Trading is still gloomy, VN-Index is approaching the 1,250 point mark again

The index maintained its green color, however, cash flow in the market remained weak. Steel stocks attracted cash flow, HVN also bounced back after 3 months of deep decline, while HBC, HNG, and LDG stocks fell sharply after negative information was announced last week.

|

| Vietnam Airlines shares hit the ceiling, contributing positively to the rally on July 29. |

Last week, reports from several organizations such as HSBC and Citibank gave positive assessments of Vietnam's economic prospects. HSBC raised its 2024 GDP growth forecast to 6.5% (previously 6%) and lowered its inflation forecast to 3.6%. In addition, the Ministry of Planning and Investment forecast that Vietnam could attract about 39-40 billion USD in foreign investment this year, equivalent to or higher than the results in 2023.

However, Vietnam's stock market still fluctuated quite negatively. VN-Index ended the week at 1,242.11 points, down 1.79%, trading volume decreased 18.3% compared to the previous week, below average. Also last week, the US Department of Commerce decided to postpone the announcement of the decision on whether Vietnam is a market economy or not until August 2, 2024 due to the recent computer incident.

Starting the new week, the green color continued to be maintained on the indices right from the beginning of the trading session. Many stock groups traded actively and contributed to maintaining the positivity of the general market. The indices maintained green throughout the session although sometimes strong selling pressure appeared. However, the cash flow in the market is still relatively weak when the market liquidity remains at a low level.

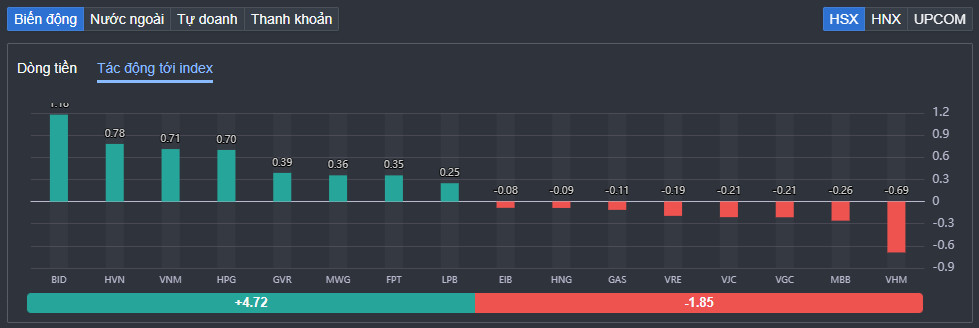

In the large-cap group, codes such as BID, VNM, HPG, GVR... increased in price well and contributed to consolidating the green color of the indices. Of which, BID increased by 1.8% and contributed 1.18 points to the VN-Index. Besides BID, some other bank stocks such as HDB, TPB, ACB, LPB or CTG also increased in price today.

Second on the list of positive impacts on the VN-Index is HVN. This stock was pulled up to the ceiling price after falling about 45% in just 3 weeks of trading. HPG also surprised in today's session when it increased by 1.6% and contributed 0.7 points to the VN-Index. Steel stocks such as TVN, VGS, NKG... also increased well. Recently, the Ministry of Industry and Trade issued Decision No. 1985/QD-BCT on the investigation and application of anti-dumping measures on some hot-rolled steel products (HRC) originating from India and China.

|

| Top 10 stocks affecting VN-Index session 7/29. |

Fertilizer and chemical stocks also had a positive trading session when BFC was pulled up to the ceiling price right from the beginning of the trading session. DDV increased by 5%, LAS increased by 4.8%, DCM increased by 4.6%, CSV increased by 2%... This industry group recorded many enterprises announcing positive business results in the second quarter. According to BFC's consolidated financial report, the enterprise's net revenue in the second quarter of 2024 reached VND 2,916 billion, up 24.9% over the same period. Profit after tax reached VND 190.3 billion, 2.9 times higher than the same period. Similarly, DCM's financial report showed that this enterprise achieved VND 598 billion in pre-tax profit in the second quarter, up 85% over the same period.

Real estate stocks were strongly differentiated in today's session. Codes such as NTL, TCH, DIG... all increased in price, of which, NTL increased by more than 4%, TCH increased by 3.9%... In the opposite direction, stocks such as PDR, DXG, HDG, NLG... were all in red.

Stocks that negatively affected the VN-Index included VHM, MBB, VGC, VJC, VRE... Of which, VHM decreased by 1.7% and took away 0.69 points from the VN-Index. MBB decreased by 0.8% and took away 0.26 points.

Notably, some stocks such as HBC, HNG, LDG or DLG were all sold at the floor price. Both HBC and HNG have just received notice of mandatory delisting. Specifically, according to HBC's audited financial statements as of December 31, 2023, the company had accumulated losses of more than VND 3,240 billion, while its charter capital was more than VND 2,741 billion. Meanwhile, HNG was forced to delist because its parent company's after-tax profits had been losing money for 3 consecutive years.

At the end of the trading session, VN-Index increased by 4.49 points (0.36%) to 1,246.6 points. The entire floor had 244 stocks increasing, 168 stocks decreasing and 94 stocks remaining unchanged. HNX-Index increased by 0.86 points (0.36%) to 237.52 points. The entire floor had 97 stocks increasing, 63 stocks decreasing and 62 stocks remaining unchanged. UPCoM-Index increased by 0.28 points (0.29%) to 95.46 points.

Total trading volume on HoSE reached 496.9 million shares, up about 8% compared to the session at the end of last week, equivalent to a trading value of VND11,380 billion. Trading value on HoSE and HNX reached VND1,061 billion and VND482 billion, respectively.

|

| Foreign investors have been net buyers and sellers in recent sessions. |

Foreign investors net sold again VND224 billion on HoSE, in which, PDR was the most net sold with VND41 billion. DCM and MWG were net sold with VND39 billion and VND27 billion respectively. On the other hand, VIX was the most net bought with VND63 billion. FPT and VNM were net bought with VND52 billion and VND37 billion respectively.

Source: https://baodautu.vn/giao-dich-chua-het-am-dam-vn-index-tien-gan-tro-lai-moc-1250-diem-d221055.html

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)