Domestic gold price today

Gold bar prices continued to increase sharply. At the end of April 18, gold brands bought at 117 million VND/tael and sold at 118 million VND/tael. Phu Quy SJC gold alone was buying and selling at 1 million VND lower than other brands.

Similarly, the price of gold rings of most brands has been adjusted to increase sharply. Specifically, DOJI in Hanoi and Ho Chi Minh City markets adjusted the price of gold rings by 500,000 VND for buying price and 1 million VND for selling price to 115 million VND/tael and 118.5 million VND/tael, respectively.

|

| Domestic gold prices continue to increase. Photo: dantri.com.vn |

Bao Tin Minh Chau listed the price of plain round gold rings at 116.5 million VND/tael for buying and 119.5 million VND/tael for selling, an increase of 1.5 million VND for both buying and selling compared to early yesterday morning.

Phu Quy SJC is buying gold rings at 115 million VND/tael and selling at 118 million VND/tael, an increase of 1.5 million VND in both directions.

Meanwhile, the price of PNJ brand gold rings is listed at 114 million VND/tael for buying and 117 million VND/tael for selling, unchanged from early this morning. Similarly, the price of SJC 9999 gold rings is fixed at 114 million VND/tael for buying and 117 million VND/tael for selling.

Domestic gold bar prices updated at 5:30 a.m. April 19 as follows:

Yellow | Area | Early morning April 18 | Early morning April 19 | Difference | ||||||

Buy | Sell | Buy | Sell | Buy | Sell | |||||

Unit of measure: Million VND/tael | Unit of measure: Thousand dong/tael | |||||||||

DOJI | Hanoi | 115.5 | 118 | 117 | 120 | +1500 | +2000 | |||

Ho Chi Minh City | 115.5 | 118 | 117 | 120 | +1500 | +2000 | ||||

SJC | Ho Chi Minh City | 115.5 | 118 | 117 | 120 | +1500 | +2000 | |||

Hanoi | 115.5 | 118 | 117 | 120 | +1500 | +2000 | ||||

Danang | 115.5 | 118 | 117 | 120 | +1500 | +2000 | ||||

PNJ | Ho Chi Minh City | 115.5 | 118 | 117 | 120 | +1500 | +2000 | |||

Hanoi | 115.5 | 118 | 117 | 120 | +1500 | +2000 | ||||

Bao Tin Minh Chau | Nationwide | 115.5 | 118 | 117 | 120 | +1500 | +2000 | |||

Phu Quy SJC | Nationwide | 114.5 | 117 | 116 | 119 | +1500 | +2000 | |||

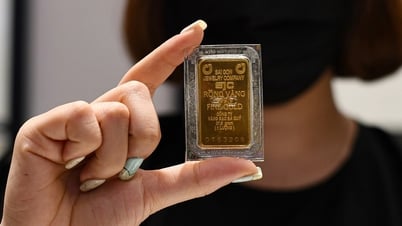

World gold price today

Gold prices were steady as markets closed for the Easter holiday, with spot gold at $3,329 an ounce and gold futures at $3,328 an ounce. Gold ended the week with a slight decline on Thursday as investors booked profits and closed long positions ahead of the holiday after a significant $110 gain the previous day.

According to experts, the reason for gold's decline in the final trading session of the week was cautious optimism surrounding the current trade negotiations between the US and Japan. However, this optimism was tempered by the statement of the Chairman of the US Federal Reserve (Fed) Jerome Powell.

Accordingly, in his speech at the Economic Club of Chicago, Mr. Powell said that the US Central Bank will be cautious about cutting interest rates. The Fed Chairman emphasized that he will wait for clearer signs, especially the impact of policy changes on issues such as immigration, regulation, and tariffs before making a decision on interest rates.

Mr. Powell stressed that President Trump's tariff policies were "significantly larger than anticipated." He also noted: "The same could be said for the economic impacts, including higher inflation and slower growth."

|

| World gold price anchored above 3,300 USD/ounce. Photo: Kitco |

The world's most powerful central banker also warned that inflation from tariffs could be temporary but "could also be more persistent." According to the FedWatch tool, these statements reduced the probability of a rate cut at the May meeting from 14.7% yesterday to 13.2% today.

After the recent strong increase, many opinions predict that the price of the yellow metal may be adjusted in the short term. This is considered completely normal and good for the market. However, the latest statement by Chairman Powell certainly increases the uncertainty related to the administration's tariff policy and its impact on inflation and economic growth. Therefore, if the Fed is more hawkish in its monetary policy, it will have a negative impact on the price of gold in the coming weeks.

With the domestic gold bar price increasing sharply and the world gold price listed at Kitco at 3,329 USD/ounce (equivalent to about 104.6 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between domestic and world gold prices is about 15.4 million VND/tael.

TRAN HO HOAI

* Please visit the Economics section to see related news and articles .

Source: https://baodaknong.vn/gia-vang-hom-nay-19-4-tang-chua-co-dau-hieu-dung-249886.html

![[Photo] The moment Harry Kane lifted the Bundesliga trophy for the first time](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/68e4a433c079457b9e84dd4b9fa694fe)

Comment (0)