Gold price today (April 4): President Trump's tax decree has caused the financial market to "shake", forcing investors to close gold positions to compensate for losses from other assets.

End of April 3, Domestic gold bar prices continue to increase. Currently, gold brands are buying at 99.5 million VND/tael and selling at 102.2 million VND/tael. Phu Quy SJC and Bao Tin Minh Chau gold are buying at 500,000 VND lower than other brands.

Similarly, the price of gold rings of various brands was also adjusted up. Specifically, the price of SJC 9999 gold rings was adjusted up by VND500,000 in both directions to VND99.4 million/tael for buying and VND102 million/tael for selling, respectively.

DOJI in Hanoi and Ho Chi Minh City markets kept the buying price the same as yesterday morning at 98.7 million VND/tael but increased the selling price by 800,000 VND to 102.2 million VND/tael.

PNJ brand gold ring price is listed at 99.5 million VND/tael and 102.2 million VND/tael, up 400,000 VND in both directions.

Bao Tin Minh Chau listed the price of plain round gold rings at 99.1 million VND/tael for buying and 102.3 million VND/tael for selling, an increase of 300,000 VND for buying price and 500,000 VND for selling price.

Phu Quy SJC is buying gold rings at 99 million VND/tael and selling at 102.3 million VND/tael, up 300,000 VND and 600,000 VND respectively.

Domestic gold bar prices updated at 5:30 a.m. April 4 as follows:

Yellow | Area | Early morning 3-4 | Early morning 4-4 | Difference | ||||||

Buy | Sell | Buy | Sell | Buy | Sell | |||||

Unit of measure: Million VND/tael | Unit of measure: Thousand dong/tael | |||||||||

DOJI | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | ||||

Ho Chi Minh City | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | ||||

SJC | Ho Chi Minh City | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | |||

Hanoi | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | ||||

Danang | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | ||||

PNJ | Ho Chi Minh City | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | |||

Hanoi | 99.1 | 101.8 | 99.5 | 102.2 | +400 | +400 | ||||

Bao Tin Minh Chau | Nationwide | 99.1 | 101.8 | 99 | 102.2 | -100 | +400 | |||

Phu Quy SJC | Nationwide | 98.7 | 98.7 | 99 | 102.2 | +300 | +500 | |||

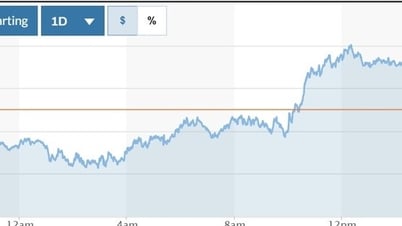

World gold price today

World gold prices fell, with spot gold down $16.8 to $3,115.7 an ounce. Gold futures last traded at $3,121.7 an ounce, down $44.5 from early this morning.

According to traders, the decline in prices in the last trading session was due to investors taking profits and selling gold to offset losses from other assets.

While some investors are selling to reduce their leveraged positions, others are seeing the dip as a buying opportunity, said Peter Grant, vice president and senior metals strategist at Zaner Metals. Investors will continue to seek safe havens, and gold is one such asset, Grant said.

US President Donald Trump’s tariff orders have sent financial markets tumbling amid fears they could slow economic growth and fuel inflation. However, gold’s overall trajectory appears to be intact, with prices up more than $500 this year.

High Ridge Futures director of metals trading David Meger called gold's move "a pullback or retracement in a sideways to uptrend."

Central banks are expected to help sustain gold's rally this year by increasing their holdings to further diversify reserves away from the US dollar amid risks stemming from President Donald Trump's policies, analysts say.

Central bank buying and strategic fund inflows into the metal will push prices higher, reaching $3,200 an ounce in the next six months, analysts at ANZ said.

The widespread tensions caused by tariffs have created deep uncertainty in financial markets and gold is the asset that is benefiting, according to independent analyst Ross Norman.

Predicting how much higher gold will go is difficult when prices are at all-time highs, but Norman said there is clearly momentum. The fact that investors are still buying as prices fall confirms that fundamental sentiment remains strong.

Meanwhile, HSBC experts believe that a combination of physical and financial market factors could put pressure on gold by the end of 2025. The bank forecasts an average price of $3,015 an ounce this year.

With the domestic gold bar price increasing and the world gold price listed at Kitco at 3,115.7 USD/ounce (equivalent to about 97.6 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between domestic and world gold prices is about 4.6 million VND/tael.

Source: https://baolangson.vn/gia-vang-hom-nay-4-4-trong-nuoc-tang-the-gioi-quay-dau-giam-5043095.html

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

Comment (0)