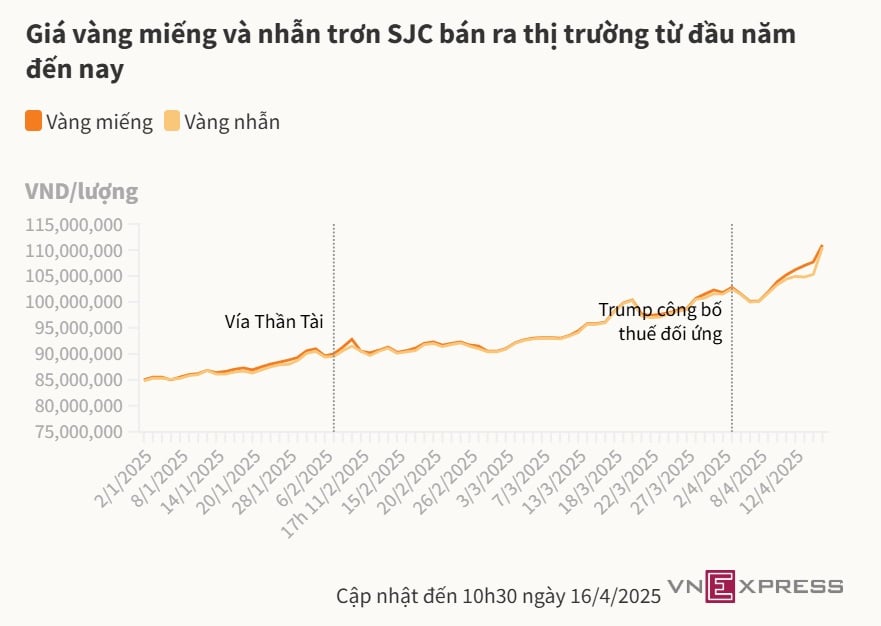

The gold price list of domestic business brands has been constantly "jumping". In about 2 hours, businesses have changed prices 4 times. At 3 pm, each tael of gold bar was listed by Saigon Jewelry Company (SJC) at a record price of 113 - 115.5 million VND per tael, an increase of 1.6 million compared to an hour ago.

Plain rings at SJC are priced at 113 - 115.53 million VND per tael, up over 2 million VND compared to early afternoon. Meanwhile, this type of gold at Bao Tin Minh Chau is priced at 111.4 - 113.9 million VND per tael.

The difference between buying and selling prices widened to VND2.5-3 million per tael, depending on the type. In total, brands increased the buying and selling prices of gold bars and plain rings by VND6-8 million compared to the beginning of the day.

Previously, in the morning session, each tael of SJC gold bars was in the range of 108.5 - 111 million VND. The price of plain gold rings was also equivalent to gold bars, around 108.3 - 111 million VND per tael.

Compared to the beginning of the year, each tael of gold increased by nearly 24 million VND. Investors who bought gold at the beginning of the year can record a profit of more than 25% up to this point.

Currently, the domestic gold price is also increasing faster than the precious metal in the international market. This morning, the domestic gold price is 6-7 million VND per tael higher than the world price, if converted according to Vietcombank's selling rate (excluding taxes and fees). At 9:00 a.m. Hanoi time, the spot gold price reached a record high of 3,271 USD per ounce, equivalent to 102.5 million VND per tael.

Goldman Sachs recently predicted that gold prices could reach $4,000 next year, thanks to central banks and ETFs buying in anticipation of a recession. Analysts at Goldman Sachs said central banks' demand for gold could average 80 tons per month this year, up from their previous estimate of 70 tons. Rising recession risks will also boost gold ETFs.

"Recent trading activity suggests that investors are seeking refuge amid rising recession risks and falling risk asset prices," Goldman Sachs said. The bank now sees a 45% chance of a US recession in the next 12 months. If that scenario plays out, "gold ETFs would accelerate their purchases, pushing prices to $3,880 by the end of the year."

Source: https://baoquangninh.vn/gia-vang-vuot-115-trieu-mot-luong-3353693.html

![[Photo] Prime Minister Pham Minh Chinh receives Swedish Minister of International Development Cooperation and Foreign Trade](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/ae50d0bb57584fd1bbe1cd77d9ad6d97)

![[Photo] Prime Minister Pham Minh Chinh works with the Standing Committee of Thai Binh Provincial Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/12/f514ab990c544e05a446f77bba59c7d1)

Comment (0)