Third quarter profits fell by 38%. Good growth in the first half of the year helped pre-tax profits in the first nine months of the year decrease slightly by 6.13% compared to the same period last year, reaching VND402 billion. To date, BIDV Securities has completed 73% of its annual plan.

BIDV Securities reports 3rd quarter profit of over 94 billion VND with 30% decrease in brokerage revenue

Third quarter profits fell by 38%. Good growth in the first half of the year helped pre-tax profits in the first nine months of the year decrease slightly by 6.13% compared to the same period last year, reaching VND402 billion. To date, BIDV Securities has completed 73% of its annual plan.

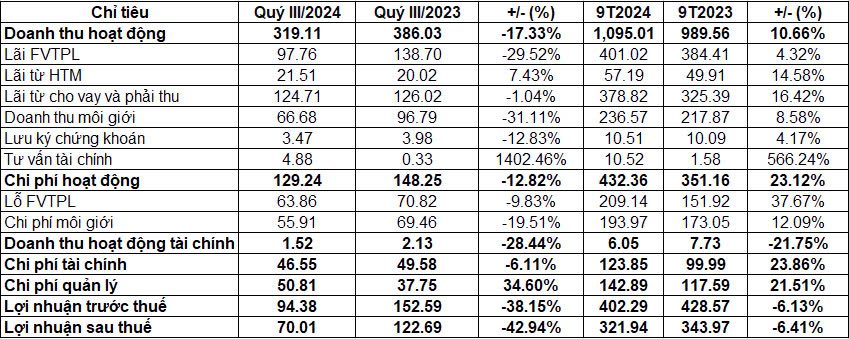

BIDV Securities Joint Stock Company (BSC, code BSI, HoSE) announced its business results for the third quarter of 2024 with not very positive results. Specifically, total operating revenue for this period only reached 319 billion VND, down 17.3% compared to the same period last year.

In the third quarter, interest from loans and receivables accounted for the largest proportion of operating revenue at VND125 billion and decreased by only 1% compared to the same period. Interest from financial assets recorded through profit/loss (FVTPL) decreased sharply by nearly 30% to nearly VND98 billion. Revenue from securities brokerage and custody also decreased by 31% and 12.8%, reaching VND67 billion and VND97 billion, respectively. Interest from investments held to maturity (HTM) reached VND21.5 billion, up 7.4%. Financial consulting revenue reached VND4.88 billion, while in the same period it was VND325 million.

Operating expenses for the period decreased by 13% to VND129 billion, of which losses from financial assets recorded through profit/loss decreased by 9.8% to VND64 billion. Brokerage expenses decreased by 20% to VND56 billion. Financial revenue also decreased by 28.4% to VND1.5 billion. Financial expenses decreased by 6% while management expenses increased by 34.6% to VND51 billion.

As a result, the company reported pre-tax profit of more than VND94 billion, down 38% compared to the same period last year. After-tax profit decreased 43% and reached more than VND70 billion.

Accumulated in the first 9 months of the year, BSC reached 1,095 billion VND, up 11% over the same period last year. Profit before tax was 402 billion VND, down 6.13% over the same period and completed 73% of the yearly plan. Profit after tax reached 322 billion VND, down 6.4%.

|

| Business results of BIDV Securities. |

As of September 30, the company's total assets reached nearly VND10,522 billion, up 26% compared to the beginning of the year. Short-term assets reached VND9,964 billion. Of which, loans accounted for the largest proportion with VND5,056 billion, up nearly 18% (VND4,889 billion came from margin lending). The company no longer had bank deposits with terms of 3 months or less, while at the beginning of the year it still had VND570 billion in banks. Meanwhile, investments held to maturity (bank deposits and deposit certificates) with terms of 3-12 months increased from VND1,245 billion to VND1,425 billion.

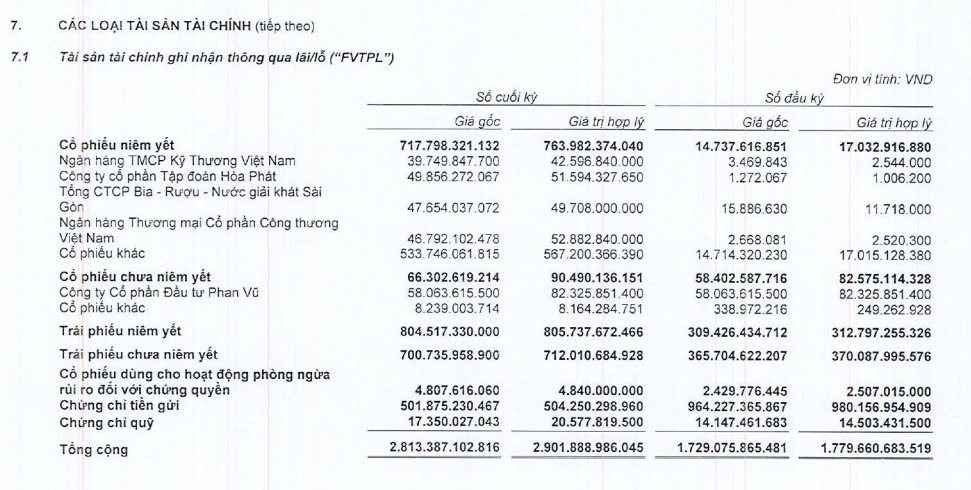

Financial assets recorded through profit/loss (FVTPL) were VND2,902 billion, up 63% compared to the beginning of the year and accounting for 28% of the asset structure. The company holds VND764 billion in listed stocks, VND806 billion in listed bonds, VND712 billion in unlisted bonds, VND504 billion in certificates of deposit... Receivables from the sale of financial assets skyrocketed from VND1.1 billion to VND216 billion.

|

| The value of financial assets recorded through profit/loss accounts for 28% of assets. |

Regarding capital structure, payables increased by one and a half times compared to the beginning of the year, reaching approximately VND5,530 billion. Of which, short-term loans increased by 55%, to VND4,349 billion. Payables for securities trading activities also increased from VND223 billion to VND1,090 billion. In addition to increasing borrowing activities, equity capital also increased significantly, mainly due to accumulated profits.

As of September 30, the company had more than VND688 billion in undistributed profits, equivalent to nearly 31% of its charter capital (VND2,230 billion). On the stock market, BSI shares are trading at around VND48,500/share, up about 12% compared to the end of last year.

Source: https://baodautu.vn/giam-30-doanh-thu-moi-gioi-chung-khoan-bidv-bao-lai-quy-iii-hon-94-ty-dong-d228047.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)