At 4:30 p.m. on March 7, 2024, the domestic SJC gold price skyrocketed, reaching its highest peak ever.

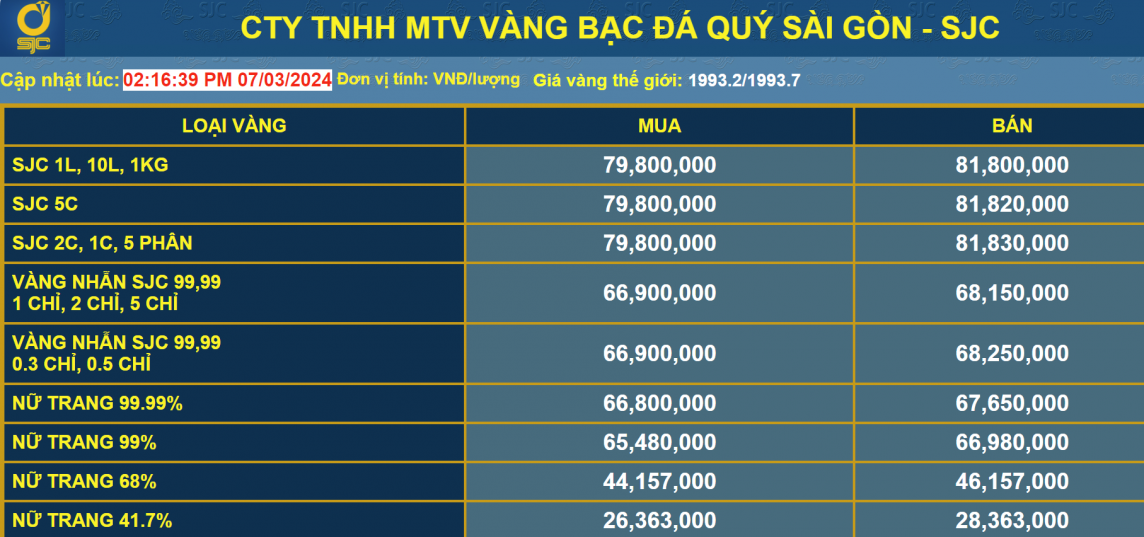

Specifically, Saigon Jewelry Company Limited - SJC listed the buying price at 79.8 million VND/tael and the selling price at 81.8 million VND/tael. This is a record high increase in domestic gold prices to date. The difference between buying and selling prices is currently at 2 million VND.

Compared to the early morning of the same day, the price of SJC gold here was adjusted up by 800,000 VND for buying and up by 780,000 VND for selling.

|

| Gold price listed at Saigon Jewelry Company Limited - SJC. Screenshot at 5:00 p.m. on March 7, 2024 |

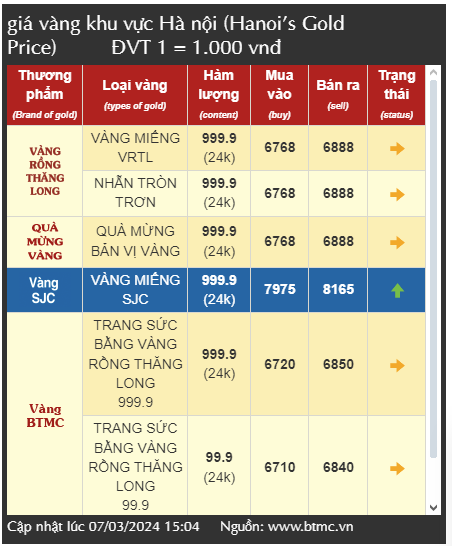

Similarly, this afternoon Bao Tin Minh Chau listed the price of SJC gold at 79.75 million VND/tael for buying and 81.65 million VND/tael for selling. Compared to early morning of the same day, the price of SJC gold increased by 700,000 VND for buying and 750,000 VND for selling.

|

| Gold price listed at Bao Tin Minh Chau. Screenshot at 5:00 p.m. on March 7, 2024 |

From the beginning of the year (early morning session on January 1, 2024) to this afternoon, the price of SJC gold at Saigon Jewelry Company Limited - SJC has increased by VND 8.8 million/tael in buying and increased by more than VND 7.7 million in selling. Compared to the same period in 2023, each tael of SJC gold bar has increased by VND 14 million in selling and increased by VND 12.6 million in buying.

In the context of record high gold prices, many investors have sold gold. Ms. Thu Phuong (Bac Tu Liem, Hanoi ) said that she bought SJC gold from Bao Tin Minh Chau at noon on November 20, 2023 for 70.75 million VND/tael. As of today, the amount of gold she bought for investment has made a profit of nearly 1.1 million VND per tael. "Buying gold for investment purposes, making a profit, so today the gold price increased to a record, I decided to sell the gold. According to many people, the gold price is still high, selling today will make little profit, but I still decided to sell. That amount of profit is enough" - Ms. Thu Phuong shared and said that selling gold at this time, although the profit is less, is reassuring, not having to worry every time I follow the gold market. When the gold price goes up, I am happy, but if the gold price slows down, the risk of loss is higher.

Today, in the context of soaring gold prices, there are still more customers coming to buy gold than to sell gold. According to statistics from Bao Tin Minh Chau, at the brand's gold stores, today the number of customers coming to buy - sell is 55% customers coming to buy and 45% customers coming to sell.

|

| Domestic gold prices increase, many investors sell gold to take profit |

Giving advice to investors and people, some economic experts said that this is the time when gold prices are quite high, so investors should not buy. For those who bought before, now selling for sure will make a profit, they should also consider selling to take profit.

Domestic gold increases and decreases according to the trend of the world market. Currently, the world gold price is very high, pushing the domestic gold price up accordingly. Therefore, investors should take advantage of this opportunity to take profits - some experts recommend and note that they should not invest in gold at this time because the gold price is at a record high, high risk, low profit rate.

The reason for the sharp increase in domestic gold prices is due to the impact of the world gold market. The sharp increase in world gold prices is due to negative economic news, causing the USD to plummet and the testimony of the Chairman of the US Federal Reserve (Fed) to support the increase in gold prices.

Specifically, the US economy continued to release some not-so-positive economic data: Wholesale sales in the US in January decreased from a 0.3% increase last month to a 1.7% decrease in February. Job opportunities were lower than last month, but slightly higher than expected.

Last night, Fed Chairman Jerome Powell gave his first speech in two days of testimony before the US Congress on March 6-7. He continued to affirm that the Fed will consider adjusting interest rates at any time, interest rates will start to decrease this year, but the timing is still unknown. Because this agency is still concerned about the risks caused by inflation, so it does not want to loosen policy too soon.

Source

![[Maritime News] Container shipping faces overcapacity that will last until 2028](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/30/6d35cbc6b0f643fd97f8aa2e9bc87aea)

Comment (0)