Illustration photo: Minh Quyet/VNA

Specifically, at 9:10 a.m., Saigon Jewelry Company SJC listed the price of gold bars at 115.5 - 118 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling compared to the closing price yesterday.

Bao Tin Minh Chau Company listed the price of gold bars and gold rings at 114.5 - 117.5 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling compared to the closing price yesterday.

Saigon Jewelry Company SJC listed the price of gold rings at 114 - 117 million VND/tael (buy - sell), an increase of 3.5 million VND/tael in both buying and selling compared to the closing price yesterday.

Phu Nhuan Jewelry Joint Stock Company listed the price of gold bars and gold rings at 110.5 - 113.6 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to the closing price yesterday.

In the world market, gold prices continued to increase to a record level in the session of April 16 and surpassed the threshold of 3,300 USD/ounce, as escalating US-China trade tensions prompted investors to seek this safe haven asset.

As of 0:45 a.m. (April 17, Vietnam time), spot gold prices increased by 3.1% to $3,327.97/ounce, after reaching a record high of $3,332.89 earlier in the session.

US gold futures closed up 3.3% at $3,324.50 an ounce.

Lukman Otunuga, senior research analyst at FXTM, said gold prices continued to receive strong support from the general weakness of the US dollar, uncertainties surrounding tariff announcements and concerns about a global economic recession.

After breaking $3,300, gold’s next moves will be largely psychological, but profit-taking or positive developments in US-China trade relations could trigger a sell-off, Otunuga said.

Meanwhile, the US dollar slipped against other major currencies and remained near a three-year low hit last week, a development that increased the appeal of gold to holders of other currencies.

Gold prices have risen nearly $700 since the start of 2025, boosted by tariff disputes, expectations of interest rate cuts and strong buying from central banks.

Ole Hansen, head of commodity strategy at Saxo Bank, said the gold rally has gotten a little out of hand, leaving the precious metal vulnerable to a pullback. However, he noted that corrections over the past year have been shallow as underlying buying has been waiting at lower levels.

According to Baotintuc.vn

Source: https://baohoabinh.com.vn/12/200251/Gia-vang-sang-174-dat-dinh-moi-118-trieu-dongluong.htm

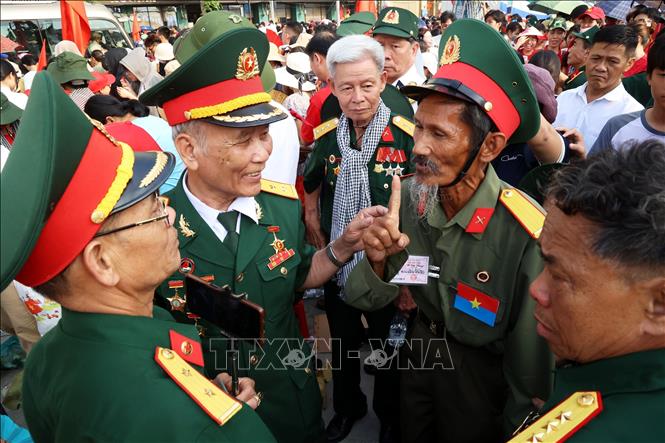

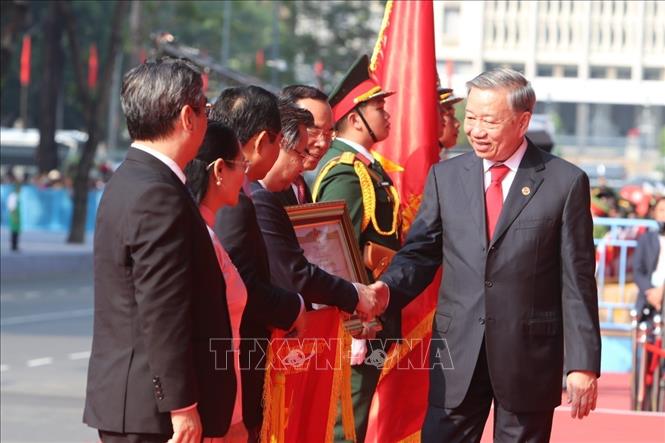

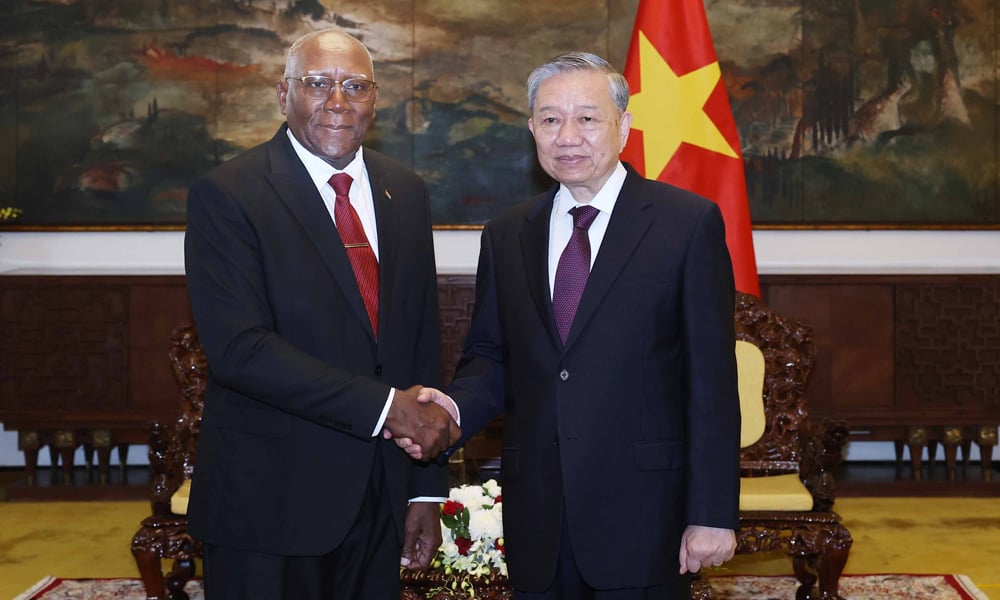

![[Photo] Mass parade to celebrate 50 years of national reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/825e459ee2f54d85b3a134cdcda46e0d)

![[Photo] Panorama of the parade celebrating the 50th anniversary of the Liberation of the South and National Reunification](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/affbd72e439d4362962babbf222ffb8b)

![[Photo] The parade took to the streets, walking among the arms of tens of thousands of people.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/180ec64521094c87bdb5a983ff1a30a4)

![[Photo] "King Cobra" Su-30MK2 completed its glorious mission on April 30](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/30/5724b5c99b7a40db81aa7c418523defe)

Comment (0)