Update the latest gold price details today, April 3, 2025 in the domestic market

At 10:30 a.m. on April 3, 2025, the domestic gold market is recording a strong increase, with gold prices approaching the threshold of 103 million VND/tael. Major gold trading units have simultaneously adjusted their buying and selling prices, reflecting the strong attraction of this precious metal. Below is detailed information on gold prices from reputable brands:

The price of SJC gold bars was listed at 100.1-102.8 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions compared to yesterday. The difference between buying and selling prices remained at 2.7 million VND/tael, showing the excitement of the market.

The price of SJC gold bars at DOJI also increased by VND1 million/tael in both directions, reaching VND100.1-102.8 million/tael. The difference between buying and selling prices remained at VND2.7 million/tael, confirming the steady upward trend.

The price of SJC gold bars at this unit is recorded at 100.0-102.9 million VND/tael, with an increase of 1 million VND/tael for buying and 1.1 million VND/tael for selling. The difference between buying and selling prices is 2.9 million VND/tael.

Gold price at PNJ is listed at 101.1-102.8 million VND/tael, up 1 million VND/tael in both directions. The difference between buying and selling price is 1.7 million VND/tael, reflecting the attraction of gold rings.

The price of SJC gold bars at Mi Hong reached 100.0-102.0 million VND/tael, with an increase of 100 thousand VND/tael in buying price and a decrease of 800 thousand VND/tael in selling price. The difference between buying and selling price is up to 2 million VND/tael.

The gold price on the morning of April 3, 2025 is showing a strong upward trend across the market, from SJC gold bars, gold rings to jewelry gold. In particular, the price of 999.9 jewelry gold at PNJ reached 99.9-102.4 million VND/tael, an increase of 800 thousand VND/tael in both directions, while 916 gold (22K) reached 91.4-93.9 million VND/tael, an increase of 730 thousand VND/tael. This is a positive signal for investors and gold hoarders.

At DOJI, the price of 9999 Hung Thinh Vuong round gold rings is listed at 99.9-102.8 million VND/tael, an increase of 1.2 million VND/tael for buying and 1.4 thousand VND/tael for selling. Bao Tin Minh Chau also recorded the price of gold rings at 100.0-102.9 million VND/tael, an increase of 1.2 million VND/tael for buying and 1.1 million VND/tael for selling.

The latest gold price list today, April 3, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 100.1 | ▲1000 | 102.8 | ▲1000 |

| DOJI Group | 100.1 | ▲1000 | 102.8 | ▲1000 |

| Red Eyelashes | 100,000 | ▲100 | 102.0 | ▼800 |

| PNJ | 100.1 | ▲1000 | 102.8 | ▲1000 |

| Vietinbank Gold | 102.8 | ▲1000 | ||

| Bao Tin Minh Chau | 100.0 | ▲1000 | 102.9 | ▲1100 |

| Phu Quy | 99.8 | ▲1100 | 102.8 | ▲1100 |

| 1. DOJI - Updated: April 3, 2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 100.100 ▲1000 | 102,800 ▲1000 |

| AVPL/SJC HCM | 100.100 ▲1000 | 102,800 ▲1000 |

| AVPL/SJC DN | 100.100 ▲1000 | 102,800 ▲1000 |

| Raw material 9999 - HN | 99,200 ▲700 | 101,200 ▲700 |

| Raw material 999 - HN | 99,100 ▲700 | 101,100 ▲700 |

| 2. PNJ - Updated: April 3, 2025 10:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,800 ▲700K | 102,500 ▲700K |

| HCMC - SJC | 99,800 ▲700K | 102,500 ▲700K |

| Hanoi - PNJ | 99,800 ▲700K | 102,500 ▲700K |

| Hanoi - SJC | 99,800 ▲700K | 102,500 ▲700K |

| Da Nang - PNJ | 99,800 ▲700K | 102,500 ▲700K |

| Da Nang - SJC | 99,800 ▲700K | 102,500 ▲700K |

| Western Region - PNJ | 99,800 ▲700K | 102,500 ▲700K |

| Western Region - SJC | 99,800 ▲700K | 102,500 ▲700K |

| Jewelry gold price - PNJ | 99,800 ▲700K | 102,500 ▲700K |

| Jewelry gold price - SJC | 99,800 ▲700K | 102,500 ▲700K |

| Jewelry gold price - Southeast | PNJ | 99,800 ▲700K |

| Jewelry gold price - SJC | 99,800 ▲700K | 102,500 ▲700K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,800 ▲700K |

| Jewelry gold price - Jewelry gold 999.9 | 99,800 ▲700K | 102,300 ▲700K |

| Jewelry gold price - Jewelry gold 999 | 99,700 ▲700K | 102,200 ▲700K |

| Jewelry gold price - Jewelry gold 99 | 98,880 ▲700K | 101,380 ▲700K |

| Jewelry gold price - 916 gold (22K) | 91,310 ▲640K | 93,810 ▲640K |

| Jewelry gold price - 750 gold (18K) | 74,380 ▲530K | 76,880 ▲530K |

| Jewelry gold price - 680 gold (16.3K) | 67,210 ▲470K | 69,710 ▲470K |

| Jewelry gold price - 650 gold (15.6K) | 64,150 ▲460K | 66,650 ▲460K |

| Jewelry gold price - 610 gold (14.6K) | 60,050 ▲420K | 62,550 ▲420K |

| Jewelry gold price - 585 gold (14K) | 57,500 ▲410K | 60,000 ▲410K |

| Jewelry gold price - 416 gold (10K) | 40,210 ▲290K | 42,710 ▲290K |

| Jewelry gold price - 375 gold (9K) | 36,010 ▲260K | 38,510 ▲260K |

| Jewelry gold price - 333 gold (8K) | 31,410 ▲230K | 33,910 ▲230K |

| 3. SJC - Updated: 04/03/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 100.100 ▲1000 | 102,800 ▲1000 |

| SJC gold 5 chi | 100.100 ▲1000 | 102,820 ▲1000 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 100.100 ▲1000 | 102,830 ▲1000 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 99,900 ▲1000 | 102,500 ▲1000 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 99,900 ▲1000 | 102,600 ▲1000 |

| Jewelry 99.99% | 99,900 ▲1000 | 102,200 ▲1000 |

| Jewelry 99% | 98,188 ▲990 | 101,188 ▲990 |

| Jewelry 68% | 66,652 ▲680 | 69,652 ▲680 |

| Jewelry 41.7% | 39,771 ▲417 | 42,771 ▲417 |

Update gold price today April 3, 2025 latest on the world market

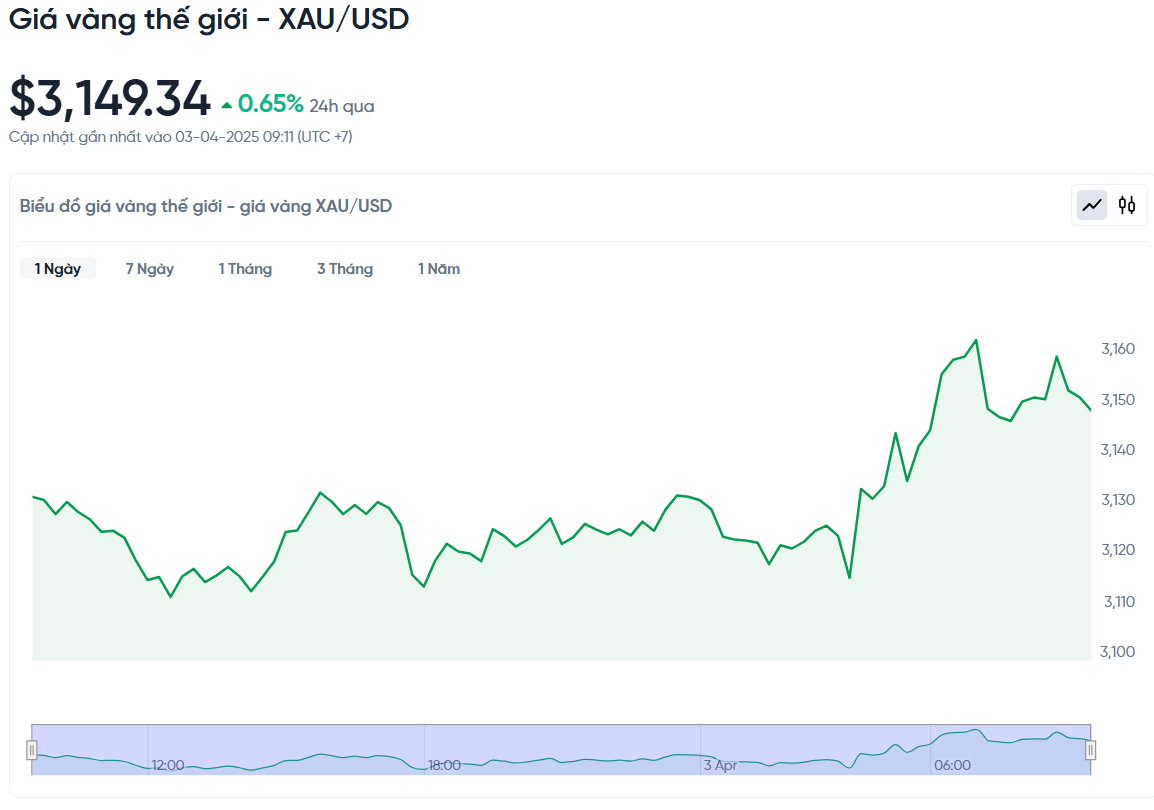

At the time of trading at 9:30 a.m. on April 3, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,149.34 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 99.64 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (100.1-102.8 million VND/tael), the SJC gold price is currently about 3.15 million VND/tael higher than the international gold price.

News, gold price trends today April 3, 2025 Domestic and world gold prices increased again after a slight decrease

Global financial markets were rocked on April 3 in Singapore when US President Donald Trump announced higher-than-expected tariffs on imports into the world's largest economy. The decision sent investors rushing to safe havens such as bonds, gold and the Japanese yen. The US's "tax wall" not only raises the cost of essential goods such as phones, clothes and electronics, but also puts heavy pressure on major technology companies. In particular, China and Taiwan - two major manufacturing hubs - face new tariffs of more than 30%, pushing total import tariffs from China to 54%, the highest level in more than a century, according to Citi expert Ben Wiltshire.

Stock markets immediately recorded sharp declines. The Nasdaq fell 3.3%, while the value of Apple - the company that manufactures iPhones mainly in China - fell nearly 7% in just a few hours. The S&P 500 also fell 2.7%, and European and Japanese markets were not immune to the impact, with the Nikkei down 2.8%. Meanwhile, gold became a bright spot as prices jumped to a record above $3,160 an ounce, reflecting investor concerns. In contrast, oil prices fell more than 2%, to $73.24 a barrel, showing signs of concern about slowing global economic growth.

Interest rates also saw significant fluctuations. The yield on the 10-year US Treasury note fell 14 basis points to 4.04%, its lowest in five months, as investors poured money into government bonds in search of safety. At the same time, many predicted that the US central bank could cut interest rates in the future to support the economy. Jeanette Gerratty, an economist in California, said that the tariffs were far beyond expectations and could disrupt everything from production to consumer prices.

The specific tariffs Trump imposed were considered “heavy-handed.” While the base tariff on imports into the US is 10%, some countries are taxed higher: China 34%, Japan 24%, Vietnam 46%, South Korea 25%, and the European Union 20%. This sent Asian markets reeling, with China’s CSI300 index down 0.24%, Hong Kong’s Hang Seng down 1.6%, and South Korea’s Kospi down 2%. Vietnam’s ETF also lost more than 8%, while the yuan weakened, hitting its lowest level in nearly two months against the dollar. In contrast, the Japanese yen gained ground, thanks to its perceived safe-haven status.

These changes will not only affect major investors, but could also directly impact consumers. Hong Kong-based expert Zhiwei Zhang warns that East Asian supply chains are under great pressure, and if other countries respond with their own tariffs, commodity prices could skyrocket. Market analyst Tony Sycamore worries that if these tariffs are not negotiated down quickly, the US economy risks falling into recession. As the “tariff wall” is erected, it will not only make it difficult for businesses but also make everything from phones to clothes more expensive for consumers.

Source: https://baodaknong.vn/gia-vang-hom-nay-3-4-2025-gia-vang-trong-nuoc-hon-vang-the-gioi-3-trieu-tang-hon-1-trieu-dong-248152.html

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)