Domestic gold price today

Entering the new trading week, the price of gold bars continues to increase sharply. Currently, gold brands are buying at 105 million VND/tael and selling at 107.5 million VND/tael. Particularly, Phu Quy SJC gold is buying at 1 million VND lower than other brands.

Similarly, the price of gold rings of various brands was also adjusted up. Specifically, the price of SJC 9999 gold rings increased by 600,000 VND for buying price and 100,000 VND for selling price to 102 million VND/tael and 105 million VND/tael, respectively.

|

| Domestic gold prices increase "skyrocketingly". Photo: thanhnien.vn |

DOJI in Hanoi and Ho Chi Minh City markets adjusted the price of gold rings up by 800,000 VND for buying and 200,000 VND for selling to 102 million VND/tael and 105 million VND/tael.

The listed price of PNJ brand gold rings is 102 million VND/tael for buying and 105.1 million VND/tael for selling, an increase of 800,000 VND for buying price and 200,000 VND for selling price.

Bao Tin Minh Chau listed the price of plain round gold rings at 102.6 million VND/tael for buying and 106.2 million VND/tael for selling, an increase of 1 million VND for buying and 1.1 million VND for selling compared to early yesterday morning.

Phu Quy SJC is buying gold rings at 102.3 million VND/tael and selling at 105.6 million VND/tael, up 600,000 VND and 700,000 VND respectively.

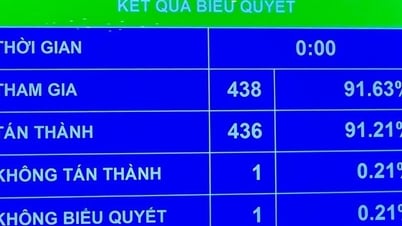

Domestic gold bar prices updated at 5:30 a.m. April 15 as follows:

Yellow | Area | Early morning April 14 | Early morning April 15 | Difference | ||||||

Buy | Sell | Buy | Sell | Buy | Sell | |||||

Unit of measure: Million VND/tael | Unit of measure: Thousand dong/tael | |||||||||

DOJI | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | ||||

Ho Chi Minh City | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | ||||

SJC | Ho Chi Minh City | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | |||

Hanoi | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | ||||

Danang | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | ||||

PNJ | Ho Chi Minh City | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | |||

Hanoi | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | ||||

Bao Tin Minh Chau | Nationwide | 103 | 106.5 | 105 | 107.5 | +2000 | +1000 | |||

Phu Quy SJC | Nationwide | 102.5 | 106.5 | 104 | 107.5 | +1500 | +1000 | |||

World gold price today

World gold prices fell, with spot gold down $27 to $3,211 an ounce. Gold futures last traded at $3,226 an ounce, down $18.3 from early this morning.

Gold prices fell, retreating from a record high hit earlier in the session, as risk appetite improved after the White House excluded smartphones, computers and some other electronics from a list of items subject to high import tariffs.

While some risk-off trades have caused gold to slide from recent highs, the current environment remains positive for gold, according to TD Securities head of commodity strategy Bart Melek.

Entering the new week, investors' willingness to take risks in global financial markets became more positive after the US government announced that some electronic items such as smartphones and computers would be exempted from tariffs in the reciprocal tariff package of US President Donald Trump.

Some positive signs related to tariffs have made investors less nervous and move to other assets instead of looking to gold for shelter, according to Peter Grant, vice president and senior metals strategist at Zaner Metals.

“However, ongoing uncertainty around trade and tariffs, a weak US dollar and falling yields tend to support gold,” Grant stressed.

Currently, the US Dollar Index is at a three-year low, making gold more attractive to foreign investors.

Meanwhile, investor sentiment remained high as last Sunday, President Trump said he would announce tariffs on imported semiconductors next week.

The US-China trade war has shaken global markets and sent investors flocking to the yellow metal, which is seen as a hedge against geopolitical and economic uncertainty.

|

| World gold prices turn down. Photo: Getty Images |

In the current context, Goldman Sachs remains optimistic about gold, raising its year-end gold price forecast to $3,700/ounce, citing stronger-than-expected central bank demand and rising recession risks impacting capital flows into gold-backed exchange-traded funds.

Recent data from the World Gold Council shows that investment flows into exchange-traded funds increased sharply in March in many regions around the world.

With the domestic gold bar price increasing sharply and the world gold price listed at Kitco at 3,211 USD/ounce (equivalent to about 100.6 million VND/tael converted according to Vietcombank exchange rate, excluding taxes and fees), the difference between domestic and world gold prices is about 6.9 million VND/tael.

TRAN HO HOAI

* Please visit the Economics section to see related news and articles .

Source: https://baodaknong.vn/gia-vang-hom-nay-15-4-the-gioi-giam-trong-nuoc-tang-249380.html

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

Comment (0)