Domestic gold price today April 17, 2025

At the time of survey at 12:00 on April 17, 2025, domestic gold prices continued to break new peaks, due to the new escalation of US-China tariffs. Specifically:

DOJI Group listed the price of SJC gold bars at 115.5-118 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 115.5-118 million VND/tael (buy - sell), an increase of 2.5 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 117-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 3.5 million VND/tael for buying and 4.5 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 115.5-118 million VND/tael (buying - selling, up 3 million VND/tael in buying direction - up 2.5 million VND/tael in selling direction compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 114.5-117 million VND/tael (buy - sell), gold price increased by 3.5 million VND/tael for buying - increased by 3 million VND/tael for selling compared to yesterday.

As of 12:00 today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 114-117 million VND/tael (buy - sell); an increase of 3.5 million VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell); an increase of 3 million VND/tael in both buying and selling compared to yesterday.

The latest gold price list today, April 17, 2025 is as follows:

| Gold price today | April 17, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 115.5 | 118 | +2500 | +2500 |

| DOJI Group | 115.5 | 118 | +2500 | +2500 |

| Red Eyelashes | 117 | 121 | +3500 | +3000 |

| PNJ | 115.5 | 118 | +2500 | +2500 |

| Vietinbank Gold | 118 | +2500 | ||

| Bao Tin Minh Chau | 115.5 | 118 | +3000 | +2500 |

| Phu Quy | 114.5 | 117 | +3500 | +3000 |

| 1. DOJI - Updated: April 17, 2025 12:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 115,500 ▲2500 | 118,000 ▲2500 |

| AVPL/SJC HCM | 115,500 ▲2500 | 118,000 ▲2500 |

| AVPL/SJC DN | 115,500 ▲2500 | 118,000 ▲2500 |

| Raw material 9999 - HN | 113,800 ▲3500 | 116,100 ▲3500 |

| Raw material 999 - HN | 113,700 ▲3500 | 116,000 ▲3500 |

| 2. PNJ - Updated: April 17, 2025 12:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,550 | 11,800 |

| PNJ 999.9 Plain Ring | 11,400 | 11,700 |

| Kim Bao Gold 999.9 | 11,400 | 11,700 |

| Gold Phuc Loc Tai 999.9 | 11,400 | 11,700 |

| 999.9 gold jewelry | 11,350 | 11,600 |

| 999 gold jewelry | 11,338 | 11,588 |

| 9920 jewelry gold | 11,267 | 11,517 |

| 99 gold jewelry | 11,244 | 11,494 |

| 750 Gold (18K) | 8,070 | 8,715 |

| 585 Gold (14K) | 6.156 | 6.801 |

| 416 Gold (10K) | 4,196 | 4,841 |

| PNJ Gold - Phoenix | 11,400 | 11,700 |

| 916 Gold (22K) | 10,386 | 10,636 |

| 610 Gold (14.6K) | 6,446 | 7,091 |

| 650 Gold (15.6K) | 6.910 | 7.555 |

| 680 Gold (16.3K) | 7,258 | 7,903 |

| 375 Gold (9K) | 3,720 | 4.365 |

| 333 Gold (8K) | 3,198 | 3,843 |

| 3. SJC - Updated: April 17, 2025 12:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 115,500 ▲2500K | 118,000 ▲2500K |

| SJC gold 5 chi | 115,500 ▲2500K | 118,020 ▲2500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 115,500 ▲2500K | 118,030 ▲2500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▲3500 | 117,000 ▲3500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▲3500 | 117,100 ▲3500 |

| Jewelry 99.99% | 114,000 ▲3500 | 116,400 ▲3500 |

| Jewelry 99% | 110,747 ▲3465 | 115,247 ▲3465 |

| Jewelry 68% | 74,309 ▲2380 | 79,309 ▲2380 |

| Jewelry 41.7% | 43,693 ▲1459 | 48,693 ▲1459 |

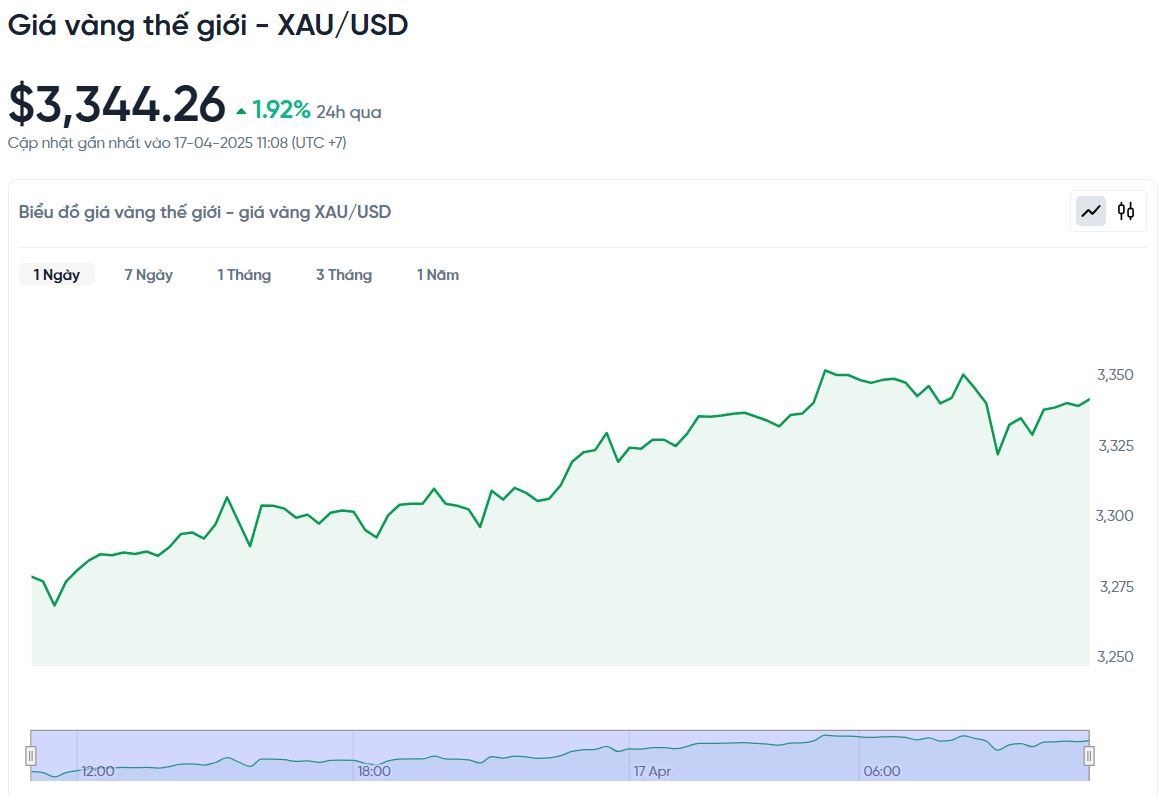

World gold price today April 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 12:00 today, Vietnam time, was 3,344.26 USD/ounce. Today's gold price increased by 62.94 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,060 VND/USD), the world gold price is about 106.12 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 11.88 million VND/tael higher than the international gold price.

World gold prices rose sharply early in the morning, surpassing $3,500/ounce, then fell slightly as investors took profits after the precious metal set a new record. Meanwhile, gold futures in the US rose slightly by 0.2% to $3,351.5.

The main reason for the sharp increase in gold prices is due to escalating trade tensions, especially restrictions on chip exports to China and tariff uncertainties, which have caused many people to rush to buy gold as a safe haven. President Donald Trump announced new tariffs of up to 245% on imports from China, sharply escalating the trade conflict between the United States and China.

According to market analyst Nikos Tzabouras, all the factors are currently favorable for gold, pushing prices to new highs. Although there may be some corrections, the metal still has the opportunity to increase further if the trade conflict persists.

With tensions between the West and China showing no signs of abating and the US dollar falling victim to Mr Trump’s trade policies, its safe-haven status is in question. The US dollar index is near a three-year low, making gold more attractive to foreign investors.

In addition, the strong volatility of the stock and bond markets may also cause many people to increase the proportion of gold in their investment portfolio to reduce risks. Since the beginning of the year, the price of gold has increased by more than 27%. Some experts predict that the price may adjust to $ 3,050 / ounce after the recent strong increase, but the overall outlook remains optimistic.

Katie Stockton, founder and managing partner at Fairlead Strategies, said the gold breakout is technically sound. She said the daily, weekly and monthly charts are all positive, and that while there are signs of “short-term bullish exhaustion,” that’s not enough to change the bullish outlook for gold.

Federal Reserve Chairman Jerome Powell recently gave a speech at the Economic Club of Chicago. He emphasized that the Fed still aims for the dual goals of maximum employment and price stability, but that progress toward achieving these goals is expected to slow in the coming time.

Powell also stressed that the US budget deficit and public debt are serious problems but not out of control. Finally, when asked about the risk of political interference in the Fed's operations, especially after recent Supreme Court decisions, Powell said the Fed is independent under the law, and there is no indication that will change.

In other precious metals markets, silver, platinum and palladium all fell, with silver down 1% to $32.43 an ounce, platinum down 0.2% to $965.46 and palladium down 1.4% to $958.26.

Gold Price Forecast

Although the price of gold has been rising steadily and breaking historical records, many large organizations still believe that the upward momentum has not stopped. New targets are set at $3,500 and even $4,000 per ounce. The main reason comes from potential risks and prolonged instability in the global economy, especially trade tensions between the US and China.

If the Trump administration continues to impose tariffs on other countries such as Canada or Mexico, global financial markets could be further volatile, further strengthening gold’s status as a safe haven asset.

Bank of America forecasts that world gold could reach $3,500/ounce by the end of 2025. At that time, the domestic SJC gold price could rise to around VND120 to 125 million per tael. If the gold price increases to $4,000, domestic gold could reach VND130 million/tael.

However, after a period of rapid growth, profit-taking pressure is inevitable. In the past, world gold prices have had strong corrections of 10% to 15% when supporting factors changed suddenly.

KCM Trade expert Tim Waterer said that the weakening of the US dollar and the defensive sentiment of investors are continuing to create favorable conditions for gold to increase in price.

Sharing the same view, Mr. Jerry Prior, CEO of Mount Lucas Management, commented that although gold has entered the "overbought" zone, it is still well supported by the risk-averse sentiment in the market.

Investors have never faced such uncertainty, Prior said. In previous crises, such as the COVID-19 pandemic or the Russia-Ukraine conflict, markets had clear strategies for responding. But now, every scenario is unpredictable and there are no rules that really work.

He believes that gold prices may continue to rise in the coming time, because this year alone, prices have increased by more than 22% and increased by 37% compared to the same period last year. This is a good opportunity for investors to rebalance their portfolios.

Goldman Sachs also noted that central bank demand for gold is exceeding expectations. The global recession and geopolitical risks continue to drive money into gold. ANZ Bank predicts that gold prices could reach $3,600 an ounce by the end of the year and $3,500 an ounce within the next six months.

Source: https://baonghean.vn/gia-vang-ngay-17-4-2025-gia-vang-domestic-va-the-gioi-tiep-tuc-tang-vuot-120-trieu-dong-luong-10295310.html

![[Photo] Prime Minister Pham Minh Chinh chairs Government Standing Committee meeting on Gia Binh airport project](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/6d3bef55258d417b9bca53fbefd4aeee)

Comment (0)