Transactions are still trickling down despite the removal of "identity"

Unblocked by Decree 10/ND-CP, condotels are expected to quickly “break the ice”, becoming a psychological boost when the possibility of being granted a red book is an important factor for investors. After the story of condotel’s identity was resolved, many investors also started launching sales programs to wait for the new wave.

However, until the end of the second quarter and July, the purchasing power of condotels still did not have a breakthrough. Both the primary and secondary markets did not record many transactions compared to the huge inventory of condotels.

According to a recent report by DKRA Group, cumulative condotel inventory by June had jumped to 42,364 units, more than the combined inventory of beach shophouses and resort villas (about 30,000 units). Condotel prices in all three regions are currently in the range of 31 - 154.5 million VND/m2.

Despite being removed, the number of condotels sold still did not meet expectations.

The number of condotels offered for sale but not yet purchased is nearly 4,900 units while the inventory waiting for the next sale is nearly 37,500 units. According to this survey consultant, throughout the second quarter, condotel consumption was 78% lower than the same period, with consumption falling 95% in April and May alone.

Although the market has previously recorded positive feedback from investors who have continuously launched many promotional sales policies, interest rate support, discounts up to 30%, profit sharing commitments, etc.

For example, in the Ho Tram area, Ba Ria - Vung Tau province, some projects are being offered for sale and customers will be committed to a profit of 6.5%/year, after the commitment period, they will be divided 90% of the exploitation profit, the product price is 2.7 - 3.5 billion VND/unit depending on the area.

However, in response to the efforts to revive the market, the number of condotel transactions is still small. This has led to many investors starting to close their portfolios to avoid incurring costs, causing financial burdens in the current period.

Accept to cut losses but find it difficult to find buyers

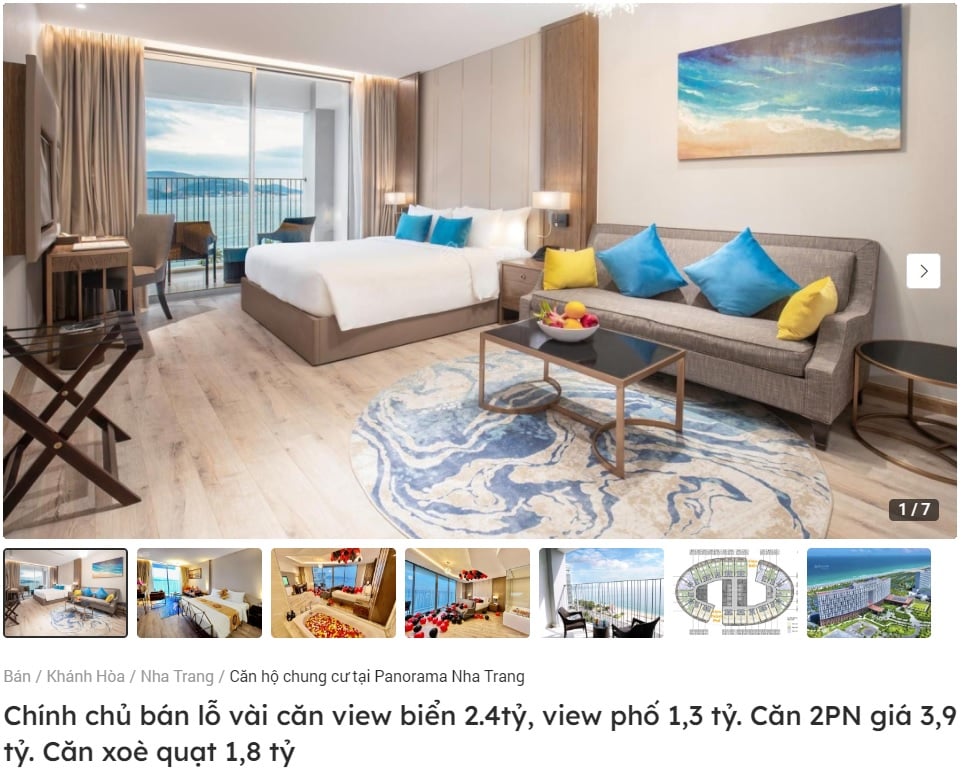

In the secondary market, many customers are still selling condotels at a loss for many reasons such as finances, lack of confidence in the market or conflicts over operations and profits with investors.

However, despite being sold below cost, many projects in good locations with potential for future development have had difficulty finding buyers in recent times. According to experts, at present, only low-priced products can be easily transferred because the risk of burying capital is not high.

As for condotels in high-end projects with large areas, the price can be up to over 5 billion VND/unit, which is very difficult to sell. For that reason, many condotel investors, after many months of unsuccessfully advertising to cut losses, have had to accept long-term holding, accept low cash flow and find ways to solve financial problems such as loan interest.

Condotel loss-cutting ads appear more and more on online real estate markets.

According to Cushman & Wakefield Vietnam, in recent years, investment in condotels has slowed down and weakened due to the impact of the pandemic and economic instability. With the pressure of annual cash flow, resort real estate projects must be located in areas with a stable source of tourists to fulfill their commitments.

In addition, condotel projects are of interest to investors because of the issue of profit. For condotels to operate, many factors must be ensured, such as convenient location, diverse and rich amenities, professional management, close coordination with domestic and international travel agencies to maintain customer sources... Moreover, profit commitments are often maintained for a long time, not all investors are trusted by customers.

So it is still too early to expect a recovery in the condotel market because it depends a lot on the overall growth of the economy. In addition, we also have to wait for the development of the tourism industry and the operating capacity of the investor. This not only requires the investor to have a lot of experience in the field of resort tourism but also to have a long-term vision to come up with a flexible business plan suitable for each ups and downs.

Many opinions also believe that, with the dependence on many factors as analyzed above, condotel is likely to be the latest recovery segment in the real estate market. Because this type still lacks legal standards, each project has different characteristics. This leads to the possibility that customers will suffer losses when disputes arise.

Not to mention that in the recent past, records from many projects show that the profits that investors receive from exploiting and operating condotels only reach 1 - 4%, not to mention many projects are unprofitable and falling in price. Meanwhile, the selling price of condotels is pushed up, far beyond the actual value, making it difficult for many investors to recover their capital in the medium term.

For these reasons, although many legal issues have been resolved, especially the acceleration of the issuance of certificates, the transaction volume of condotels has not yet met expectations. For condotels to recover, it still depends a lot on the long-term vision of investors and buyers as well as the support of the Government to restore confidence in this market.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)