Domestic gold price today April 5, 2025

At the time of survey at 4:30 a.m. on April 5, 2025, the domestic gold price dropped sharply by nearly 1 million VND to nearly 101 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 98.8-101.3 million VND/tael (buy - sell), a decrease of 700 thousand VND/tael in buying - a decrease of 900 thousand VND/tael in selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 98.8-101.3 million VND/tael (buy - sell), down 700 thousand VND/tael for buying - down 900 thousand VND/tael for selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 99.6-101.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 200 thousand VND/tael for buying and decreased by 200 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 98.8-101.3 million VND/tael (buying - selling, down 700 thousand VND/tael in buying direction - down 900 thousand VND/tael in selling direction compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 98.6-101.3 million VND/tael (buy - sell), gold price decreased 400 thousand VND/tael for buying - decreased 900 thousand VND/tael for selling compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.5-101.3 million VND/tael (buy - sell); down 200,000 VND/tael for buying - down 900,000 VND/tael for selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 98.8-101.3 million VND/tael (buy - sell); down 300 thousand VND/tael for buying - down 1 million VND/tael for selling.

The latest gold price list today, April 5, 2025 is as follows:

| Gold price today | April 5, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 98.8 | 101.3 | -700 | -900 |

| DOJI Group | 98.8 | 101.3 | -700 | -900 |

| Red Eyelashes | 99.6 | 101.5 | +200 | -200 |

| PNJ | 98.8 | 101.3 | -700 | -900 |

| Vietinbank Gold | 101.3 | -900 | ||

| Bao Tin Minh Chau | 98.8 | 101.3 | -200 | -900 |

| Phu Quy | 98.6 | 101.3 | -400 | -900 |

| 1. DOJI - Updated: April 5, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 98,800 ▼700K | 101,300 ▼900K |

| AVPL/SJC HCM | 98,800 ▼700K | 101,300 ▼900K |

| AVPL/SJC DN | 98,800 ▼700K | 101,300 ▼900K |

| Raw material 9999 - HN | 98,300 ▼200K | 100,400 ▼900K |

| Raw material 999 - HN | 98,200 ▼200K | 100,300 ▼900K |

| 2. PNJ - Updated: April 5, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 9,880 | 10,130 |

| PNJ 999.9 Plain Ring | 9,870 | 10,130 |

| Kim Bao Gold 999.9 | 9,870 | 10,130 |

| Gold Phuc Loc Tai 999.9 | 9,870 | 10,130 |

| 999.9 gold jewelry | 9,870 | 10,120 |

| 999 gold jewelry | 9,860 | 10,110 |

| 9920 jewelry gold | 9,799 | 10,049 |

| 99 gold jewelry | 9,779 | 10,029 |

| 750 Gold (18K) | 7,355 | 7,605 |

| 585 Gold (14K) | 5,685 | 5,935 |

| 416 Gold (10K) | 3,975 | 4,225 |

| PNJ Gold - Phoenix | 9,870 | 10,130 |

| 916 Gold (22K) | 9,030 | 9,280 |

| 610 Gold (14.6K) | 5,938 | 6,188 |

| 650 Gold (15.6K) | 6,343 | 6,593 |

| 680 Gold (16.3K) | 6,647 | 6,897 |

| 375 Gold (9K) | 3,560 | 3,810 |

| 333 Gold (8K) | 3,105 | 3,355 |

| 3. SJC - Updated: 4/5/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,800 ▼700K | 101,300 ▼900K |

| SJC gold 5 chi | 98,800 ▼700K | 101,320 ▼900K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,800 ▼700K | 101,330 ▼900K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,700 ▼700K | 101,200 ▼800K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,700 ▼700K | 101,300 ▼800K |

| Jewelry 99.99% | 98,700 ▼700K | 100,900 ▼800K |

| Jewelry 99% | 96,901 ▼792K | 99,901 ▼792K |

| Jewelry 68% | 65,769 ▼544K | 68,769 ▼544K |

| Jewelry 41.7% | 39,229 ▼344K | 42,229 ▼344K |

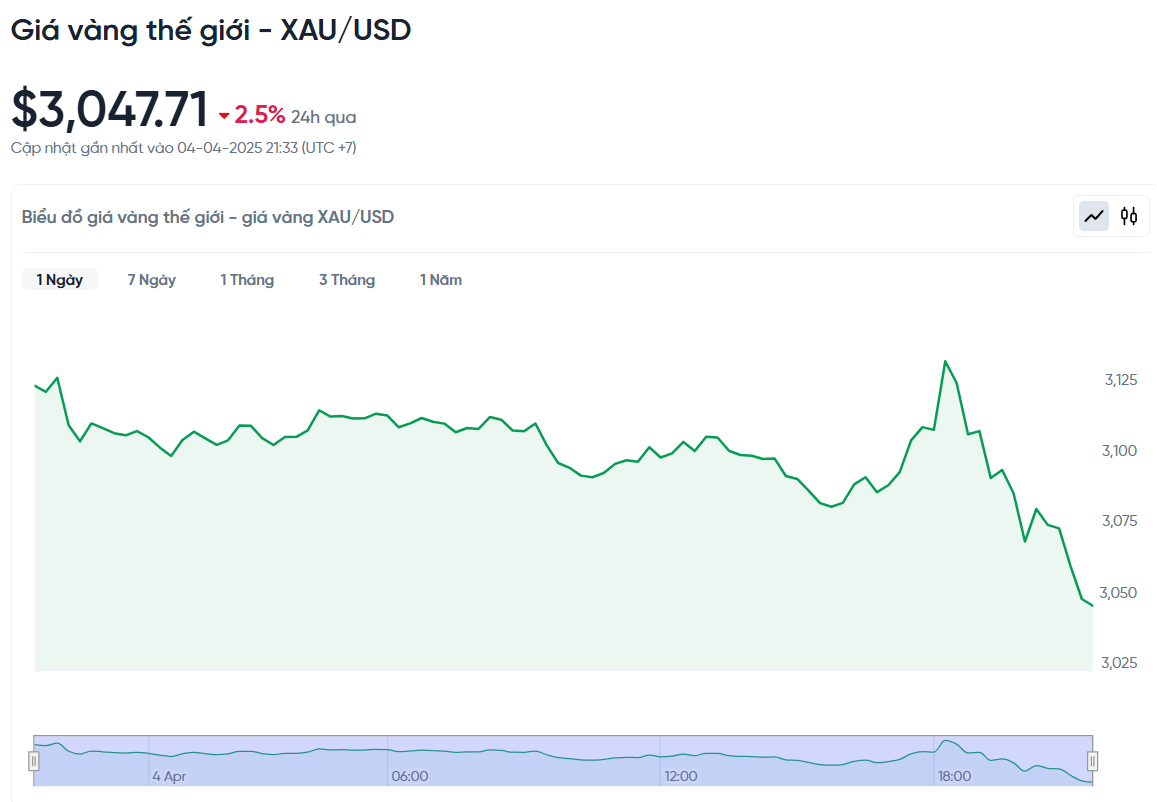

World gold price today April 5, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,047.71 USD/ounce. Today's gold price decreased by 78.11 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (25,960 VND/USD), the world gold price is about 96.61 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 4.69 million VND/tael higher than the international gold price.

The world gold price fell sharply after investors rushed to sell to cover losses in other investments. The main reason was China's announcement of retaliatory tariffs on US goods, raising concerns about a new trade war.

Gold futures in the US also fell 1.6% to $3,072.1. According to experts, many investors were forced to sell gold to compensate for losses from other markets such as coffee, rubber, stocks, etc. when they received margin calls.

China’s retaliation comes after the US imposed new tariffs on a range of imported goods. The Chinese Ministry of Finance announced that it would impose an additional 34% tariff on all US goods starting April 10. The news sent global stock markets down for two consecutive days and raised fears of an economic recession.

The gold market is still under pressure, trading below $3,100/ounce, as the US economy continued to create more jobs than expected last month. The US March employment report showed the economy added 228,000 jobs, higher than the 135,000 forecast by experts.

However, the unemployment rate edged up slightly from 4.1% to 4.2%, while analysts expected it to remain unchanged. "This data reinforces the Federal Reserve's view of holding off on rate cuts," said Alex Ebkarian, CEO of Allegiance Gold.

However, Chris Zaccarelli, chief investment officer at Northlight Asset Management, noted that despite the strong jobs numbers, stocks were still down on trade war concerns after former President Trump proposed global tariffs. "The market is now less concerned about the jobs report and more about the risk of trade conflicts that could push the world into recession," he said.

Gold prices tend to rise sharply when interest rates are low. The market currently expects the Fed to cut interest rates by 120 basis points between June and the end of the year. In addition, investors are waiting for a speech by Fed Chairman Jerome Powell to grasp the direction of monetary policy.

Not only gold, silver prices also fell sharply by 4.9% to $30.32/ounce, recording the worst weekly decline since September 2020. Platinum and palladium fell 2.8% and 1.4%, respectively, to $925.55 and $915.21, and were also under selling pressure during the week.

Gold Price Forecast

Technically, bulls in the June gold futures market still have the upper hand in the short term. The bulls’ target is to close above the resistance level of $3,201.60. The bears want to push the price below the support zone of $3,0310.

The immediate resistance is at $3,150 and then $3,160.2. The immediate support is at $3,089.3 and then the weekly low at $3,073.5. The Wyckoff Technical Indicator is currently at 8.5 out of 10, indicating that the uptrend is still quite strong.

The gold market is experiencing a lot of volatility as investors react to the global import tariffs proposed by US President Donald Trump. Although gold prices may correct lower in the short term, some major financial institutions believe that the risk of a deep decline is insignificant.

Before the tax policy was announced, experts at RBC Capital Markets raised their gold price forecast. They expect prices to average around $3,039 an ounce this year and could rise to $3,195 an ounce next year.

While RBC remains optimistic about the long-term outlook, it believes the recent rally has been too rapid. In the event of a correction, gold prices could retreat to support around $2,821/ounce to consolidate the trend.

Experts at TD Securities also believe that gold will continue to fluctuate strongly. They said that although prices are high, the actual holdings of large investors are still quite low, which shows that the market has not yet fallen into a state of overload.

TD believes that if there is a correction, the possibility of a deep decline is low. Many investors have achieved good profits over the past year, so it will not be easy to sell just because of a few short-term fluctuations.

Some forecasts are even more optimistic, expecting that if the current trend is maintained, gold prices could reach $3,500/ounce by the end of the year. However, analysts also warn that if the supporting factors change, gold could face a deeper correction.

Source: https://baonghean.vn/gia-vang-hom-nay-5-4-2025-gia-vang-trong-nuoc-va-the-gioi-giam-sau-do-nha-dau-tu-o-at-ban-ra-de-bu-lo-10294487.html

![[Photo] Prime Ministers of Vietnam and Thailand visit the Exhibition of traditional handicraft products](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/6cfcd1c23b3e4a238b7fcf93c91a65dd)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)