World oil prices

According to data from Oil Price at 6:00 a.m. on February 17 (Vietnam time), WTI oil price was trading at 79.19 USD/barrel, up 1.16 USD/barrel, equivalent to an increase of 1.49%. Meanwhile, Brent oil price was trading at 83.46 USD/barrel, up 0.6 USD/barrel, equivalent to an increase of 0.72% in the past 24 hours.

For the week, Brent rose more than 1% and WTI rose about 3%. Both oil benchmarks posted their second weekly gain after a huge gain of nearly 6% the previous week.

Brent oil price exceeds 83 USD/barrel. (Illustration photo: Bluesky)

Oil prices have maintained their upward momentum, supported by the growing risk of conflict in the Middle East.

Hezbollah said on February 15 it fired dozens of rockets at a northern Israeli town in response to Israeli attacks that killed 10 civilians in southern Lebanon.

Meanwhile, Gaza's largest hospital is under siege in the conflict between Israel and Hamas, as Israeli forces deploy warplanes in Rafah, the last Palestinian refuge in the enclave.

Meanwhile, threats remain in the Red Sea after a missile fired from Yemen hit an oil tanker carrying crude oil to India.

“The market sees oil still flowing and the disruption is minor,” said Giovanni Staunovo, an analyst at UBS, commenting on the oil market’s reaction to the news from the Middle East.

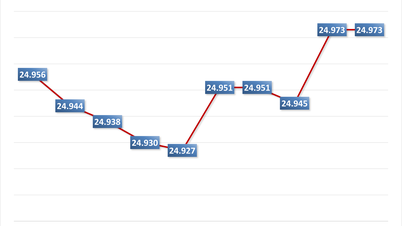

Domestic gasoline prices

In the most recent adjustment period on February 15, the price of E5 RON92 gasoline increased by VND711/liter, not higher than VND22,831/liter; RON95 gasoline increased by VND675, not higher than VND23,919/liter.

Prices of all types of oil also increased simultaneously, of which diesel increased by 654 VND, not higher than 21,361 VND/liter; kerosene increased by 633 VND, not higher than 21,221 VND/liter; mazut increased by 308 VND, not higher than 15,906 VND/kg.

In this management period, the Ministry of Industry and Trade - Ministry of Finance decided to set aside a price stabilization fund for fuel oil at 300 VND/kg (as in the previous period), and not set aside for gasoline, diesel and kerosene.

At the same time, do not use the fund for all petroleum products.

According to the Ministry of Industry and Trade, the world oil market in this management period (from February 8, 2024 to February 14, 2024) is affected by factors such as: concerns that tensions in the Middle East could disrupt oil supplies; conflicts in the Red Sea region affecting transportation activities; the Organization of the Petroleum Exporting Countries (OPEC) maintaining its forecast of increased oil demand this year; the decline in operating capacity of oil refineries in the US, etc.

Cong Hieu

Source

Comment (0)