Vietnam's startup ecosystem is not attractive enough to attract many foreign investment funds to stay in the market for a long time, and the number of funds with more than five deals can be counted on one hand.

Ms. Le Han Tue Lam, CEO of VinVentures - Photo: NVCC.

VinVentures, a technology investment fund with total assets of about 150 million USD belonging to Vingroup , has just released a report on Vietnam's startup ecosystem in 2024.

Ms. Le Han Tue Lam, executive director of VinVentures Fund, shared with Tuoi Tre Online about notable market trends.

Decline for the fourth consecutive year

* According to you, what are the notable points in the Vietnam startup ecosystem report 2024 that VinVentures has published?

- There are two points worth noting.

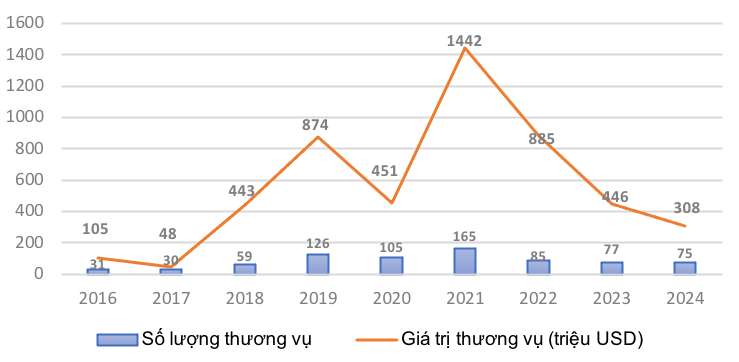

Firstly, this is the fourth consecutive year (2021 - 2024) that Vietnam has witnessed a decrease in the total value of investment deals in start-ups.

The second notable point is that in 2024, the market will witness the "reign" of previously neglected fields, typically agricultural technology with prominent deals such as Techcoop, Kamereo and DTrack.

In addition, start-ups in the ESG (environmental, social and governance) sector have also thrived through notable deals such as Nami Energy, Dat Bike, EBoost and PVA PRO.

* What do the two notable points above say?

- The first point reflects the challenges in attracting investment capital into the ecosystem, but is also an opportunity for start-ups to promote innovation and improve business models.

The second point is a sign that investors are gradually shifting their priorities to sustainable areas with long-term growth potential.

* According to you, why did the total transaction value in 2024 decrease sharply while the number of transactions did not change significantly?

- The number of transactions will remain stable in 2024, mainly coming from early-stage investments (pre-series A), accounting for about 82% of total transactions, with a value of 1-5 million USD.

This reflects the overall development picture of the Vietnamese ecosystem, an emerging market with the rise of many fields and young startups, most of which are under three years old.

The value of each investment deal is still limited because most of the products and services of start-ups are in the early stages of development and have not reached scalable scale.

This situation highlights the urgent need to enhance development capacity and promote innovation to attract more capital and create breakthroughs in the ecosystem.

Consumers experience DatBike electric vehicles - Photo: DATBIKE

Not many foreign funds have been attached to the market for long.

* Why has the market trend over the past year recorded an increase in the number of large-scale deals, while the average value size in this round has decreased?

- High interest rates cause venture capitalists around the world and the region to reduce their "risk-taking", especially with large-value transactions.

Deals over $10 million (from series B onwards) mainly come from foreign investment funds. However, the number of foreign investors who have been involved in the Vietnamese market for a long time is still small.

Meanwhile, domestic funds with more modest capital sizes often focus on early-stage deals.

This reality creates a significant gap for potential large-scale deals, as the market does not yet have enough suitable investors to exploit and support start-ups in their stronger growth phase.

* What can quantify the view that the number of foreign investors who have been with the market for a long time is not large?

- The total number of venture capital funds and private equity funds operating in Vietnam is about 60 units; of which up to 60% are foreign funds.

However, the number of foreign funds with more than five investments in Vietnam can be counted on the fingers.

For a foreign fund to fully understand the domestic market, it takes both time and initiative, which can be considered through many factors such as the number of deals they invest in.

In addition, most foreign investors paid attention to Vietnam from around 2018-2019 and really stepped up investment around 2021-2022, which is only about 3-4 years ago.

Therefore, the number of foreign investors who understand the market is still very low.

Number and value of investment deals in startups in Vietnam from 2016-2024 - Photo: HONG PHUC

* International investors are more focused on later-stage deals. Meanwhile, local investors tend to stick to early-stage deals. How does this play out in Vietnam?

- This view is quite true in Vietnam, because foreign investors' capital is more abundant, their average fund size is also several hundred million USD, so their deal size is also larger.

Meanwhile, domestic funds are mainly small and medium-sized funds, usually under 50 million USD in size.

In fact, there are not many funds that reach the size of 50 million USD because the actual amount disbursed by LPs (Limited Partners - investors of the fund) is based on investment performance.

With modest capital, the strategy of focusing on early-stage startups is considered quite suitable for domestic investors.

Is the 'fundraising winter' over?

Is the 'fundraising winter' over?Source: https://tuoitre.vn/giam-doc-quy-vinventures-nha-dau-tu-dan-chuyen-huong-uu-tien-vao-nhung-linh-vuc-ben-vung-20250117190952248.htm

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

Comment (0)