Domestic gold price today April 21, 2025

At the time of survey at 4:30 p.m. on April 21, 2025, domestic gold prices increased sharply again. Specifically:

DOJI Group listed the price of SJC gold bars at 116-118 million VND/tael (buy - sell), an increase of 4 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 116-118 million VND/tael (buy - sell), an increase of 4 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, according to the latest information, there is currently no SJC gold for sale, and there is currently no new price update at this store.

SJC gold price at Ngoc Tham Jewelry Company Limited was traded by businesses at the highest level of 116-122 million VND/tael (buying - selling), an increase of 7 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 116-118 million VND/tael (buying - selling), an increase of 4 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 115.5-118 million VND/tael (buy - sell), gold price increased by 4 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 113.5-117 million VND/tael (buy - sell); the price increased by 4 million VND/tael for buying - increased by 3.5 million VND/tael for selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 114.5-118 million VND/tael (buy - sell); an increase of 3.7 million VND/tael for buying - an increase of 4 million VND/tael for selling compared to yesterday.

The latest gold price list today, April 21, 2025 is as follows:

| Gold price today | April 21, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 116 | 118 | +4000 | +4000 |

| DOJI Group | 116 | 118 | +4000 | +4000 |

| Red Eyelashes | n/a | n/a | n/a | n/a |

| PNJ | 116 | 118 | +4000 | +4000 |

| Vietinbank Gold | 118 | +4000 | ||

| Bao Tin Minh Chau | 116 | 118 | +4000 | +4000 |

| Phu Quy | 115.5 | 118 | +4000 | +4000 |

| 1. DOJI - Updated: April 21, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 116,000 ▲4000K | 118,000 ▲4000K |

| AVPL/SJC HCM | 116,000 ▲4000K | 118,000 ▲4000K |

| AVPL/SJC DN | 116,000 ▲4000K | 118,000 ▲4000K |

| Raw material 9999 - HN | 113,300 ▲4000K | 116,100 ▲3500K |

| Raw material 999 - HN | 113,200 ▲4000K | 116,000 ▲3500K |

| 2. PNJ - Updated: April 21, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 113,500 ▲4000K | 116,900 ▲3400K |

| HCMC - SJC | 116,000 ▲4000K | 118,000 ▲4000K |

| Hanoi - PNJ | 113,500 ▲4000K | 116,900 ▲3400K |

| Hanoi - SJC | 116,000 ▲4000K | 118,000 ▲4000K |

| Da Nang - PNJ | 113,500 ▲4000K | 116,900 ▲3400K |

| Da Nang - SJC | 116,000 ▲4000K | 118,000 ▲4000K |

| Western Region - PNJ | 113,500 ▲4000K | 116,900 ▲3400K |

| Western Region - SJC | 116,000 ▲4000K | 118,000 ▲4000K |

| Jewelry gold price - PNJ | 113,500 ▲4000K | 116,900 ▲3400K |

| Jewelry gold price - SJC | 116,000 ▲4000K | 118,000 ▲4000K |

| Jewelry gold price - Southeast | PNJ | 113,500 ▲4000K |

| Jewelry gold price - SJC | 116,000 ▲4000K | 118,000 ▲4000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 113,500 ▲4000K |

| Jewelry gold price - Kim Bao Gold 999.9 | 113,500 ▲4000K | 116,900 ▲3400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 113,500 ▲4000K | 116,900 ▲3400K |

| Jewelry gold price - Jewelry gold 999.9 | 113,500 ▲4000K | 116,000 ▲4000K |

| Jewelry gold price - Jewelry gold 999 | 113,380 ▲3990K | 115,880 ▲3990K |

| Jewelry gold price - Jewelry gold 9920 | 112,670 ▲3970K | 115,170 ▲3970K |

| Jewelry gold price - Jewelry gold 99 | 112,440 ▲3960K | 114,940 ▲3960K |

| Jewelry gold price - 750 gold (18K) | 79.650 ▲3000K | 87.150 ▲3000K |

| Jewelry gold price - 585 gold (14K) | 60,510 ▲2340K | 68,010 ▲2340K |

| Jewelry gold price - 416 gold (10K) | 40,910 ▲1670K | 48,410 ▲1670K |

| Jewelry gold price - 916 gold (22K) | 103,860 ▲3670K | 106,360 ▲3670K |

| Jewelry gold price - 610 gold (14.6K) | 63,410 ▲2440K | 70,910 ▲2440K |

| Jewelry gold price - 650 gold (15.6K) | 68,050 ▲2600K | 75,550 ▲2600K |

| Jewelry gold price - 680 gold (16.3K) | 71,530 ▲2720K | 79,030 ▲2720K |

| Jewelry gold price - 375 gold (9K) | 36,150 ▲1500K | 43,650 ▲1500K |

| Jewelry gold price - 333 gold (8K) | 30,930 ▲1320K | 38,430 ▲1320K |

| 3. SJC - Updated: April 21, 2025 16:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 116,000 ▲4000K | 118,000 ▲4000K |

| SJC gold 5 chi | 116,000 ▲4000K | 118,020 ▲4000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 116,000 ▲4000K | 118,030 ▲4000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 113,000 ▲3500K | 116,000 ▲2500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 113,000 ▲3500K | 116,100 ▲2500K |

| Jewelry 99.99% | 113,000 ▲3500K | 115,400 ▲2400K |

| Jewelry 99% | 108,757 ▲2376K | 114,257 ▲2376K |

| Jewelry 68% | 72,629 ▲1632K | 78,629 ▲1632K |

| Jewelry 41.7% | 42,276 ▲1000K | 48,276 ▲1000K |

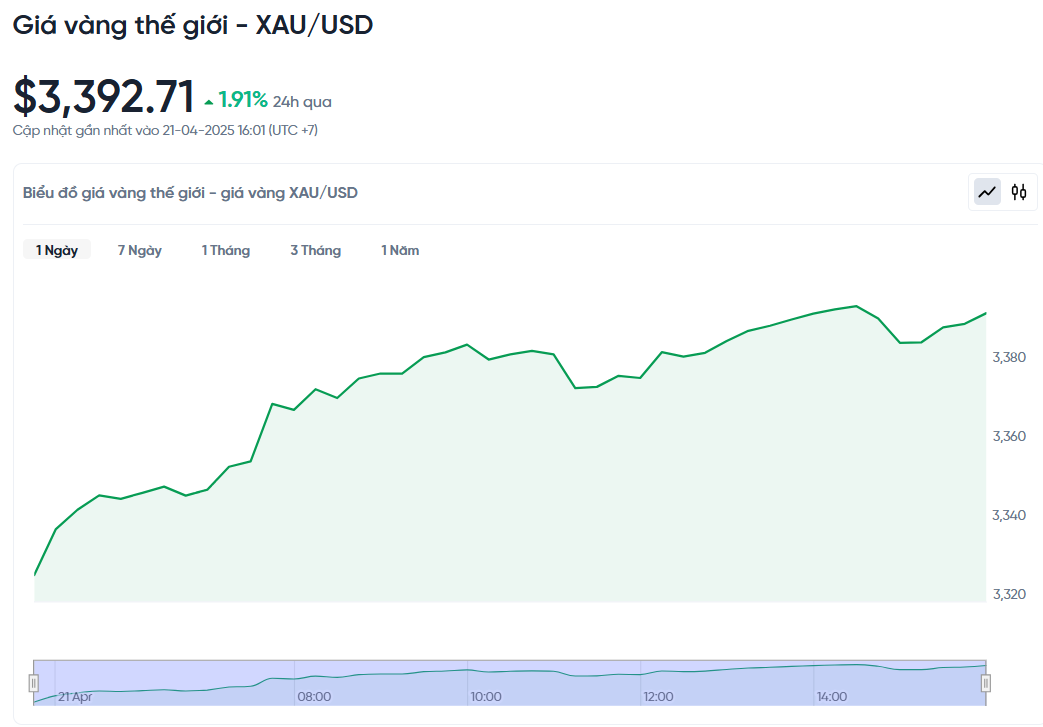

World gold price today April 21, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. today, Vietnam time, was 3,392.71 USD/ounce. Today's gold price increased by 63.38 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,060 VND/USD), the world gold price is about 107.64 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.36 million VND/tael higher than the international gold price.

World gold prices continued to rise sharply and hit a new record due to the depreciation of the USD and concerns about the global economic recession due to the US-China trade tension. The demand for gold as a safe investment channel has pushed prices up. Earlier in the trading session, the gold price hit a record of 3,395.95 USD. The price of gold futures in the US also increased by 2.1% to 3,396.6 USD.

The main reason for this increase is China's new move that increases US-China trade tensions. China has warned countries not to enter into economic agreements with the US if it causes damage to this country.

In addition, Trump’s criticism of Federal Reserve Chairman Jerome Powell last week also weakened the dollar, falling to its lowest level in more than three years. This has shaken global markets and worsened the economic outlook for the world’s largest economy, causing many investors to withdraw from US assets.

Concerns about the role of the US dollar in the global monetary system are supporting gold prices, according to UBS analyst Giovanni Staunovo. Risk aversion in the stock market is also making gold an attractive investment channel. Gold prices are forecast to continue to rise and reach the $3,500 mark in the next few months.

Besides, despite positive signs such as the nuclear negotiations between the US and Iran, or the temporary ceasefire in Ukraine announced by Russia, investors still remain worried, causing the demand for gold to not decrease.

Since the beginning of 2025, the price of gold has increased by more than 700 USD. Notably, it took 12 years (from 2008) for the price of gold to increase from 1,000 USD/ounce to 2,000 USD/ounce.

The next target for gold is around $3,500, according to Yeap Jun Rong, market strategist at IG. However, in the short term, the market may be overbought, and technical indicators suggest a temporary correction is possible.

Besides gold prices, silver prices also increased by 0.5% to 32.74 USD/ounce, platinum prices increased by 0.4% to 971.10 USD, while palladium prices decreased slightly by 0.3% to 958.93 USD.

Gold Price Forecast

Kitco expert Jim Wyckoff also believes that the current gold price uptrend is still very solid. He explains that the technical chart is maintaining a positive signal and the demand for gold as a haven remains very strong.

Sean Lusk, co-director of commercial hedging at Walsh Trading, said the market is still in a "safe haven" mode, and gold is where the money is flowing.

Speculators are buying aggressively, TV pundits are recommending holding gold, and central banks are continuing to accumulate, he said. Lusk said his 25% target for the year was met at $3,301 an ounce and is now looking toward the next level around $3,434 an ounce.

However, some other experts advise investors to be cautious when participating in the gold market at this time. Mr. NS Ramaswamy, Head of Commodities at Ventura, warned that gold should not be bought right now when the price has increased too much. According to him, it is better to wait for the price to adjust to lower levels such as 3,150 USD or 3,080 USD/ounce before considering buying.

Gold will continue to be in demand as central banks increase purchases and investors seek safe havens, said Navneet Damani, senior vice president, commodities and currencies research at Motilal Oswal Financial Services. He recommends buying on any correction in gold prices, especially in the medium to long term, unless there is a major breakthrough in international trade negotiations.

Technically, the recent strong buying trend suggests a positive short-term outlook for gold prices. However, the RSI is at very high levels (above 70), reflecting overbought conditions and may require a slight correction to “rest” before resuming the long-term uptrend.

If a short-term pullback occurs, the $3,350 area could be the first support level. Next is the Asian session low, around $3,328-$3,329. A break of this level could see gold fall to $3,300, possibly even retesting Friday’s low of $3,284. A break of this level would raise the possibility of deeper corrections.

While no major economic data is due to be released in the US on Monday, investors will be looking ahead to trade-related news and preliminary PMI figures on Wednesday to determine the next direction of gold prices.

Source: https://baonghean.vn/gia-vang-ngay-21-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-tro-lai-vuot-muc-120-trieu-dong-10295615.html

![[Infographic] How much more will people have to pay when household electricity prices increase by 4.8% from today, May 10?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/10/4a5fc910eb8a4113aadcd7a62655e5d6)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

Comment (0)