Gold prices have surged, hitting new records due to geopolitical uncertainties, challenges to the US economy and expectations of higher inflation. Market volatility has made gold a safe haven asset in the early months of Mr. Trump’s term.

Many Wall Street forecasters expect gold prices to continue to rise in the coming period.

This expert believes that after reaching a record high, the price of gold could plummet to $1,820/ounce in the next five years, wiping out all of gold's gains over the past year.

Mr. Mills gives three reasons why prices will fall in the long term.

Market supply will increase

Higher gold prices are prompting producers to continue to mine more gold. Higher supply will put further downward pressure on prices in the coming years.

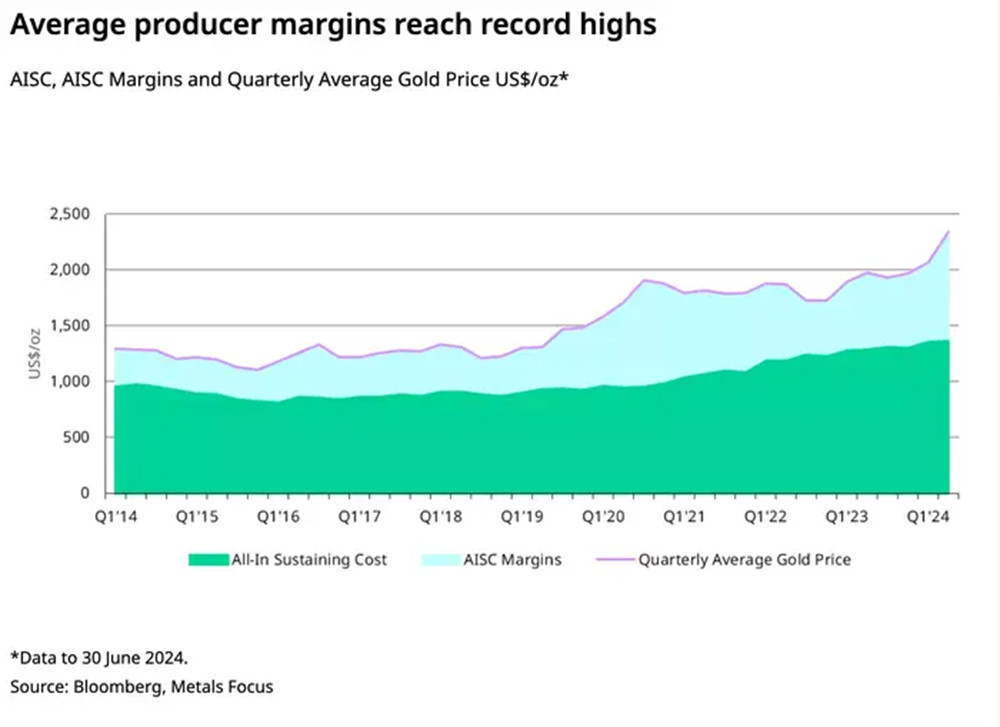

Gold mining has become more profitable in recent years, with the average profit margin for gold miners expected to reach $950 an ounce by the second quarter of 2024, the most profitable mining period since 2012, according to data from the World Gold Council (WGC).

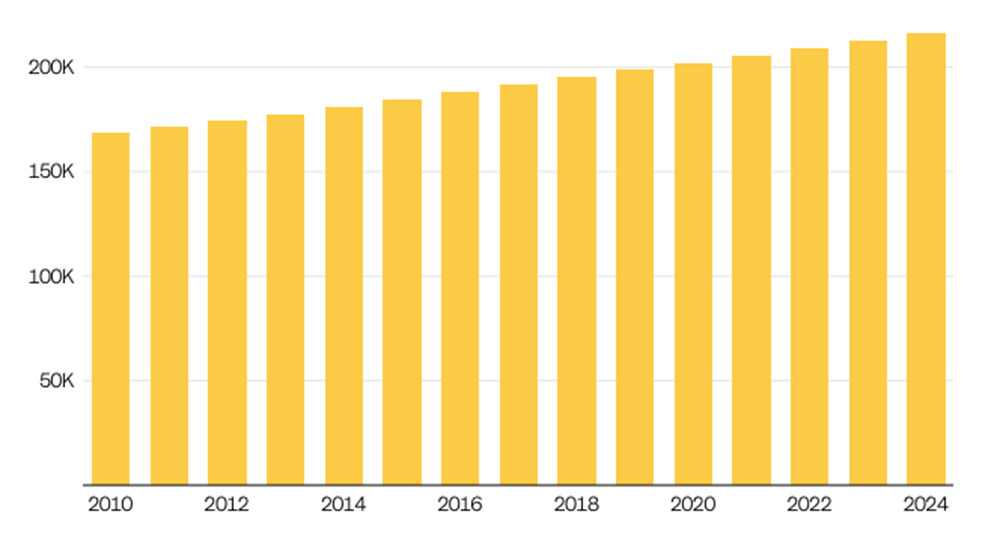

According to analysts, above-ground gold reserves will reach 216,265 tonnes by 2024, up 9% in five years. Australia is one of the world's largest gold producers.

Mills said that more gold is expected to be recycled in the coming years, which will also increase supply.

Gold demand will decrease

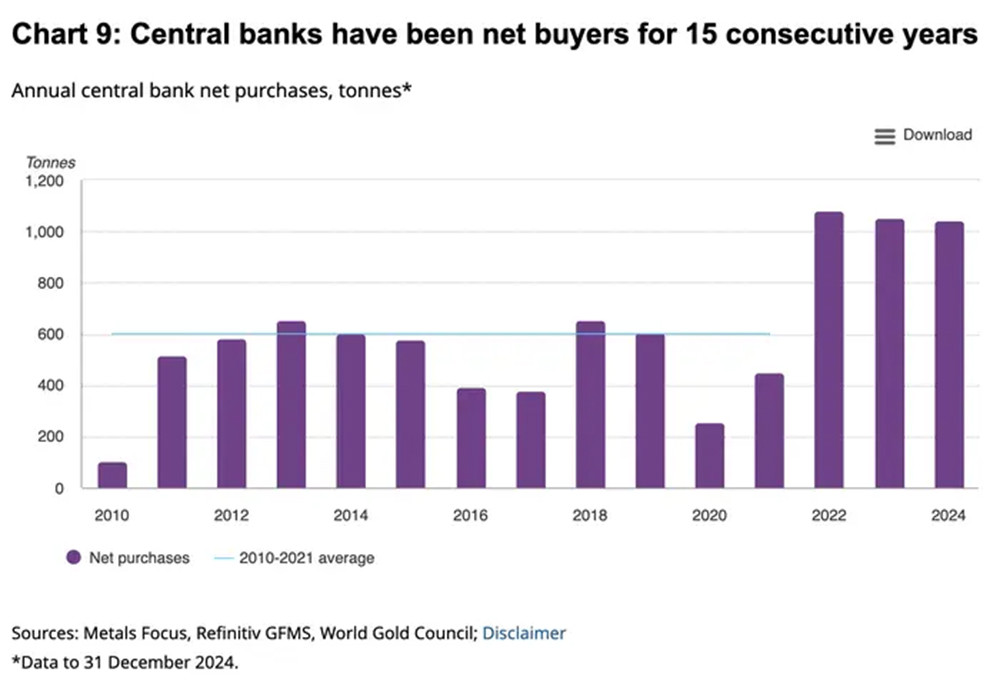

Central banks and investors have been more interested in buying gold this year as a way to diversify reserves and seek shelter from macro uncertainty.

On the investor side, gold funds have been the most popular in recent years. Inflows into gold ETFs reached $9.4 billion in February, the highest in nearly three years, according to WGC data.

But there are signs that global demand for gold is starting to wane. In a survey conducted by the WGC last year, 71% of central banks said they expected their gold holdings to remain unchanged or fall over the next 12 months.

Investor demand is also likely to decline, as economic concerns are often short-term factors that affect gold prices, Mills said.

He pointed to a brief rally in gold in 2020 as the pandemic sparked unprecedented economic concerns, but prices quickly fell back and did not return to their previous peak until late 2023.

“If you look at the price of gold over the last 25, 30 years, you can see that it has gone up a lot and then gone down,” he said.

Signs of gold price peak

Activity in the gold industry is following a familiar pattern, indicating that prices are nearing a peak, Mills said.

M&A activity is booming, as tends to happen when markets peak. Gold deal activity is expected to increase 32% year-over-year by 2024, according to data from S&P Global Market Intelligence.

There has also been a recent increase in gold investment funds, which has happened during previous peaks.

All of these factors are pushing gold prices higher, Mills said, and caution should be taken not to expect prices to rise indefinitely in the near term.

(According to BI)

Source: https://vietnamnet.vn/gia-vang-lap-dinh-chuyen-gia-canh-bao-nguy-co-trang-tay-trong-5-nam-toi-2393678.html

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

Comment (0)