| Gold price today increased sharply, SJC gold is anchored at 79 million VND/tael. SJC gold price today increased by more than 600 thousand, 999.9 gold ring exceeded 66 million VND/tael. |

Domestic gold price

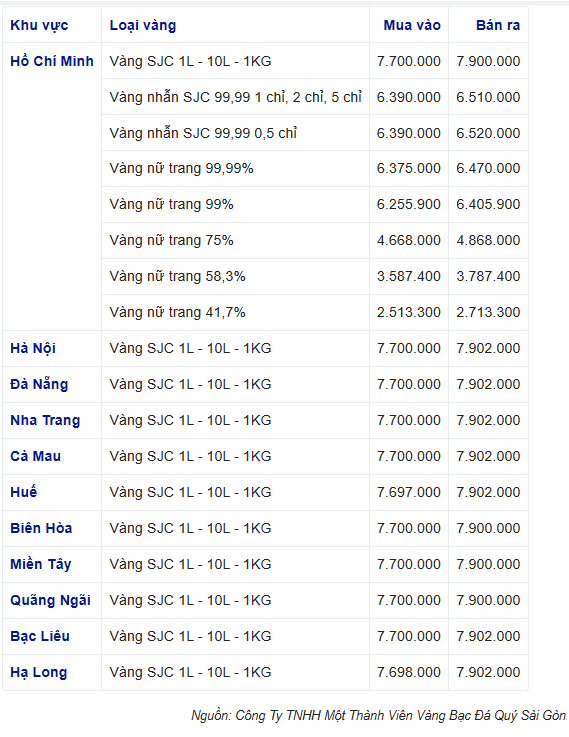

Gold price at noon on February 28, SJC gold price at Saigon Jewelry Company in Ho Chi Minh City was around 77.00 - 79.00, down 500 thousand VND/tael for buying and down 500 thousand VND/tael for selling compared to yesterday's closing price. The difference between buying and selling is up to 2 million VND/tael.

|

The price of SJC gold bars traded at Saigon Jewelry Company in Hanoi is around 77.00 - 79.02 million VND/tael, down 500,000 VND/tael for buying and down 500,000 VND/tael for selling compared to yesterday's closing price.

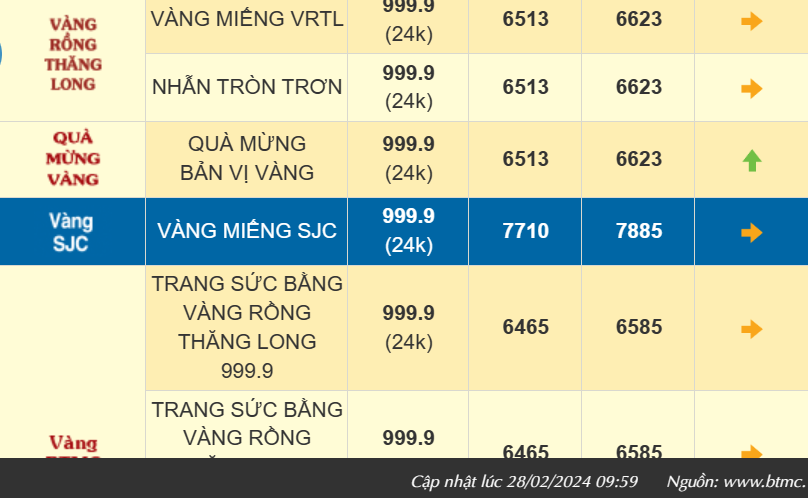

The price of SJC gold bars at Bao Tin Minh Chau Company is trading around 77.10 - 78.85 million VND/tael, down 450 thousand VND/tael for buying and down 550 thousand VND/tael for selling compared to the previous closing price.

|

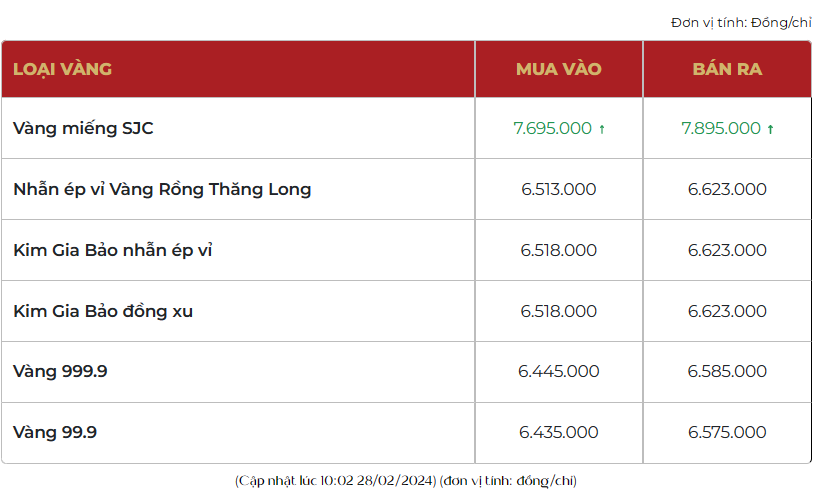

At Bao Tin Manh Hai, SJC gold bars are being traded at 76.95 - 78.95 million VND/tael for buying and selling, down 550 thousand VND/tael for buying and down 450 thousand VND/tael for selling compared to yesterday.

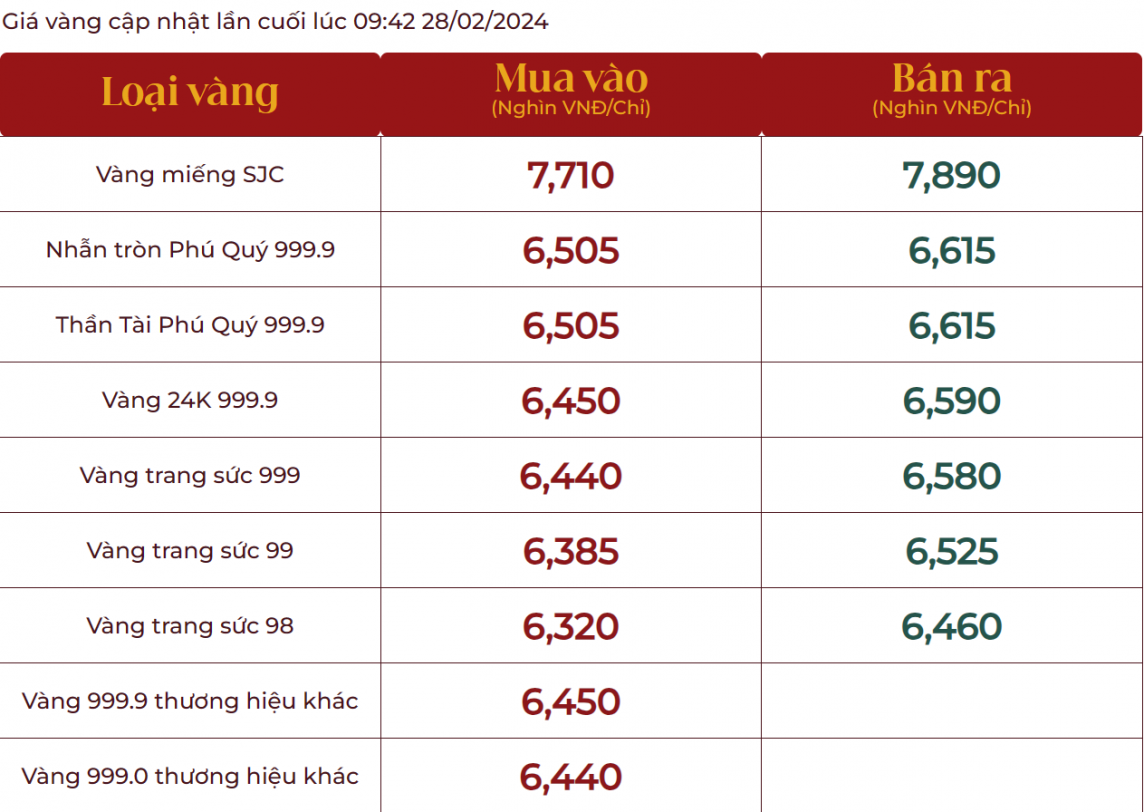

At Phu Quy Group, the price of SJC gold bars is currently trading around 77.10 - 78.90 million VND/tael for buying and selling, down 300,000 VND/tael for buying and down 400,000 VND/tael for selling compared to yesterday.

In addition, the price of 999.9 gold rings (24k) today continued to increase. Specifically, the price of Thang Long dragon gold bars and plain round rings at Bao Tin Minh Chau Company was traded at 65.13 - 66.23 million VND/tael for buying and selling, an increase of 450 thousand VND/tael for buying and 500 thousand VND/tael for selling compared to the closing price yesterday.

|

| Domestic gold prices today fluctuated in opposite directions, SJC gold bars plummeted, 999.9 gold ring prices increased sharply |

Thang Long 99.99 (24k) gold jewelry is trading around 64.65 - 65.85 million VND/tael, an increase of 100 thousand VND/tael for buying and an increase of 100 thousand VND/tael for selling compared to yesterday.

Similarly, Thang Long Gold Dragon blister rings and Kim Gia Bao blister rings are being traded at Bao Tin Manh Hai Company at around 65.13 - 66.23 million VND/tael for buying and selling, up 100,000 VND/tael for buying and up 150,000 VND/tael for selling compared to yesterday's closing price.

|

| Gold price traded at Bao Tin Manh Hai Company |

The price of 999.9 gold is around 64.45 - 65.85 million VND/tael, an increase of 100 thousand/tael for buying and 100 thousand/tael for selling compared to yesterday. The price of 99.9 gold is currently around 64.35 - 65.75 million VND/tael, an increase of 100 thousand/tael for buying and 100 thousand/tael for selling compared to yesterday.

At Phu Quy Group, Phu Quy 999.9 Round Ring and Phu Quy 999.9 God of Wealth are trading around 65.05 - 66.15 VND/tael, an increase of 150 thousand VND/tael for buying and an increase of 150 thousand VND/tael for selling compared to yesterday.

|

| Gold price traded at Phu Quy Group |

24K 999.9 gold is trading around 64.50 - 65.90 million VND/tael, up 400 thousand VND/tael for buying and up 400 thousand VND/tael for selling compared to yesterday.

World gold price

In the international market, the precious metal is trading stably at around 2,030 USD/ounce, down slightly from yesterday's session. Currently, the world gold price converted according to the listed exchange rate is around 60.8 million VND/tael, about 4 million VND/tael lower than ring gold and 18 million VND/tael lower than SJC gold.

|

| World gold price chart this afternoon |

World gold prices have not been able to break out in the context of US bond yields inching up and the USD index stabilizing around 103.8 points.

Gold markets were little reacted to the weaker-than-expected economic data. Gold futures for April delivery last traded at $2,043.10 an ounce, up 0.21% on the day.

The report noted that broad consumer optimism declined as both current sentiment and expectations declined in February. The Current Situation Index fell to 147.20, down from 154.9 in January. Meanwhile, the Expectations Index fell to 79.80, down from 81.50.

“An Expectations Index below 80 typically signals an impending recession,” the report said.

Dana Peterson, chief economist at The Conference Board, said all income groups felt the drop in confidence, except for households earning less than $15,000 and those earning more than $125,000.

“The February data shows that while overall inflation remains consumers’ primary concern, they are now a little less concerned about food and gas prices, which have fallen in recent months. But they are more concerned about the state of the labor market and the political environment in the United States,” Peterson said.

Some analysts expect core PCE, which strips out volatile food and energy costs, to rise more than expected, which would certainly be a hot topic at the Fed’s next policy meeting in March 2024.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

Comment (0)