Domestic gold price today April 23, 2025

At the time of survey at 4:30 a.m. on April 23, 2025, the domestic gold price increased to an all-time high of VND 124 million/tael. Specifically:

The price of SJC gold bars listed by DOJI Group is at 122-124 million VND/tael (buy - sell), a sharp increase of 6 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 122-124 million VND/tael (buy - sell), an increase of 6 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, according to the latest information, there is currently no SJC gold for sale, and there is currently no new price update at this store.

SJC gold price at Ngoc Tham Jewelry Company Limited is traded by businesses at 118-122 million VND/tael (buy - sell), down 500 thousand VND/tael in buying direction - down 2 million VND/tael in selling direction compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120.5-122.5 million VND/tael (buying - selling), an increase of 4.5 million VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 120-123 million VND/tael (buy - sell), gold price increased by 4.5 million VND/tael in buying direction - increased by 5 million VND in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 117.2-119 million VND/tael (buy - sell); the gold price increased by 3.7 million VND/tael in the buying direction - increased by 2 million VND in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 119-122 million VND/tael (buy - sell); an increase of 4.5 million VND/tael in buying - an increase of 4 million VND in selling compared to yesterday.

The latest gold price list today, April 23, 2025 is as follows:

| Gold price today | April 22, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 122 | 124 | +6000 | +6000 |

| DOJI Group | 122 | 124 | +6000 | +6000 |

| Ngoc Tham | 118 | 122 | -500 | -2000 |

| PNJ | 122 | 124 | +6000 | +6000 |

| Vietinbank Gold | 124 | +6000 | ||

| Bao Tin Minh Chau | 120.5 | 122.5 | +4500 | +4500 |

| Phu Quy | 120 | 123 | +4500 | +5000 |

| 1. DOJI - Updated: April 23, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 122,000 ▲6000K | 124,000 ▲6000K |

| AVPL/SJC HCM | 122,000 ▲6000K | 124,000 ▲6000K |

| AVPL/SJC DN | 122,000 ▲6000K | 124,000 ▲6000K |

| Raw material 9999 - HN | 117,000 ▲3700K | 118,100 ▲2000K |

| Raw material 999 - HN | 116,900 ▲3700K | 118,090 ▲2090K |

| 2. PNJ - Updated: April 23, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| HCMC - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Hanoi - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Hanoi - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Da Nang - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Da Nang - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Western Region - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Western Region - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - PNJ | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - Southeast | PNJ | 117,000 ▲3500K |

| Jewelry gold price - SJC | 122,000 ▲6000K | 124,000 ▲6000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 117,000 ▲3500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 117,000 ▲3500K | 120,000 ▲3100K |

| Jewelry gold price - Jewelry gold 999.9 | 117,000 ▲3500K | 119,500 ▲3500K |

| Jewelry gold price - Jewelry gold 999 | 116,880 ▲3500K | 119,380 ▲3500K |

| Jewelry gold price - Jewelry gold 9920 | 116,140 ▲3470K | 118,640 ▲3470K |

| Jewelry gold price - Jewelry gold 99 | 115,910 ▲3470K | 118,410 ▲3470K |

| Jewelry gold price - 750 gold (18K) | 82,280 ▲2630K | 89,780 ▲2630K |

| Jewelry gold price - 585 gold (14K) | 62,560 ▲2050K | 70,060 ▲2050K |

| Jewelry gold price - 416 gold (10K) | 42,360 ▲1450K | 49,860 ▲1450K |

| Jewelry gold price - 916 gold (22K) | 107,060 ▲3200K | 109,560 ▲3200K |

| Jewelry gold price - 610 gold (14.6K) | 65,550 ▲2140K | 73,050 ▲2140K |

| Jewelry gold price - 650 gold (15.6K) | 70,330 ▲2280K | 77,830 ▲2280K |

| Jewelry gold price - 680 gold (16.3K) | 73,910 ▲2380K | 81,410 ▲2380K |

| Jewelry gold price - 375 gold (9K) | 37,460 ▲1310K | 44,960 ▲1310K |

| Jewelry gold price - 333 gold (8K) | 32,090 ▲1160K | 39,590 ▲1160K |

| 3. SJC - Updated: April 23, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 122,000 ▲6000K | 124,000 ▲6000K |

| SJC gold 5 chi | 122,000 ▲6000K | 124,020 ▲6000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 122,000 ▲6000K | 124,030 ▲6000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 116,500 ▲3500K | 119,500 ▲3500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 116,500 ▲3500K | 119,600 ▲3500K |

| Jewelry 99.99% | 116,500 ▲3500K | 118,900 ▲3500K |

| Jewelry 99% | 112,722 ▲3965K | 117,722 ▲3465K |

| Jewelry 68% | 75,010 ▲2380K | 81,010 ▲2380K |

| Jewelry 41.7% | 43,736 ▲1459K | 49,736 ▲1459K |

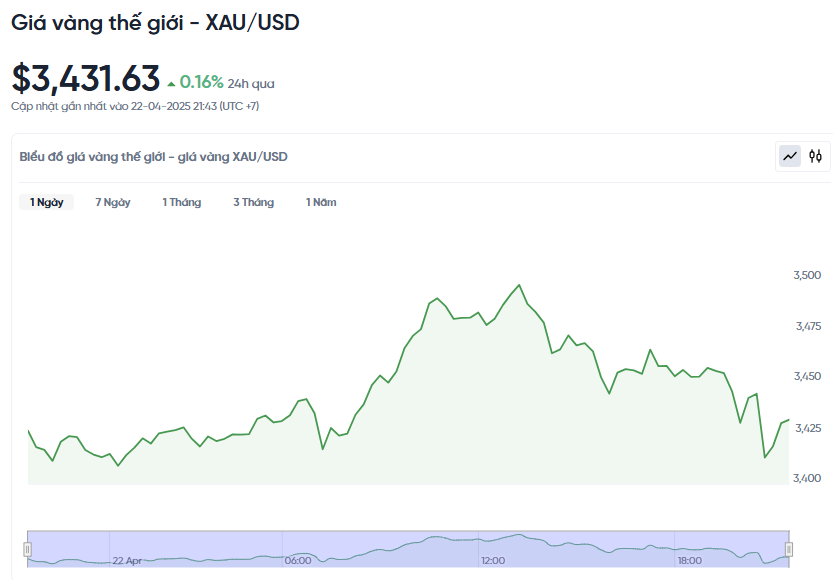

World gold price today April 23, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. today, Vietnam time, was at 3,431.63 USD/ounce. Today's gold price increased by 5.49 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,115 VND/USD), the world gold price is about 109.1 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 14.9 million VND/tael higher than the international gold price.

Over the past month, domestic gold investors have made significant profits. From March 22 to April 22, profits from SJC gold bars at SJC reached about VND23.1 million/tael. 9999 round gold rings at DOJI brought in profits of about VND18.7 million/tael, while at Bao Tin Minh Chau it was VND20.9 million/tael.

The world gold price today set a new record, approaching the 3,500 USD/ounce mark. The main reason is the weakening USD, US President Donald Trump's criticism of the Federal Reserve (Fed), along with concerns about the trade war. Meanwhile, the price of gold futures on the US market increased by 0.9%, reaching 3,454.6 USD.

"Traders have had to digest the impact of Trump's harsh criticism of the Fed and personal attacks on Chairman Powell. Now they are bracing for more volatility ahead of earnings reports and speeches from the central bank," said David Morrison of Trade Nation.

"The rally is so strong that investors are reluctant to sell," said Fawad Razaqzada, market analyst at City Index and FOREX.com. "It's hard to predict where gold will go next, but it's clear that gold is in a strong uptrend."

Gold prices have risen more than 30% this year, helped by strong central bank demand and lingering trade tensions. The confrontation between the US and China has created economic uncertainty, putting pressure on risk assets, while gold has become a safe haven.

"Tariff uncertainty is the main factor that is putting downward pressure on currencies in Asia, which is driving gold buying," said Daniel Ghali, commodity strategist at TD Securities. Gold's relative strength index (RSI) is currently at 79, indicating that the metal is overbought.

Alongside gold, spot silver rose 0.3% to $32.63 an ounce. Platinum held steady at $962.36, while palladium rose 1.4% to $940. Silver has struggled to maintain gains above $33 an ounce recently.

US economic data due for release on Wednesday includes the weekly Johnson Redbook retail sales report, the IMF's world economic outlook and the Richmond Fed business activity survey.

Markets are now focused on upcoming speeches from several Federal Reserve officials this week, with investors hoping the Fed will provide clarity on the direction of monetary policy, especially as confidence in the central bank’s independence is questioned.

Gold Price Forecast

Technically, the June gold bulls have the strong near-term technical advantage. The bulls’ next upside price objective is to close above solid resistance at $3,600. Meanwhile, the bears’ objective is to push prices below key technical support at $3,300.

First resistance is seen at the overnight high of $3,509.90, followed by $3,525. First support is seen at the overnight low of $3,423.90, followed by $3,400. The Wyckoff Market Rating Index currently stands at 9.5/10.

With the global economy experiencing many uncertainties, the demand for safe havens continues to be a factor that keeps gold in an attractive position. Each time the price of gold corrects, the market witnesses a strong increase in buying power, showing investors' confidence in the long-term upward trend of this precious metal.

ABC Refinery expert Nicholas Frappell said that the uncertainty in tariff policy and the tough stance from the US side risk disrupting the global supply chain. At that time, the demand for shelter will continue to push gold prices higher. If the instability continues, the gold rally shows no signs of stopping.

ANZ Bank believes that gold hedging activities in the market have not yet peaked, proving that there is still a lot of room for price increases. Therefore, ANZ has raised its year-end gold price forecast to $3,600/ounce.

KCM Trade expert Tim Waterer said that, in the context of the disagreement between Mr. Trump and Mr. Powell still not resolved, investors are shifting away from US assets and choosing gold as a safer option when the USD continues to weaken.

In addition, Citi Research has revised up its gold price forecast for the next three months from $3,200 to $3,500 an ounce, citing increased purchases by Chinese insurance companies and continued strong safe-haven flows.

CPM Group also shares the same opinion, saying that the current upward trend in gold prices could last for at least two more years, as the global economy is still facing many uncertainties and challenges.

From a domestic perspective, Mr. Nguyen Quang Huy, Executive Director of the Faculty of Finance and Banking at Nguyen Trai University, said that it is difficult to determine exactly when the gold price will cool down. The gold price can decrease at any time if market sentiment changes or when large organizations start selling to take profits.

Source: https://baonghean.vn/gia-vang-hom-nay-23-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-manh-tao-ky-luc-moi-10295710.html

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

Comment (0)