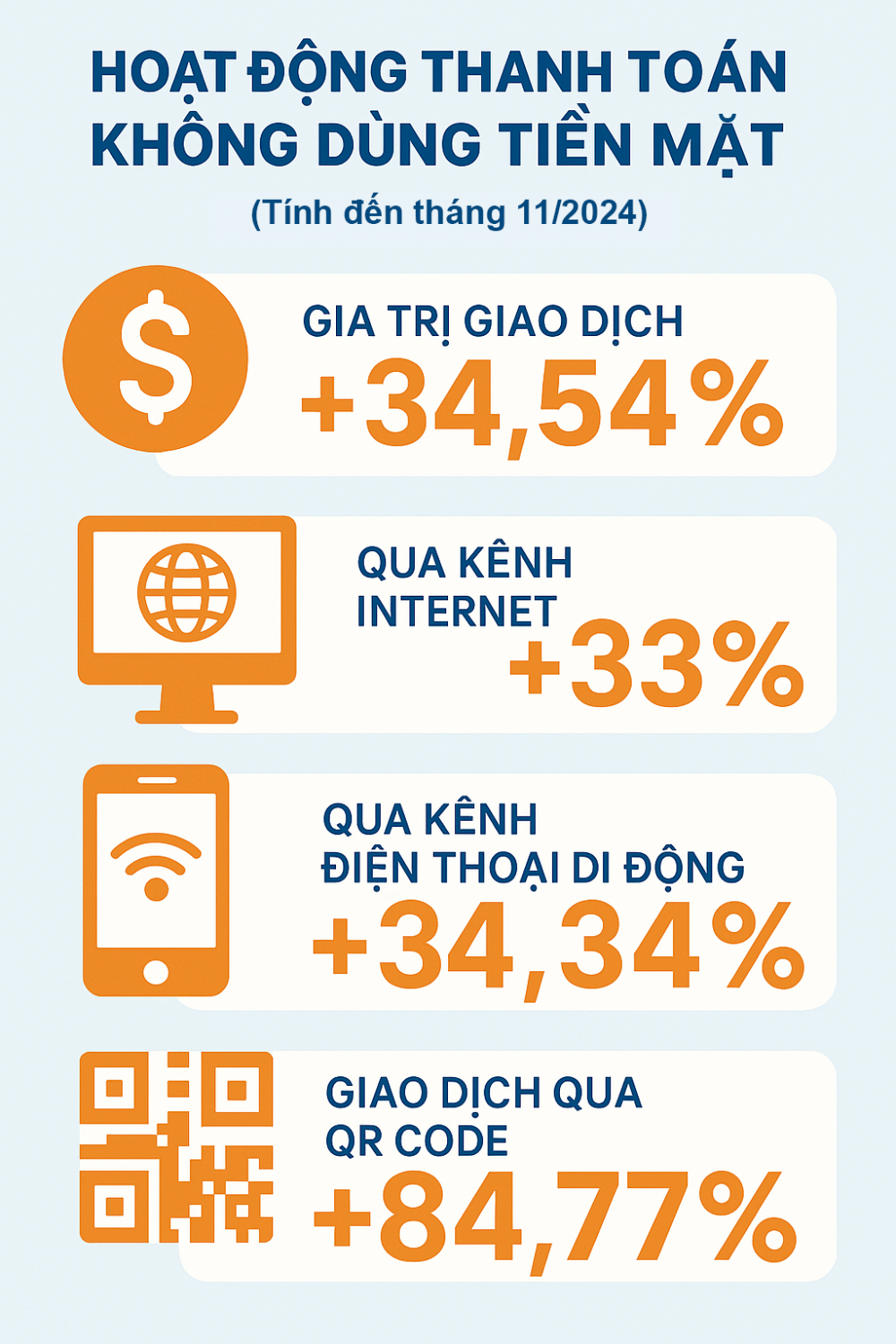

Non-cash payment activities have also been continuously expanded with the drastic implementation of many solutions by ministries, branches, localities and relevant agencies. The value of non-cash payment transactions increased by 34.54%; via the Internet channel increased by 33%, via mobile phone channel increased by 34.34%; transactions via QR Code increased by 84.77% compared to the same period in November 2023.

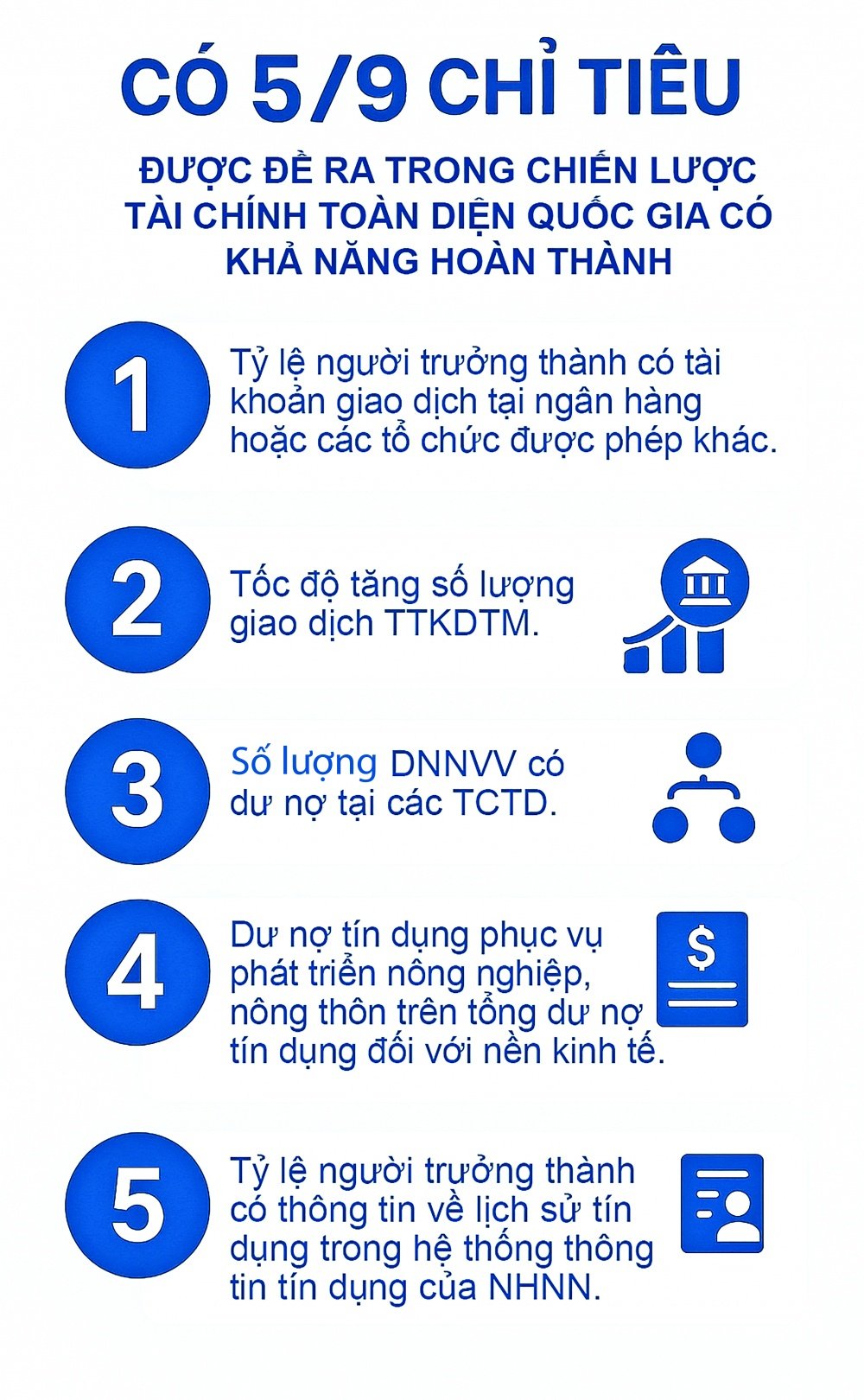

Thanks to that, 5/9 targets set out in the National Comprehensive Financial Strategy are likely to be achieved, including: The proportion of adults with transaction accounts at banks or other licensed organizations; The growth rate of the number of e-commerce transactions; The number of SMEs with outstanding loans at credit institutions; Outstanding credit for agricultural and rural development over total outstanding credit for the economy; The proportion of adults with credit history information in the State Bank's credit information system.

|

Financial education from school is a strategic and urgent step.

According to Deputy Governor of the State Bank of Vietnam Pham Thanh Ha, financial education is one of the key objectives to effectively implement the National Financial Inclusion Strategy. In the context of a rapidly developing digital economy, financial thinking has become an essential skill for modern citizens. However, the reality shows that many Vietnamese people are still unfamiliar with basic financial concepts.

To raise financial awareness in the community, ministries and sectors, including the State Bank, have coordinated to implement training programs to equip people and businesses with financial knowledge and skills. The Ministry of Education and Training has also integrated financial education content into the National General Education Program. Along with that, the authorities continue to improve the legal framework related to the provision of financial products and services, enhance information transparency, as well as dispute and complaint resolution mechanisms, thereby better protecting the rights of financial consumers.

However, to communicate and educate about finance to all target groups is a big challenge, requiring diversification in the form of approach. In recent times, the State Bank has implemented many creative communication programs, helping to maximize the coverage of financial and banking knowledge to the public. Typical programs include the game show "Smart Money", the cartoon series "Key Keeper", the contest "Understanding Money Correctly", "Future Banker"... These forms have contributed to spreading information in a more vivid, closer and more accessible way to people of different ages and occupations.

Assessing the financial education communication activities of the State Bank, Ms. Anna Szawacki, Representative of the German Savings Banks International Cooperation Foundation (DSIK), said that financial knowledge is conveyed very naturally and incidentally, not dry or academic. Ms. Anna also expressed her belief that, under the direction of the State Bank and the coordination of relevant functional units, Vietnam will continue to effectively implement financial education communication activities.

Prof. Dr. Le Anh Vinh, Director of the Vietnam Institute of Educational Sciences, emphasized that financial education is one of the important goals for the successful implementation of the National Comprehensive Financial Strategy. In particular, personal financial management is not simply about making money or saving, but is a comprehensive combination of income, spending, saving, investing and risk management. At the same time, this is also related to building personal habits and behaviors, combined with knowledge of financial products and services. However, at present, many Vietnamese people still do not have much access to financial knowledge, so financial education right from school is a strategic and urgent step.

From a management perspective, Associate Professor, Dr. Pham Quoc Khanh, Deputy Director of the Department of Quality Management, Ministry of Education and Training, emphasized the importance of orienting financial education in general education programs. To achieve effectiveness, schools need to integrate financial education content into the curriculum through subjects and extracurricular activities. At the same time, teachers need to be equipped with professional skills to convey knowledge in an easy-to-understand and close-to-student manner.

Regarding this issue, Ms. Le Anh Lan, education expert of the United Nations Children's Fund UNICEF in Vietnam, said that financial education should not only stop at providing basic knowledge, but also focus on in-depth understanding of personal financial management skills such as spending, saving, investing and risk management. To do this, teachers need to be equipped with specialized knowledge of financial education, and at the same time understand students' psychology as well as the barriers they may encounter when approaching financial concepts.

|

In response to practical demands, Banking Times and FPT Corporation have officially signed a cooperation agreement to deploy the "Smart Finance" playground - the first financial education playground in Vietnam for high school students nationwide. The "Smart Finance" playground is expected to be deployed from May 2025, for primary, secondary and high school students nationwide. Through a system of quality questions and an attractive and lively online competition format, the program will help students access knowledge about consumption, savings and personal financial management in the form of "learning while playing - playing while learning". It is expected that in the first year, the program will reach more than 1 million students.

With the strengths of both units, Deputy Governor of the State Bank of Vietnam Pham Thanh Ha hopes that the cooperation between FPT Corporation and Banking Times will not only create a meaningful playground for high school students nationwide, but also contribute practically to the popularization of financial knowledge, building smart financial management habits for Vietnamese people, especially the young generation, the core digital citizen force in the future.

On the part of the Banking sector, in the coming time, the sector will continue to coordinate with media and press agencies to implement financial education communication programs that are creative, easy to understand, easy to access, highly interactive, and apply the power of digital technology. At the same time, coordinate with educational and training institutions, socio-political organizations, and professional associations to implement appropriate programs for each target group.

Source: https://thoibaonganhang.vn/giao-duc-tai-chinh-be-phong-cho-chien-luoc-tai-chinh-toan-dien-162618.html

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)