USD exchange rate today 12/28/2024

At the time of the survey at 5:00 a.m. on December 28, the central exchange rate at the State Bank was 24,322 VND/USD, up 12 VND from the previous trading session. The USD selling price at commercial banks remained unchanged at 25,536 VND/USD. The USD Index (DXY) was 108.04, down 0.06 points from yesterday.

Specifically, at Vietcombank , the USD exchange rate increased by 13 VND for buying and selling compared to the previous session, at 25,208 - 25,538 VND/USD, buying and selling. The USD/VND exchange rate on the free market at the end of today increased by 69 VND for buying and selling, trading around 25,676 - 25,845 VND/USD.

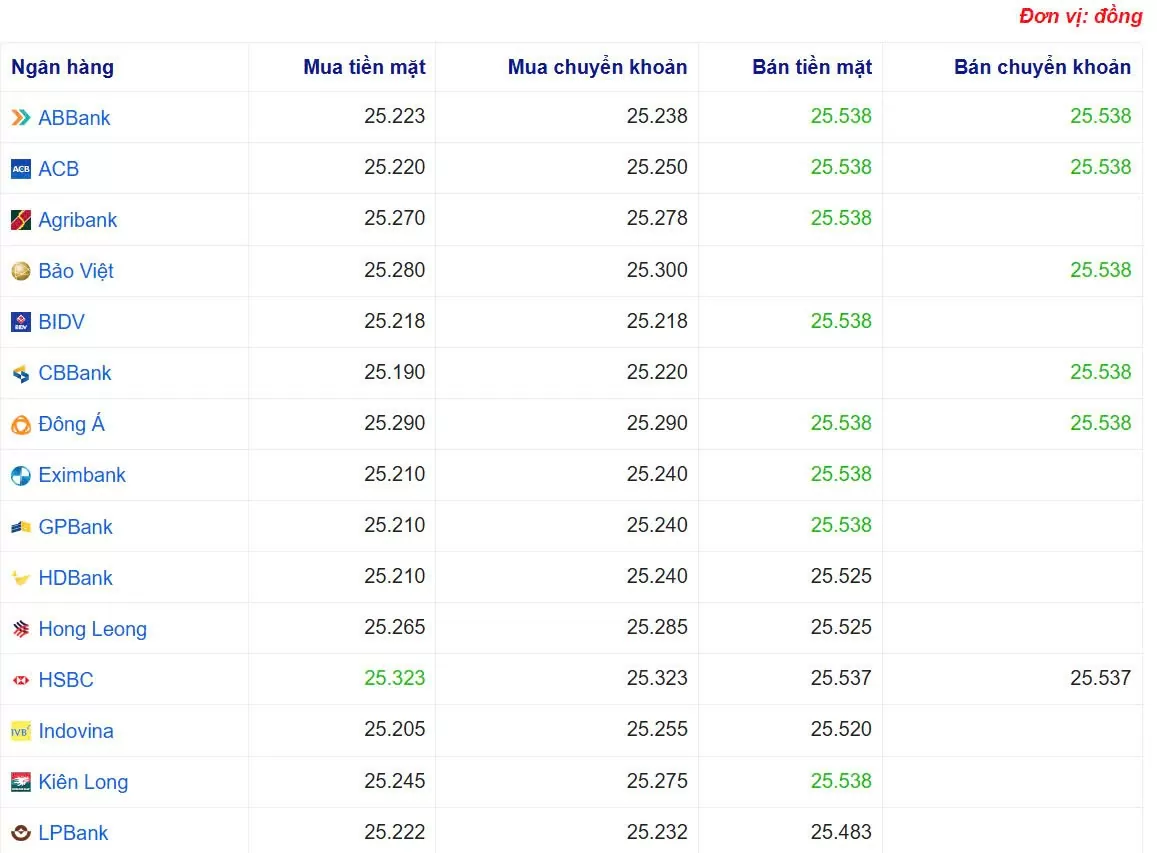

|

| USD exchange rate at some banks. Photo webgia.com |

| 1. Agribank – Updated: December 28, 2024 09:30 – Time of the source website | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25,270 | 25,278 | 25,538 |

| EUR | EUR | 25,977 | 26,081 | 27,179 |

| GBP | GBP | 31,263 | 31,389 | 32,349 |

| HKD | HKD | 3,210 | 3,223 | 3,328 |

| CHF | CHF | 27,760 | 27,871 | 28,712 |

| JPY | JPY | 157.56 | 158.19 | 164.95 |

| AUD | AUD | 15,511 | 15,573 | 16,077 |

| SGD | SGD | 18,391 | 18,465 | 18,976 |

| THB | THB | 725 | 728 | 759 |

| CAD | CAD | 17,336 | 17,406 | 17,898 |

| NZD | NZD | 14,062 | 14,547 | |

| KRW | KRW | 16.53 | 18.13 | |

| 2. Sacombank – Updated: 02/15/2008 07:16 – Time of website source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| USD | USD | 25250 | 25250 | 25538 |

| AUD | AUD | 15447 | 15547 | 16118 |

| CAD | CAD | 17323 | 17423 | 17977 |

| CHF | CHF | 27871 | 27901 | 28774 |

| CNY | CNY | 0 | 3452.3 | 0 |

| CZK | CZK | 0 | 1000 | 0 |

| DKK | DKK | 0 | 3521 | 0 |

| EUR | EUR | 26054 | 26154 | 27029 |

| GBP | GBP | 31334 | 31384 | 32494 |

| HKD | HKD | 0 | 3271 | 0 |

| JPY | JPY | 158.29 | 158.79 | 165.3 |

| KHR | KHR | 0 | 6,032 | 0 |

| KRW | KRW | 0 | 16.9 | 0 |

| LAK | LAK | 0 | 1.122 | 0 |

| MYR | MYR | 0 | 5876 | 0 |

| NOK | NOK | 0 | 2229 | 0 |

| NZD | NZD | 0 | 14118 | 0 |

| PHP | PHP | 0 | 406 | 0 |

| SEK | SEK | 0 | 2280 | 0 |

| SGD | SGD | 18325 | 18455 | 19186 |

| THB | THB | 0 | 691.9 | 0 |

| TWD | TWD | 0 | 779 | 0 |

| XAU | XAU | 8270000 | 8270000 | 8470000 |

| XBJ | XBJ | 7900000 | 7900000 | 8470000 |

|

| USD exchange rate today December 28, 2024. Illustration photo |

In the "black market", the black market USD exchange rate as of 5:00 a.m. on December 28, 2024 is as follows:

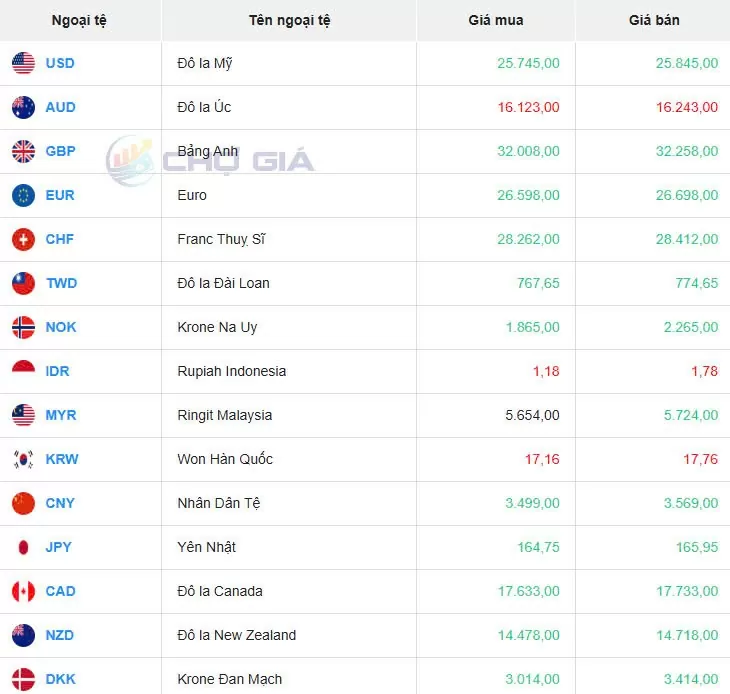

|

| Black market on December 28, 2024. Photo: Chogia.vn |

USD exchange rate today December 28, 2024 on the world market

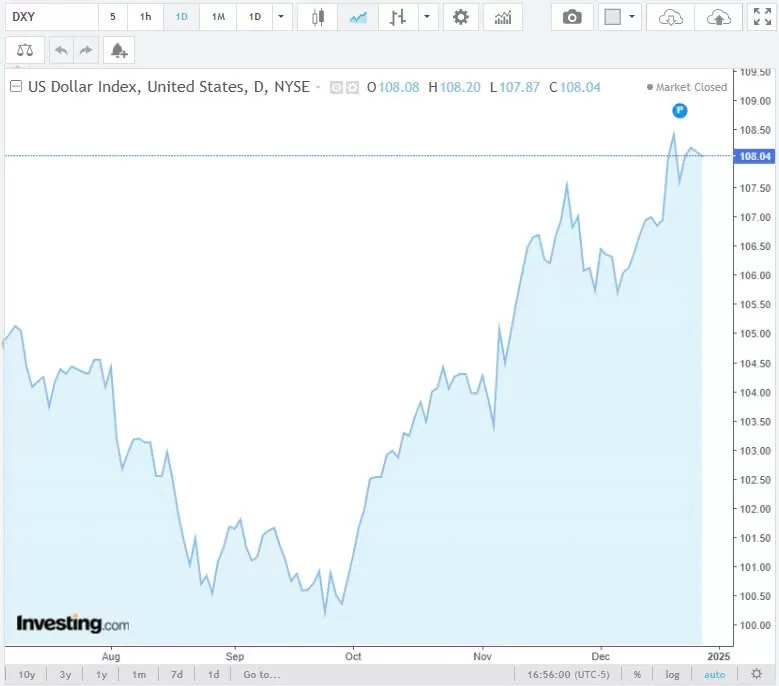

The Dollar Index (DXY), which measures the USD against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), stopped at 108.04, down 0.06 points compared to trading on December 27, 2024.

|

| DXY index developments in recent times. |

Global stocks, the US dollar and some Treasury yields look set to end the Christmas week on Friday with a small pullback of the broader uptrend, weighed down by a lack of interest and participation heading into the final week of the year.

Wall Street’s major indexes opened lower, capping a holiday-shortened week of optimism that was starting to look like a classic “Santa Claus” rally. The yield on the benchmark 10-year Treasury note edged up slightly but remained below a near eight-month high hit on Thursday, while yields on shorter-term Treasuries fell.

The dollar is on track for a nearly 7% annual gain while the Japanese yen is poised for a fourth straight year of declines on Friday, as traders expect strong U.S. growth, as well as tax cuts, tariffs and deregulation by President-elect Donald Trump’s new administration, to make the Federal Reserve more cautious about cutting interest rates through 2025.

The Dow Jones Industrial Average (.DJI) fell 0.56% after the open. The S&P 500 (.SPX), open new tab , fell 0.65%, putting the Wall Street benchmark on track for a 1% gain for the week. The Nasdaq Composite (.IXIC) fell 0.79% in early trading.

The Dow is up 14% in 2024, the S&P 500 is up 25% and the tech-heavy Nasdaq is up 30%.

Analysts say the stock market could change course as investors return from vacation and reassess the risk of rising inflation in the United States under Trump against highly valued Wall Street stocks.

“There is still some upside potential for this bull market, but it is very limited,” said Luca Paolini, chief strategist at Pictet Asset Management. “(Trump’s) inauguration day is likely to be a turning point and all the good news (that may come) will be priced in at that point,” Paolini added.

MSCI's broadest index of shares in the world (.MIWO00000PUS) fell 0.32% on Friday and was still up 1.07% for the week. MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 0.12%, posting a 1.5% gain for the week, while Tokyo's Nikkei (.N225) rose 1.8%. Europe's Stoxx 600 (.STOXX) rose 0.27% on Friday and was up 0.7% for the week.

The dollar index, which measures the value of the currency against six other major currencies, fell 0.09%, posting a small gain on the week and ending 2024 up more than six percent year-on-year.

The USD/JPY pair fell 0.15%, but was near levels last seen in July, while the greenback has also gained 5.3% this month against the yen and is up nearly 12% in 2024 against the weakened Japanese currency. The euro, up 0.09%, remains at a two-year low.

The BoJ did not raise interest rates this month. Governor Kazuo Ueda said he wanted to wait for clarity on Trump’s policies, underscoring growing concerns among central banks around the world about the impact of U.S. tariffs on global trade.

Earlier this month, Fed Chairman Jerome Powell said U.S. central bank officials “will be cautious about cutting further” after cutting interest rates by a quarter point as expected. The U.S. economy is also facing the impact of Donald Trump, who has proposed deregulation, tax cuts, tariff hikes and tighter immigration policies that economists see as both growth-boosting and inflationary.

Meanwhile, traders expect the Bank of Japan to keep its loose monetary policy and the European Central Bank to continue cutting interest rates.

Traders are pricing in a 37 basis point US rate cut by 2025, while money markets will not fully reflect that cut until June, when the ECB is expected to cut its deposit rate by a full percentage point to 2% as the eurozone economy slows.

Expectations of higher U.S. interest rates pushed the yield on the benchmark 10-year Treasury note, which rises as fixed-income prices fall, to its highest since early May on Thursday morning at 4.641%. It had earlier risen 1.4 basis points to 4.595%.

The yield on the benchmark two-year Treasury note, which tracks interest rate forecasts, was trading around 4.32%, down 1.2 basis points since late Thursday. The trend in U.S. debt also sent euro zone yields higher, with the yield on the 10-year German government bond rising 4.8 basis points to 2.372% on Friday.

Elsewhere, gold fell 0.84% to $2,612.20 an ounce, set to rise about 27% this year and post its biggest annual gain since 2011 as geopolitical and inflation concerns boosted the safe-haven asset.

Oil prices are also set to rise this week as investors await news on economic stimulus efforts in China, the world’s largest crude importer. Brent crude futures rose 1% on the day to $73.99 a barrel, up 1.5% for the week.

Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Hanoi: 1. Quoc Trinh Ha Trung Gold Shop – No. 27 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 2. Gold and Silver Fine Arts – No. 31 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 3. Minh Chien Jewelry Store – No. 119 Cau Giay, Cau Giay District, Hanoi 4. Thinh Quang Gold and Silver Company – No. 43 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 5. Toan Thuy Store – No. 455 Nguyen Trai, Thanh Xuan, Hanoi and No. 6 Nguyen Tuan, Thanh Xuan District, Hanoi 6. Bao Tin Minh Chau Gold, Silver and Gemstones – No. 19 Tran Nhan Tong, Hai Ba Trung District, Hanoi 7. Chinh Quang Store – No. 30 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 8. Kim Linh 3 Store – No. 47 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 9. Huy Khoi Store – No. 19 Ha Trung, Hang Bong, Hoan Kiem District, Hanoi 10. System of transaction offices at banks such as: Sacombank, VietinBank, Vietcombank, SHB Refer to the popular addresses for Foreign Currency Exchange - Buying and Selling USD in Ho Chi Minh City: 1. Minh Thu Currency Exchange – 22 Nguyen Thai Binh, District 1, HCMC 2. Kim Mai Gold Shop – 84 Cong Quynh, District 1, HCMC 3. Kim Chau Gold Shop – 784 Dien Bien Phu, Ward 10, District 10. Ho Chi Minh City 4. Saigon Jewelry Center – 40-42 Phan Boi Chau, District 1, HCMC 5. Kim Hung foreign currency exchange agency - No. 209 Pham Van Hai, Binh Chanh, Ho Chi Minh City 6. DOJI Jewelry Store – Diamond Plaza Le Duan, 34 Le Duan, Ben Nghe, District 1, HCMC 7. Kim Tam Hai Shop – No. 27 Truong Chinh, Tan Thoi Nhat Ward, District 12, HCMC 8. Bich Thuy Gold Shop – No. 39 Pham Van Hai Market, Ward 3, Tan Binh District, HCMC 9. Ha Tam Gold Shop – No. 2 Nguyen An Ninh, Ben Thanh Ward, District 1, HCMC 10. System of transaction offices at banks in Ho Chi Minh City such as: Sacombank, VietinBank, Vietcombank, SHB, Eximbank |

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)