Need State Bank intervention

According to Mr. Nguyen Quang Huy, financial expert, Nguyen Trai University, in the context of world gold price exceeding 3,300 USD/ounce and domestic gold price reaching 118 million VND/tael, the large difference between the two markets is posing many challenges for macroeconomic management.

To control the "hot" increase and limit speculative risks, stabilizing the gold market needs to be done carefully, delicately and effectively.

The State Bank, as a market regulator, needs to continue applying appropriate policies and regulatory tools to balance supply and demand, ensure liquidity, stabilize market sentiment, and minimize unhealthy speculative activities that cause instability.

In addition, inspection and supervision mechanisms also need to be strengthened to promptly detect and handle speculative behaviors that affect the market.

At the same time, it is necessary to implement a synchronous communication strategy, spreading the message of smart investment, proactive personal finance, gradually replacing the mentality of hoarding physical gold as a traditional "savings" channel. The media should reach many classes - especially women and the elderly - in a close, easy-to-understand form.

Finally, inter-sectoral coordination between the State Bank, the Ministry of Finance , media agencies and gold businesses is a key factor in building a transparent, stable gold market that is in harmony with international trends and sustainable in the long term.

Associate Professor, Dr. Nguyen Huu Huan - Ho Chi Minh City University of Economics also said that the high demand but scarce supply caused the gold price to increase suddenly, and it is very likely that the State Bank will have to intervene.

"In my opinion, the State Bank's intervention will not be as strong as before, because there are currently too many issues that need to be prioritized over the gold market. Among them, the issue of tariffs and exchange rates is very tense. It is very difficult to use foreign currency to intervene in the gold market at this time," Mr. Huan commented.

However, he said that the State Bank can intervene with administrative measures or market orientation. Requiring commercial banks to sell gold to the market will be very difficult to do because the scarce supply is real.

"It is possible to build a credit gold market managed by the State Bank, limiting people's ownership of raw gold to completely handle the problem of the gold market and the phenomenon of goldification of the economy. Allowing gold imports at this time is not feasible," said Mr. Huan.

Increase gold imports

Dr. Nguyen Tri Hieu analyzed that gold imports will help meet part of people's purchasing needs. When supply is limited, it can easily lead to high prices. Therefore, increasing supply is a fundamental solution to cool down gold prices.

"In the past, the supply of SJC gold bars was mainly due to the State Bank's stabilization sale, which was only a temporary solution. Meanwhile, due to the increasing price of gold, people did not sell, so the supply became more scarce. Therefore, the management agency needs to allow businesses to import gold and switch to the role of manager and supervisor," Dr. Nguyen Tri Hieu proposed.

Mr. Nguyen Quang Huy, financial expert, Nguyen Trai University also emphasized the need to comprehensively amend Decree 24 to manage the gold market more effectively.

According to him, the State Bank's monopoly on gold bar imports is making the market uncompetitive, creating a large gap between domestic and world gold prices. Therefore, he proposed to soon allow units to participate in gold bar imports based on strict criteria on credit, finance, risk management capacity, social responsibility... in which there is still the participation of economic units with leading State factors to ensure national monetary security and private economic units to ensure competitiveness according to market factors.

Along with that, Mr. Huy also emphasized the need to consider opening a gold trading floor, allowing gold account trading and gold derivatives trading to diversify investment channels, and limit physical gold trading among people.

People stop buying

According to experts, besides the impact of world prices, gold prices will decrease when people do not rush to buy.

Dr. Nguyen Tri Hieu warned that people should not rush to buy gold when the market is "hot", because this will easily push prices up further. In addition, buying gold in the context of high prices like now will have many potential risks.

"No asset increases forever without adjustment. Investors need to stay calm and cautious, avoid rushing into the gold market based on emotions and following the crowd. Instead, they should diversify their investment portfolio, focusing on areas that bring long-term and sustainable value. Because investing in gold at the peak has the risk of big losses in case the market reverses," said Mr. Hieu.

Similarly, Mr. Huy also analyzed that the supply of SJC gold is scarce, while the demand for buying is increasing rapidly. The sharp increase in the difference between domestic and world gold prices reflects a clear imbalance between supply and demand. The "FOMO" (fear of missing out) mentality causes many people to rush to buy gold during the period of strong price increases, unintentionally adding fuel to the wave of price increases.

"The gold market never goes in a straight line. Prices can increase sharply in the short term but can also easily adjust when the following factors occur: market sentiment changes, regulatory policies intervene to stabilize prices, and profit-taking pressure increases from international financial institutions. Therefore, people need to stay calm, closely observe market developments and not follow the crowd mentality," Mr. Huy advised.

Expert Tran Duy Phuong also emphasized that the psychology of rushing to buy gold is also the reason for the sharp increase in gold prices. Therefore, there should be specific warnings so that people and investors have a correct view of gold investment when prices are escalating.

According to him, people rushing to buy gold to store when prices are at record highs will easily get stuck in a financial loop, leading to very high risks. "People should not buy because of the crowd mentality, buy to "surf" because the gold price is having many unpredictable fluctuations. If there is a need to buy, you can wait for the time when the price adjusts down," Mr. Phuong advised.

Mr. Phuong emphasized that investing in gold can only help investors gain capital, that is, the difference between the selling price and the initial purchase price, but does not create stable profits. Therefore, investing in gold should be viewed broadly to have a complete picture, not just focusing on investing in gold when it is hot.

The increasing demand for gold by investors and people, coupled with the fragmented market structure and limited transparency, creates opportunities for speculation, amplifying price fluctuations, leading to a gold "bubble" and subsequent collapses.

Sharing the same view, Associate Professor Dr. Nguyen Huu Huan recommends that investors should consider carefully before buying gold during the period when prices are at high levels.

"Buying gold at this stage is still quite risky because the gold price is still at a relatively high level. Investors should wait for the sessions of downward adjustment to buy, which will be more reasonable, and limit buying and selling at a time when the gold price is increasing like now. At the same time, they should diversify their investment portfolio to avoid risks to the maximum extent," the expert stated.

In general, instead of following the crowd, investors should monitor macroeconomic factors, global financial and trade policies to make reasonable decisions, avoiding risks when gold prices may adjust in the near future.

(According to VTC News)

Source: https://baoyenbai.com.vn/12/348957/Gia-vang-tang-dien-cuong-lam-gi-de-ha-nhiet.aspx

![[Photo] General Secretary To Lam attends the conference to review 10 years of implementing Directive No. 05 of the Politburo and evaluate the results of implementing Regulation No. 09 of the Central Public Security Party Committee.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/2f44458c655a4403acd7929dbbfa5039)

![[Photo] Panorama of the Opening Ceremony of the 43rd Nhan Dan Newspaper National Table Tennis Championship](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/5e22950340b941309280448198bcf1d9)

![[Photo] President Luong Cuong presents the 40-year Party membership badge to Chief of the Office of the President Le Khanh Hai](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/a22bc55dd7bf4a2ab7e3958d32282c15)

![[Photo] Close-up of Tang Long Bridge, Thu Duc City after repairing rutting](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/086736d9d11f43198f5bd8d78df9bd41)

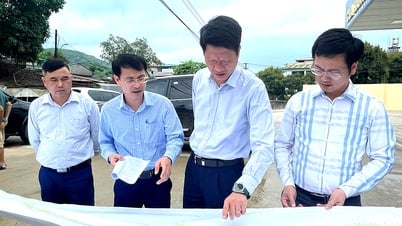

![[Photo] Prime Minister Pham Minh Chinh inspects the progress of the National Exhibition and Fair Center project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/19/35189ac8807140d897ad2b7d2583fbae)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)