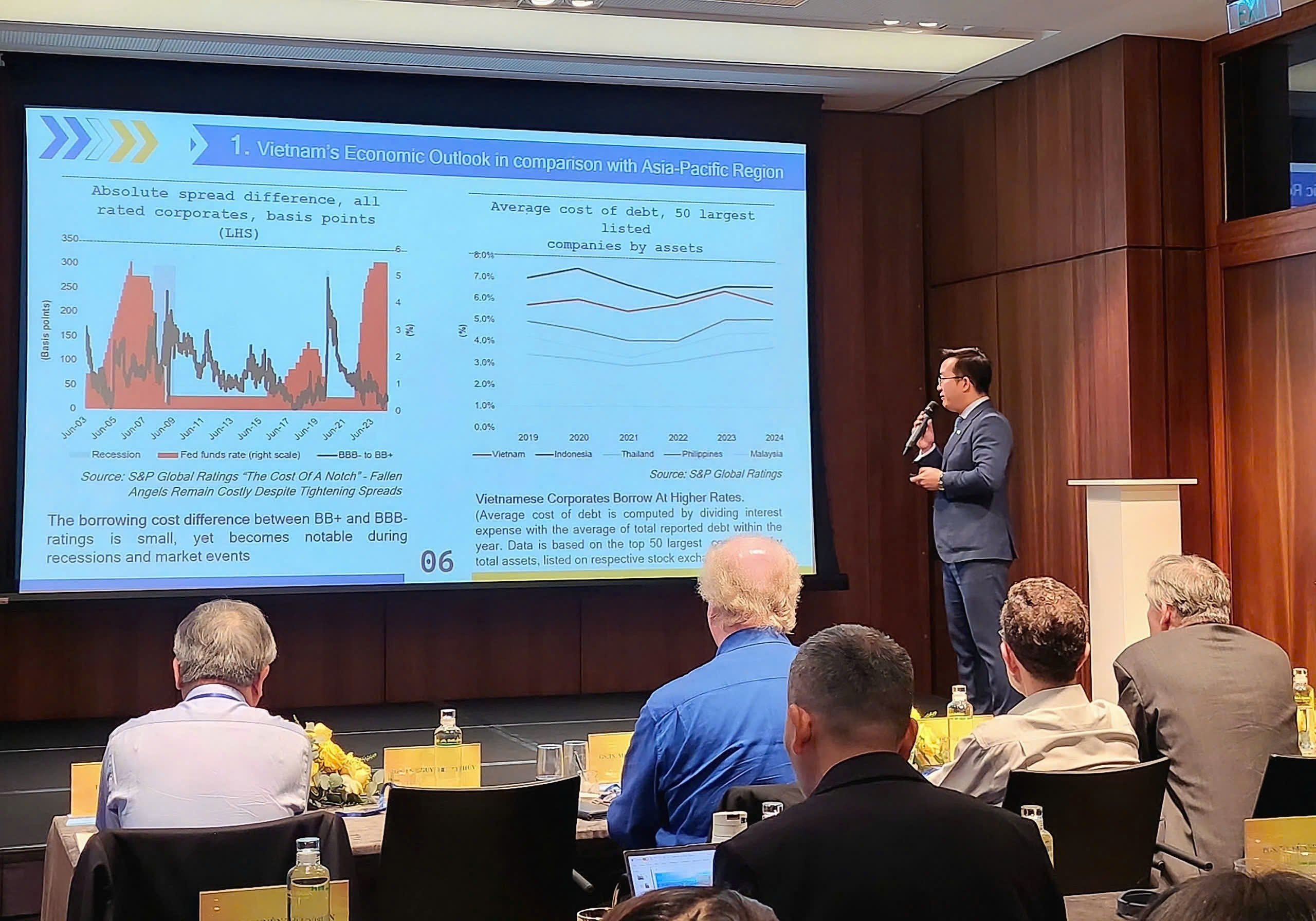

Speakers discussed the impacts, challenges and policy options to realize the goal of turning Ho Chi Minh City into a regional and international financial center.

This is also an opportunity for researchers and policymakers to discuss the necessary conditions, from legal reform, upgrading technology infrastructure to developing high-quality human resources, towards the goal of making Vietnam a high-income country by 2045.

|

| Speakers at the Forum “International Capital Markets and Policy Choices of Emerging Economies ”. |

Developing Ho Chi Minh City into an international financial center has become one of the important goals to ensure the rapid and sustainable development of the Vietnamese economy in the coming time. This is especially meaningful in the context that the whole country is trying to mobilize all resources to achieve the GDP growth target of 8% or more in 2025, contributing to creating a solid foundation to achieve a double-digit GDP growth rate.

However, this is an ambitious and challenging goal. Despite its many advantages in terms of geographical location, development history and role as the most important economic center of the country, Ho Chi Minh City still faces fierce competition from other cities in the region such as Bangkok, Manila or Kuala Lumpur.

To realize this goal, not only the City but also the whole country needs to have extensive reforms to integrate more deeply into the international financial system. That includes fundamental changes in the legal system, technology infrastructure and technical infrastructure, to facilitate the development of a financial center of regional and international stature.

Accordingly, at the Workshop, Nam A Bank representatives and speakers focused on discussing and exchanging the latest research results on financial integration and international capital markets, practical lessons from Vietnam and other emerging economies...

Presenting at the Workshop on the topic of Commercial Bank Strategy to take advantage of new opportunities when Ho Chi Minh City becomes an international financial center, Mr. Vo Hoang Hai - Deputy General Director of Nam A Bank emphasized: "The international financial center is not only a place to gather quality capital flows but also plays a strategic role in promoting innovation, developing high technology, improving management capacity and increasing national competitiveness. To seize the opportunity when Ho Chi Minh City becomes an international financial center, Nam A Bank has proactively implemented international standards such as: Financial standards (IFRS international financial reporting), ESG, issuing sustainable development reports, implementing Basel III and advanced Basel II risk standards...".

|

| Mr. Vo Hoang Hai - Deputy General Director of Nam A Bank shared at the Forum |

Careful preparation of international standards will be an important premise for commercial banks in general and Nam A Bank in particular to attract capital from foreign financial institutions and successfully implement the proposed strategies.

In recent years, Nam A Bank has focused on implementing the core strategy of “digital transformation and green transformation” for sustainable development. This is the first bank in Vietnam to sign a cooperation agreement with the Global Climate Partnership Fund (GCPF) to implement the “Green Credit” program to provide preferential capital to finance consumer needs and production and business plans that are friendly to the environment and society.

Nam A Bank has signed a memorandum of understanding with ResponsAbility Fund Management Company (Switzerland) to promote sustainable development and green credit in Vietnam. The bank also focuses on diversifying international capital sources to prepare well for the transition process.

Source: https://thoibaonganhang.vn/giai-phap-thuc-hien-hoa-muc-tieu-dua-tp-ho-chi-minh-thanh-trung-tam-tai-chinh-quoc-te-162310.html

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

Comment (0)