Domestic gold price today April 23, 2025

At the time of survey at 4:00 p.m. on April 23, 2025, the domestic gold price continued to decline sharply this afternoon, bringing the domestic gold price below the 120 million mark. Specifically:

The price of SJC gold bars listed by DOJI Group is at 116.5-119.5 million VND/tael (buy - sell), a sharp decrease of 5.5 million VND/tael in buying - 4.5 million VND/tael in selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 116.5-119.5 million VND/tael (buy - sell), a sharp decrease of 5.5 million VND/tael in buying - 4.5 million VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 116.5-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged for buying - down 5 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 116.5-119.5 million VND/tael (buying - selling, down 4 million VND/tael in buying direction - down 3 million VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 116.5-119.5 million VND/tael (buy - sell), gold price decreased 3.5 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:00 p.m. this afternoon, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 112.5-115.3 million VND/tael (buy - sell); the gold price decreased by 4.7 million VND/tael in the buying direction - decreased by 3.7 million VND in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); down 4 million VND/tael in both buying and selling compared to yesterday.

The latest gold price list today, April 23, 2025 is as follows:

| Gold price today | April 23, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 116.5 | 119.5 | -5500 | -4500 |

| DOJI Group | 116.5 | 119.5 | -5500 | -4500 |

| Red Eyelashes | 116.5 | 119.5 | - | -5000 |

| PNJ | 116.5 | 119.5 | -5500 | -4500 |

| Vietinbank Gold | 119.5 | -4500 | ||

| Bao Tin Minh Chau | 116.5 | 119.5 | -4000 | -3000 |

| Phu Quy | 116.5 | 119.5 | -3500 | -3500 |

| 1. DOJI - Updated: April 23, 2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 116,500 ▼5500K | 119,500 ▼4500K |

| AVPL/SJC HCM | 116,500 ▼5500K | 119,500 ▼4500K |

| AVPL/SJC DN | 116,500 ▼5500K | 119,500 ▼4500K |

| Raw material 9999 - HN | 112,300 ▼4700K | 114,400 ▼3700K |

| Raw material 999 - HN | 112,200 ▼4700K | 114,300 ▼3700K |

| 2. PNJ - Updated: April 23, 2025 16:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,650 | 11,950 |

| PNJ 999.9 Plain Ring | 11,270 | 11,590 |

| Kim Bao Gold 999.9 | 11,270 | 11,590 |

| Gold Phuc Loc Tai 999.9 | 11,270 | 11,590 |

| 999.9 gold jewelry | 11,270 | 11,520 |

| 999 gold jewelry | 11,259 | 11,509 |

| 9920 jewelry gold | 11,188 | 11,438 |

| 99 gold jewelry | 11,165 | 11,415 |

| 750 Gold (18K) | 7,905 | 8,655 |

| 585 Gold (14K) | 6,004 | 6,754 |

| 416 Gold (10K) | 4,057 | 4,807 |

| PNJ Gold - Phoenix | 11,270 | 11,590 |

| 916 Gold (22K) | 10,312 | 10,562 |

| 610 Gold (14.6K) | 6,292 | 7,042 |

| 650 Gold (15.6K) | 6,753 | 7,503 |

| 680 Gold (16.3K) | 7,099 | 7,849 |

| 375 Gold (9K) | 3,585 | 4,335 |

| 333 Gold (8K) | 3,067 | 3,817 |

| 3. SJC - Updated: April 23, 2025 16:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 116,500 ▼5500K | 119,500 ▼4500K |

| SJC gold 5 chi | 116,500 ▼5500K | 119,500 ▼4500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 116,500 ▼5500K | 119,500 ▼4500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 112,500 ▼3500K | 115,500 ▼3500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 112,500 ▼3500K | 115,600 ▼3500K |

| Jewelry 99.99% | 112,500 ▼3500K | 114,900 ▼3500K |

| Jewelry 99% | 108,762 ▼3465K | 113,762 ▼3465K |

| Jewelry 68% | 72,289 ▼2380K | 78,289 ▼2380K |

| Jewelry 41.7% | 42,068 ▼1459K | 48,068 ▼1459K |

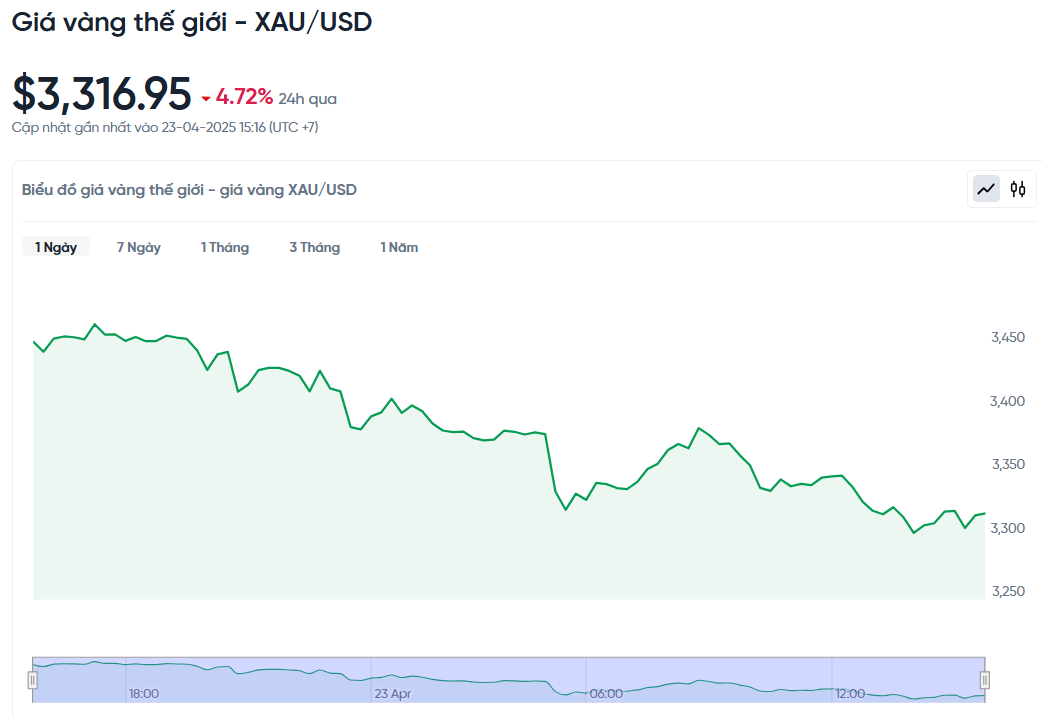

World gold price today April 23, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:00 p.m. this afternoon, Vietnam time, was 3,316.95 USD/ounce. Today's gold price decreased by 163.88 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,141 VND/USD), the world gold price is about 105.55 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 13.95 million VND/tael higher than the international gold price.

World gold prices fell sharply by nearly 5% after US President Donald Trump eased his criticism of Federal Reserve Chairman Jerome Powell and expressed optimism about a trade deal with China. During a press conference at the White House, Mr. Trump said the high tariffs that the US imposed on Chinese goods would be reduced significantly, but would never go to 0%.

World gold prices plummeted after Mr. Trump changed his tone. Specifically, spot gold prices fell 4.75%, while US gold futures fell 2.9% to $3,320.3. According to Kelvin Wong, Mr. Trump's change of stance caused gold prices to fall into a state of oversold in the short term.

In addition, the Russia-Ukraine conflict also showed signs of cooling down when Russian President Vladirmir Putin lowered many conditions for a ceasefire and peace with Ukraine. The above proposal was made at a meeting between the Russian president and Mr. Steve Witkoff, special envoy of US President Donald Trump, in the middle of the month.

Comments by US Treasury Secretary Bessent hinting at a possible thaw in the US-China tariff war triggered a sell-off in gold. US stocks rose more than 2% and the dollar recovered. The US Dollar Index rose 0.7%.

According to expert Wong, there is no sign that the gold rally has ended, so prices are still likely to recover in the near future. Meanwhile, Minneapolis Federal Reserve Bank President Neel Kashkari said it is too early to assess the impact of tariffs on inflation and the economy, thereby adjusting short-term interest rates.

The biggest risk factor for gold prices is a sudden drop in demand from central banks. Additionally, if the US economy continues to grow despite tariffs, the Fed may become more aggressive in curbing inflation, putting downward pressure on gold prices.

Other precious metals also had mixed performances, with silver up 0.8% to $32.79 an ounce, platinum up 0.2% to $960.54, while palladium remained flat at $935.15. JP Morgan forecasts that silver prices could face difficulties due to unstable industrial demand. However, it forecasts that silver prices could rise to around $39 an ounce by the end of 2025.

Gold Price Forecast

Gold prices are likely to surpass $4,000 an ounce by 2026 as fears of a recession grow, according to a new report from JP Morgan. The bank forecasts that gold prices will average $3,675 an ounce in the fourth quarter of 2025 and continue to rise above $4,000 an ounce by the second quarter of 2026. If demand for gold increases more than expected, this price could be reached even sooner.

One of the key factors driving the sharp rise in gold prices is that demand for gold from investors and central banks remains high, averaging about 710 tonnes per quarter this year, JP Morgan said.

Gold prices are under profit-taking pressure as the US stock market recovers strongly, said Kitco expert Jim Wyckoff. This is the reason why gold prices have fallen after a strong increase in the previous period.

Mr. Wyckoff said that the recent large fluctuations in gold prices may be a sign that the current growth cycle is approaching a peak. However, this peak may be short-term in terms of time, not necessarily in terms of price.

Technically, June gold investors still hold a clear advantage. However, the price action in the most recent session shows signs of exhaustion. The next target for buyers is to close above the strong resistance at the contract's high of $3,509.90 an ounce.

Meanwhile, the sellers will try to push the price below $3,200/ounce to create a deeper correction. Currently, the nearest resistance is at $3,550, while the first support is at $3,375/ounce.

FXTM’s Lukman Otunuga also agrees that gold is in a correction phase. He believes that prices could fall to $3,250 or even $3,140, with the key psychological support at $3,000. However, if gold holds $3,300, a recovery to $3,400 or higher remains possible.

Source: https://baonghean.vn/gia-vang-ngay-23-4-2025-gia-vang-trong-nuoc-va-the-gioi-giam-mot-mach-hon-5-trieu-dong-10295766.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

![[Photo] National Assembly Chairman works with leaders of Can Tho city, Hau Giang and Soc Trang provinces](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c40b0aead4bd43c8ba1f48d2de40720e)

Comment (0)