Domestic gold price today March 29, 2025

At the time of the survey at 4:30 a.m. on March 29, 2025, the domestic gold price increased rapidly, the price of gold rings was close to 101 million VND/tael, the price of gold bars had exceeded 100 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 98.2-100.2 million VND/tael (buy - sell), an increase of 800 thousand VND/tael for buying - an increase of 1.3 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 98.2-100.2 million VND/tael (buy - sell), an increase of 800 thousand VND/tael in buying - an increase of 1.3 million VND/tael in selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 98-99.6 million VND/tael for buying and selling. Compared to yesterday, the gold price decreased by 500 thousand VND/tael for buying and decreased by 100 thousand VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 98.3-100.2 million VND/tael (buying - selling, up 800 thousand VND/tael in buying direction - up 1.3 million VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 98.3-100.2 million VND/tael (buy - sell), gold price increased by 900 thousand VND/tael in buying direction - increased by 1.3 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 98.4-100.2 million VND/tael (buy - sell); an increase of 1.2 million VND/tael in the buying direction - an increase of 700 thousand VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 98.6-100.6 million VND/tael (buy - sell); increased by 1 million VND/tael for buying - increased by 900 thousand VND/tael for selling.

The latest gold price list today, March 29, 2025 is as follows:

| Gold price today | March 29, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 98.2 | 100.2 | +800 | +1300 |

| DOJI Group | 98.2 | 100.2 | +800 | +1300 |

| Red Eyelashes | 98 | 99.6 | -500 | -100 |

| PNJ | 98.2 | 100.2 | +800 | +1300 |

| Vietinbank Gold | 100.2 | +1300 | ||

| Bao Tin Minh Chau | 98.3 | 100.2 | +800 | +1300 |

| Phu Quy | 98.3 | 100.2 | +900 | +1300 |

| 1. DOJI - Updated: March 29, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 98,200 ▲800K | 100,200 ▲1300K |

| AVPL/SJC HCM | 98,200 ▲800K | 100,200 ▲1300K |

| AVPL/SJC DN | 98,200 ▲800K | 100,200 ▲1300K |

| Raw material 9999 - HN | 98,400 ▲1200K | 99,300 ▲700K |

| Raw material 999 - HN | 98,300 ▲1200K | 99,200 ▲700K |

| 2. PNJ - Updated: March 29, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| HCMC - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Hanoi - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Hanoi - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Da Nang - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Da Nang - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Western Region - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Western Region - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Jewelry gold price - PNJ | 98,200 ▲800K | 100,200 ▲800K |

| Jewelry gold price - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Jewelry gold price - Southeast | PNJ | 98,200 ▲800K |

| Jewelry gold price - SJC | 98,200 ▲800K | 100,200 ▲1300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 98,200 ▲800K |

| Jewelry gold price - Jewelry gold 999.9 | 97,600 ▲800K | 100.100 ▲800K |

| Jewelry gold price - Jewelry gold 999 | 97,500 ▲800K | 100,000 ▲800K |

| Jewelry gold price - Jewelry gold 99 | 96,700 ▲790K | 99,200 ▲790K |

| Jewelry gold price - 916 gold (22K) | 89,290 ▲730K | 91,790 ▲730K |

| Jewelry gold price - 750 gold (18K) | 72,730 ▲600K | 75,230 ▲600K |

| Jewelry gold price - 680 gold (16.3K) | 65,720 ▲550K | 68,220 ▲550K |

| Jewelry gold price - 650 gold (15.6K) | 62,720 ▲520K | 65,220 ▲520K |

| Jewelry gold price - 610 gold (14.6K) | 58,710 ▲490K | 61,210 ▲490K |

| Jewelry gold price - 585 gold (14K) | 56,210 ▲470K | 58,710 ▲470K |

| Jewelry gold price - 416 gold (10K) | 39,290 ▲330K | 41,790 ▲330K |

| Jewelry gold price - 375 gold (9K) | 35,190 ▲300K | 37,690 ▲300K |

| Jewelry gold price - 333 gold (8K) | 30,680 ▲260K | 33,180 ▲260K |

| 3. SJC - Updated: 03/29/2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 98,200 ▲800K | 100,200 ▲1300K |

| SJC gold 5 chi | 98,200 ▲800K | 100,220 ▲1300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 98,200 ▲800K | 100,230 ▲1300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,100 ▲900K | 100,100 ▲1400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,100 ▲900K | 100,200 ▲1400K |

| Jewelry 99.99% | 98,100 ▲900K | 99,800 ▲1400K |

| Jewelry 99% | 95,812 ▲1387K | 98,812 ▲1387K |

| Jewelry 68% | 65,021 ▲953K | 68,021 ▲953K |

| Jewelry 41.7% | 38,771 ▲585K | 41,771 ▲585K |

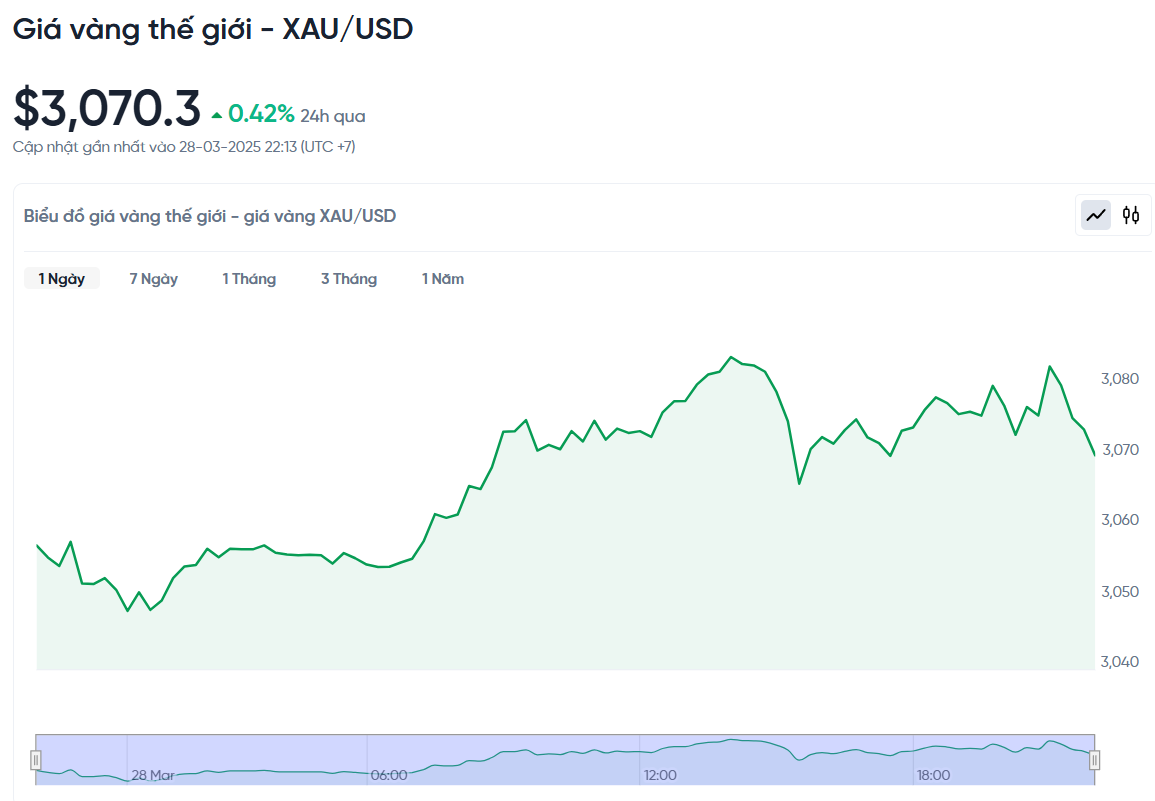

World gold price today March 29, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,070.3 USD/ounce. Today's gold price increased by 12.77 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,960 VND/USD), the world gold price is about 97.14 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.06 million VND/tael higher than the international gold price.

World gold prices are being maintained at a very high level, close to new peaks, as inflation continues to be a major concern for the US economy. The Core Personal Consumption Expenditure Index (Core PCE) increased by 0.4% last month, higher than the 0.3% increase in January. This increase exceeded the previous forecast of experts, who only expected a similar increase last month.

Inflation, as measured by the Core PCE index, rose 2.8% over the past 12 months, up from 2.7% in January and also exceeding economists' forecasts. The higher-than-expected inflation caused the gold market to react positively, with gold prices rising 0.74% during the trading session.

The personal consumption expenditures (PCE) price index rose more than analysts expected. However, Peter Grant, vice president and senior metals strategist at Zaner Metals, said the data was not enough to significantly change expectations for a Federal Reserve rate cut, as the increase was only slightly higher than expected.

The world gold price yesterday, March 28, reached a record of 3,086.21 USD/ounce - the 18th time this year. Overall, gold increased by 1.8% for the week and is on track to increase for the fourth consecutive week. Meanwhile, the price of gold futures in the US also increased by 0.7%, to 3,083.20 USD.

The current world situation is very tense, especially in the Middle East when the ceasefire agreement collapsed, plus the increasingly complicated situation between Russia and Ukraine. These unprecedented geopolitical risks have caused investors to seek safe haven assets such as gold, pushing the price of gold to a record high of over 3,100 USD/ounce.

Since Trump took office for a second term in January, gold has risen more than $400 in the first 50 days, outperforming all major asset classes such as the S&P 500, leading technology stocks, and even Bitcoin. Gold futures for June delivery on the Comex division of the New York Mercantile Exchange have hit a new record of $3,117 an ounce, while silver has also surged past the key $35 an ounce level.

Investors are awaiting Mr Trump’s retaliatory tariffs plan, expected to be announced on April 2. Experts say the former US president’s policies could increase inflation, threaten economic growth and escalate trade tensions.

Besides gold, other precious metals also gained. Silver rose 0.3% to $34.52 an ounce, platinum fell 0.2% to $983.95, while palladium rose 0.6% to $981.51. All three posted gains this week.

Gold Price Forecast

From a technical analysis perspective, gold prices have broken the important psychological level of $3,000/ounce and may be aiming for a target of $4,000/ounce in the near future.

However, rising gold prices too quickly could lead to temporary corrections. If gold prices fall below important support levels such as $3,000 or further below $2,800, the market will face the risk of a sharp correction.

In the context of soaring gold prices, many major banks on Wall Street have continuously raised their gold price forecasts. Analysts at Bank of America (BofA) recently increased their gold price forecast from $3,000 to $3,500 in the next 18 months.

The main reason given is that investors are expected to increase their gold purchases by about 10%, especially from China, central banks around the world, along with ETFs that hold physical gold.

Not only Bank of America, Macquarie Group also made a similar prediction when it said that the price of gold could reach $3,500 in the third quarter of this year. Even analysts at JPMorgan were bolder when they asked whether the price of gold could reach $4,000 in the near future.

JPMorgan explained that it took only 210 days for gold to rise from $2,500 to $3,000, significantly faster than previous $500 increases (averaging about 1,700 days). With the current rapid increase and the increasing attractiveness of gold in the eyes of investors, the bank believes that the possibility of gold reaching $4,000 may not be far away.

Sharing the same view, Goldman Sachs recently raised its gold price forecast to $3,300 by the end of this year, up from its previous forecast of $3,100 in late February. Goldman Sachs analysts Lina Thomas and Daan Struyven said central banks have been buying more than 1,000 tons of gold per year for three consecutive years, and this trend is likely to continue into 2025.

Goldman Sachs also noted that demand for gold-backed ETFs has been stronger than expected, especially as investors seek protection against economic uncertainty. If demand continues to accelerate and reach levels similar to those seen during the Covid-19 pandemic in 2020, gold could even reach $3,680 by the end of the year.

Source: https://baonghean.vn/gia-vang-hom-nay-29-3-2025-gia-vang-trong-nuoc-va-the-gioi-quy-1-2025-tang-manh-nhat-39-nam-qua-10293986.html

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] National conference to disseminate and implement Resolution No. 66-NQ/TW and Resolution No. 68-NQ/TW of the Politburo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/adf666b9303a4213998b395b05234b6a)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

Comment (0)