The world gold price today (December 23) slightly decreased to 2,621 USD/ounce in the context of a quiet trading market before Christmas. Domestically, the price of gold bars and gold rings recovered early this week after consecutive declines last week, trading at 84.3 million VND/tael; gold rings traded at 83.6 million VND/tael.

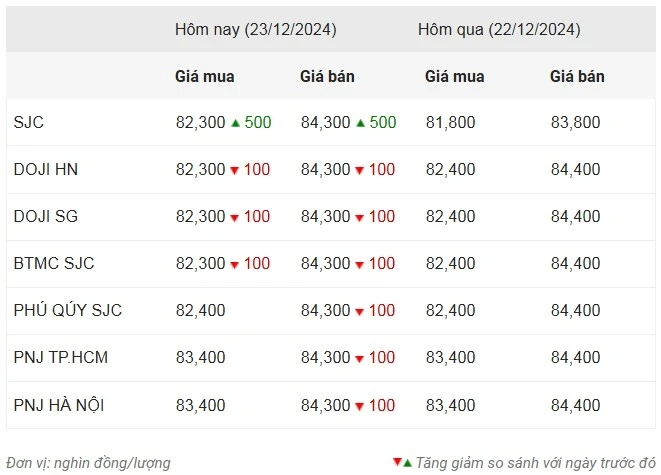

Specifically, at 11:00 a.m. on December 23, Saigon Jewelry Company (SJC) listed the buying and selling price of SJC gold bars at 82.3-84.3 million VND/tael, an increase of half a million VND compared to the closing price last week.

Price gold ring SJC 9999 closed the week buying at 82.3 million VND/tael, selling at 84.1 million VND/tael, up 500,000 VND compared to the previous week's closing price.

DOJI gold bar price in Hanoi and Ho Chi Minh City is 82.3 million VND/tael for buying and 84.3 million VND/tael for selling, down 100,000 VND compared to the previous closing price.

This brand listed the buying and selling price of Doji Hung Thinh Vuong 9999 gold ring at 83.3-84.3 million VND/tael.

PNJ Gold closed the week buying at 83.4 million VND/tael and selling at 84.4 million VND/tael.

As of 11:00 a.m. on December 23 (Vietnam time), gold price World prices fell slightly by 1.3 USD compared to the previous session to 2,621.1 USD/ounce.

The global gold market is experiencing consecutive downward adjustments as the US Federal Reserve (FED) may slow down its interest rate cut process in 2025 and investors are preparing for the Christmas holiday. However, the world gold price still maintains an important support level around 2,600 USD/ounce.

Last week, at the end of 2024 monetary policy meeting, the FED officially cut interest rates by another 25 basis points, bringing the current FED interest rate to between 4.25% - 4.5%.

In 2025, the Fed is expected to cut rates by a total of only 50 basis points by the end of the year instead of the expected 100 basis points due to a solid labor market and slowing inflation. The US central bank's cautious stance, combined with the trend of resting at the end of the year, is making gold face certain challenges.

In the medium and long term, many experts predict that gold prices will reach $3,000/ounce next year.

Multinational investment bank Goldman Sachs believes that gold demand will continue to increase as central banks continue to buy gold to diversify their reserves, pushing the price of this precious metal to $3,000/ounce by the end of 2025.

Next year, consulting firm State Street predicts a 50% chance of gold trading between $2,600 and $2,900 an ounce, a 30% chance of $2,900 to $3,100 an ounce, and only a 20% chance of it falling below $2,600.

This morning, the USD-Index was at a high of 107.73 points; the yield on 10-year US Treasury bonds was at 4.521%; US stocks recovered thanks to weaker-than-expected inflation data; world oil prices edged up after a week of decline, trading at $72.92/barrel for Brent and $69.88/barrel for WTI.

Source

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)