Domestic gold price today April 17, 2025

At the time of survey at 4:30 a.m. on April 17, 2025, domestic gold prices increased dramatically to a new peak, and if the increase continues this week, it is forecasted to reach 120 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 113-115.5 million VND/tael (buy - sell), an increase of 7.5 million VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 113-115.5 million VND/tael (buy - sell), an increase of 7.5 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 113.5-116.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 7 million VND/tael for buying and 8 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 112.5-115.5 million VND/tael (buying - selling, up 7 million VND/tael in buying direction - up 7.5 million VND/tael in selling direction compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 111-114 million VND/tael (buy - sell), gold price increased by 6.2 million VND/tael in buying direction - increased by 6 million VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 110.5-113.5 million VND/tael (buy - sell); an increase of 7.3 million VND/tael in buying - an increase of 7 million VND/tael in selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 112-115 million VND/tael (buy - sell); an increase of 7.9 million VND/tael for buying - an increase of 8 million VND/tael for selling compared to yesterday.

The latest gold price list today, April 17, 2025 is as follows:

| Gold price today | April 17, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 113 | 115.5 | +7500 | +7500 |

| DOJI Group | 113 | 115.5 | +7500 | +7500 |

| Red Eyelashes | 113.5 | 116.5 | +7000 | +8000 |

| PNJ | 113 | 115.5 | +7500 | +7500 |

| Vietinbank Gold | 115.5 | +7500 | ||

| Bao Tin Minh Chau | 112.5 | 115.5 | +7000 | +7500 |

| Phu Quy | 111 | 114 | +6200 | +6000 |

| 1. DOJI - Updated: April 17, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 113,000 ▲7500K | 115,500 ▲7500K |

| AVPL/SJC HCM | 113,000 ▲7500K | 115,500 ▲7500K |

| AVPL/SJC DN | 113,000 ▲7500K | 115,500 ▲7500K |

| Raw material 9999 - HN | 110,300 ▲7300K | 112,600 ▲7000K |

| Raw material 999 - HN | 110,200 ▲7300K | 112,500 ▲7000K |

| 2. PNJ - Updated: April 17, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| HCMC - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Hanoi - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Hanoi - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Da Nang - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Da Nang - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Western Region - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Western Region - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Jewelry gold price - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Jewelry gold price - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Jewelry gold price - Southeast | PNJ | 110,500 ▲7700K |

| Jewelry gold price - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 110,500 ▲7700K |

| Jewelry gold price - Kim Bao Gold 999.9 | 110,500 ▲7700K | 113,600 ▲7600K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 110,500 ▲7700K | 113,600 ▲7600K |

| Jewelry gold price - Jewelry gold 999.9 | 110,500 ▲7700K | 113,000 ▲7700K |

| Jewelry gold price - Jewelry gold 999 | 110,390 ▲7690K | 112,890 ▲7690K |

| Jewelry gold price - Jewelry gold 9920 | 109,700 ▲7640K | 112,200 ▲7640K |

| Jewelry gold price - Jewelry gold 99 | 109,470 ▲7620K | 111,970 ▲7620K |

| Jewelry gold price - 750 gold (18K) | 82,400 ▲5770K | 84,900 ▲5770K |

| Jewelry gold price - 585 gold (14K) | 63,760 ▲4510K | 66,260 ▲4510K |

| Jewelry gold price - 416 gold (10K) | 44,660 ▲3200K | 47,160 ▲3200K |

| Jewelry gold price - 916 gold (22K) | 101,110 ▲7050K | 103,610 ▲7050K |

| Jewelry gold price - 610 gold (14.6K) | 66,580 ▲4700K | 69,080 ▲4700K |

| Jewelry gold price - 650 gold (15.6K) | 71,100 ▲5000K | 73,600 ▲5000K |

| Jewelry gold price - 680 gold (16.3K) | 74,490 ▲5240K | 76,990 ▲5240K |

| Jewelry gold price - 375 gold (9K) | 40,030 ▲2890K | 42,530 ▲2890K |

| Jewelry gold price - 333 gold (8K) | 34,940 ▲2540K | 37,440 ▲2540K |

| 3. SJC - Updated: April 17, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 113,000 ▲7500K | 115,500 ▲7500K |

| SJC gold 5 chi | 113,000 ▲7500K | 115,520 ▲7500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 113,000 ▲7500K | 115,530 ▲7500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 110,500 ▲7500K | 113,500 ▲7500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 110,500 ▲7500K | 113,600 ▲7500K |

| Jewelry 99.99% | 110,500 ▲7500K | 112,900 ▲7400K |

| Jewelry 99% | 107,282 ▲6626K | 111,782 ▲7326K |

| Jewelry 68% | 71,929 ▲3832K | 76,929 ▲5032K |

| Jewelry 41.7% | 42,234 ▲1886K | 47,234 ▲3086K |

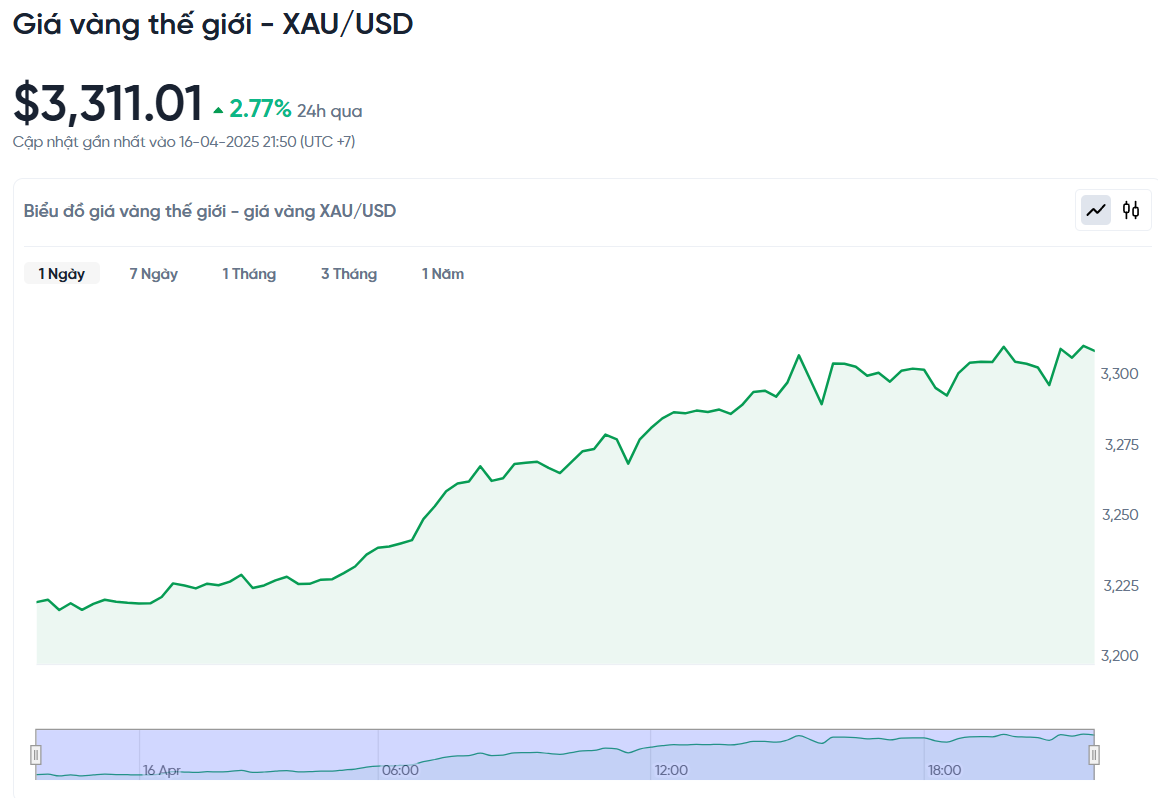

World gold price today April 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,311.01 USD/ounce. Today's gold price increased by 89.12 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,010 VND/USD), the world gold price is about 104.87 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.63 million VND/tael higher than the international gold price.

The world gold price increased sharply to an all-time high, surpassing the threshold of 3,300 USD/ounce thanks to the weakening USD and the US-China trade tension causing investors to rush into safe assets. Specifically, the spot gold price increased by 2.77%, the gold futures price in the US also increased by 2.7%, to 3,326.4 USD.

According to Lukman Otunuga, senior analyst at FXTM, gold is strongly supported by a weaker US dollar, tariff uncertainty and global recession fears. "After surpassing $3,300, market sentiment will determine the next leg up. Speculators may target $3,400, $3,500 or higher. However, if there is positive news on the US-China trade front or profit-taking, gold prices could fall sharply," he said.

Trade tensions escalated after US President Donald Trump ordered an investigation into the possibility of imposing tariffs on all imports of strategic minerals, in an effort to put pressure on China. This move further destabilized global financial markets, driving money into gold.

In addition, the US dollar continued to weaken against other currencies, hovering around a three-year low, making gold more attractive to foreign investors. Since the beginning of the year, gold prices have increased by nearly $700, thanks to factors such as the tariff war, expectations of a Fed rate cut and strong demand from central banks.

However, Ole Hansen, head of commodity strategy at Saxo Bank, warned: "The current rally is a bit overheated and vulnerable to a correction. However, over the past year, every decline has been short-lived, as there has always been buying pressure on dips."

Not only tax policy, the US Federal Reserve (Fed) is expected to cut interest rates soon, which is also contributing to the increase in gold prices. Low interest rates make other investment channels less attractive, while gold becomes more attractive in the eyes of investors.

The inflow of money into gold ETFs is also increasing strongly again. In the first quarter of 2025, these funds attracted 226.5 tons of gold equivalent to 21.1 billion USD, the highest level since the beginning of 2022, when the world was shaken by the war in Ukraine. This shows that individual and institutional investors are increasing their gold reserves as a risk-hedging measure.

In other precious metals markets, silver prices rose 2.2% to $33.01 an ounce, platinum prices rose 0.5% to $963.76, while palladium prices fell slightly 0.4% to $968.04.

Gold Price Forecast

In this context, analysts believe that the next target for gold will be $3,500/ounce, and this price may not be too far away if the instability continues. Since the beginning of the year, gold has set 25 new historical peaks, of which 13 peaks are above the $3,000 mark, a number that shows the sustainable strength of this upward trend.

Mike McGlone believes that gold's move above $3,200 an ounce could be just the start of a stronger bull run, with a further target of $4,000 an ounce. Currently, $3,000 is considered a base level, and reaching $4,000 is just a matter of time.

Sharing a positive view, Goldman Sachs has just raised its year-end gold price forecast to $3,700/ounce and does not rule out the possibility that the price will jump to $3,900 if the economy falls into recession.

The bank even expects gold to reach $4,000 an ounce by mid-2026. According to them, gold demand from central banks is growing much stronger than initially expected, amid recession risks and geopolitical tensions still looming globally.

In this situation, many experts believe that the upward trend of gold prices will continue in the coming time. Domestic gold prices are also forecast to fluctuate in an upward trend, remaining at a high level due to the influence of international developments.

ANZ Bank has also adjusted its forecast, raising its year-end gold price expectation to $3,600 an ounce, with a short-term target of $3,500 in six months. They believe that demand for gold as a hedge against risk will increase in the coming time.

Jim Wyckoff, an expert at Kitco Metals, said investors are now waiting for major economic signals that could give gold a boost. Although there has been no new breakthrough news, the technical trend is still supporting the upside.

Today, the US is expected to release a series of important economic data such as weekly mortgage applications (MBA), retail sales, industrial production, NAHB housing confidence index, manufacturing and trade inventories, international capital flows and liquid energy inventories from the US Department of Energy (DOE). These data may have further impact on gold price movements in the coming sessions.

Source: https://baonghean.vn/gia-vang-hom-nay-17-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-soc-co-the-len-120-trieu-dong-10295277.html

![[Photo] Magical moment of double five-colored clouds on Ba Den mountain on the day of the Buddha's relic procession](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/7a710556965c413397f9e38ac9708d2f)

![[Photo] General Secretary To Lam and international leaders attend the parade celebrating the 80th anniversary of the victory over fascism in Russia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/4ec77ed7629a45c79d6e8aa952f20dd3)

![[Photo] Russian military power on display at parade celebrating 80 years of victory over fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/ce054c3a71b74b1da3be310973aebcfd)

![[Photo] Prime Minister Pham Minh Chinh chairs a special Government meeting on the arrangement of administrative units at all levels.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/9/6a22e6a997424870abfb39817bb9bb6c)

Comment (0)