Domestic gold price today April 15, 2025

At the time of the survey at 4:30 a.m. on April 15, 2025, domestic gold prices were rising to a record high, but today it is forecast to turn around and decrease slightly following world gold prices. Specifically:

DOJI Group listed the price of SJC gold bars at 105-107.5 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and 1 million VND/tael for selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 105-107.5 million VND/tael (buy - sell), an increase of 2 million VND/tael for buying and 1 million VND/tael for selling compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 105.7-107.5 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 1.7 million VND/tael for buying and 2 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 105-107.5 million VND/tael (buying - selling, up 2 million VND/tael for buying - up 1 million VND/tael for selling compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 104-107.5 million VND/tael (buy - sell), gold price increased by 1.5 million VND/tael for buying - increased by 1 million VND/tael for selling compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 102-105 million VND/tael (buy - sell); an increase of 800 thousand VND/tael in buying - an increase of 200 thousand VND/tael in selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 102.6-106.2 million VND/tael (buy - sell); increased 1 million VND/tael for buying - increased 1.1 million VND/tael for selling compared to yesterday.

The latest gold price list today, April 15, 2025 is as follows:

| Gold price today | April 14, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 105 | 107.5 | +2000 | +1000 |

| DOJI Group | 105 | 107.5 | +2000 | +1000 |

| Red Eyelashes | 105.7 | 107.5 | +1700 | +2000 |

| PNJ | 105 | 107.5 | +2000 | +1000 |

| Vietinbank Gold | 107.5 | +1000 | ||

| Bao Tin Minh Chau | 105 | 107.5 | +2000 | +1000 |

| Phu Quy | 104 | 107.5 | +1500 | +1000 |

| 1. DOJI - Updated: April 15, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 105,000 ▲2000K | 107,500 ▲1000K |

| AVPL/SJC HCM | 105,000 ▲2000K | 107,500 ▲1000K |

| AVPL/SJC DN | 105,000 ▲2000K | 107,500 ▲1000K |

| Raw material 9999 - HN | 101,800 ▲800K | 104,100 ▲200K |

| Raw material 999 - HN | 101,700 ▲800K | 104,000 ▲200K |

| 2. PNJ - Updated: April 15, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 102,000 ▲800K | 105,100 ▲200K |

| HCMC - SJC | 105,000 ▲2000K | 107,500 ▲1000K |

| Hanoi - PNJ | 102,000 ▲800K | 105,100 ▲200K |

| Hanoi - SJC | 105,000 ▲2000K | 107,500 ▲1000K |

| Da Nang - PNJ | 102,000 ▲800K | 105,100 ▲200K |

| Da Nang - SJC | 105,000 ▲2000K | 107,500 ▲1000K |

| Western Region - PNJ | 102,000 ▲800K | 105,100 ▲200K |

| Western Region - SJC | 105,000 ▲2000K | 107,500 ▲1000K |

| Jewelry gold price - PNJ | 102,000 ▲800K | 105,100 ▲200K |

| Jewelry gold price - SJC | 105,000 ▲2000K | 107,500 ▲1000K |

| Jewelry gold price - Southeast | PNJ | 102,000 ▲800K |

| Jewelry gold price - SJC | 105,000 ▲2000K | 107,500 ▲1000K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 102,000 ▲800K |

| Jewelry gold price - Kim Bao Gold 999.9 | 102,000 ▲800K | 105,100 ▲200K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 102,000 ▲800K | 105,100 ▲200K |

| Jewelry gold price - Jewelry gold 999.9 | 102,000 ▲800K | 104,500 ▲800K |

| Jewelry gold price - Jewelry gold 999 | 101,900 ▲800K | 104,400 ▲800K |

| Jewelry gold price - Jewelry gold 9920 | 101,260 ▲790K | 103,760 ▲790K |

| Jewelry gold price - Jewelry gold 99 | 101,060 ▲800K | 103,560 ▲800K |

| Jewelry gold price - 750 gold (18K) | 76,030 ▲600K | 78,530 ▲600K |

| Jewelry gold price - 585 gold (14K) | 58,780 ▲460K | 61,280 ▲460K |

| Jewelry gold price - 416 gold (10K) | 41,120 ▲330K | 43,620 ▲330K |

| Jewelry gold price - 916 gold (22K) | 93,320 ▲730K | 95,820 ▲730K |

| Jewelry gold price - 610 gold (14.6K) | 61,400 ▲490K | 63,900 ▲490K |

| Jewelry gold price - 650 gold (15.6K) | 65,580 ▲520K | 68,080 ▲520K |

| Jewelry gold price - 680 gold (16.3K) | 68,710 ▲540K | 71,210 ▲540K |

| Jewelry gold price - 375 gold (9K) | 36,840 ▲300K | 39,340 ▲300K |

| Jewelry gold price - 333 gold (8K) | 32,140 ▲270K | 34,640 ▲270K |

| 3. SJC - Updated: April 15, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 105,000 ▲2000K | 107,500 ▲1000K |

| SJC gold 5 chi | 105,000 ▲2000K | 107,520 ▲1000K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 105,000 ▲2000K | 107,530 ▲1000K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 102,000 ▲600K | 105,000 ▲100K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 102,000 ▲600K | 105,100 ▲100K |

| Jewelry 99.99% | 102,000 ▲600K | 104,500 ▲100K |

| Jewelry 99% | 99,665 ▲99K | 103,465 ▲99K |

| Jewelry 68% | 67,417 ▲68K | 71,217 ▲68K |

| Jewelry 41.7% | 39,930 ▲41K | 43,730 ▲41K |

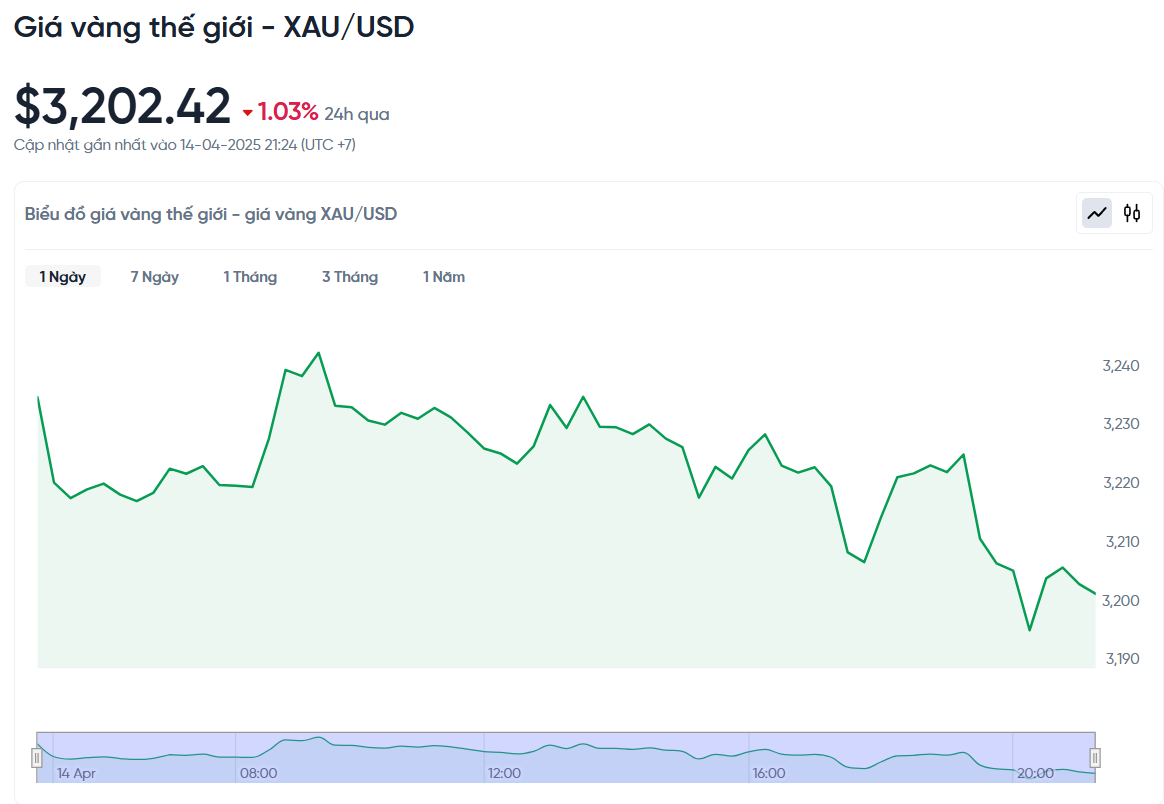

World gold price today April 15, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 6:00 p.m. today, Vietnam time, was 3,202.42 USD/ounce. Today's gold price decreased by 33.49 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,000 VND/USD), the world gold price is about 101.41 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 6.09 million VND/tael higher than the international gold price.

World gold prices fell more than 1% after hitting a record high. The main reason came from the more optimistic market sentiment after the White House decided to exempt some electronic products imported from China, including phones and computers.

Specifically, the spot gold price decreased by 1.03%, while the gold futures price in the US also decreased by 0.9%, down to 3,215.70 USD/ounce. Despite the price adjustment, many experts still believe that the current environment is still favorable for gold to continue to be popular.

Bart Melek, an expert at TD Securities, said that the US exemption from tariffs on some technology products has somewhat cooled down trade tensions, making gold less attractive as a safe haven. However, factors such as a weak US dollar and low bond yields continue to support gold prices.

However, trade uncertainties, a weak US dollar and low bond yields continue to support gold prices. The US dollar is currently at a three-year low against other currencies, making gold more attractive because it is often purchased in US dollars.

The recovery in global stock markets is also a factor that makes it difficult for gold prices to increase further. Stocks in Asia and Europe recorded gains in the latest session, but the risk-off sentiment in the market is still present.

Global gold demand is currently likened to a three-legged stool, consisting of investment demand, central bank purchases, and consumer demand in major markets such as China and India. Of these three factors, only demand in India is showing signs of slowing down, the rest are supporting gold prices.

The Trump administration’s trade policies are having a major impact on all three of these pillars, so while gold is a traditional safe haven, it is still experiencing the same volatility as other risk assets.

In other precious metals, silver fell 1.1% to $31.91 an ounce. Platinum edged up 0.5% to $947.05 and palladium rose 3.4% to $946.36 an ounce.

Gold Price Forecast

The gold market is showing a clear short-term bullish bias. The June gold futures contract is now heavily biased towards the bulls, with the next target being a close above the strong resistance level at $3,300/ounce.

Meanwhile, the bears are still trying to push the price below the important support level of $3,100. Notable technical levels now include the nearest resistance level of $3,263, followed by $3,275; while the support level is $3,221.10, followed by $3,200.

Goldman Sachs has just raised its year-end gold price forecast to $3,700 an ounce, from $3,300 as before. The main reason is the strong increase in gold purchases from central banks and the wave of recession fears causing strong money flows into gold ETFs.

According to Goldman Sachs, central banks are buying an average of 80 tons of gold per month, far exceeding the previous forecast of 70 tons and many times higher than the average of only 17 tons/month before 2022. At the same time, capital flows into gold ETFs are also increasing rapidly as investors seek safe havens, especially when the probability of the US falling into recession in the next 12 months is forecast at 45%.

In the medium-term scenario, if central bank purchases continue at 100 tonnes/month, gold prices could reach $3,810 by the end of 2025. If the US economy falls into recession, ETF inflows could surge as they did during the pandemic, pushing gold prices to $3,880.

However, if the economic recovery is more stable than expected and the uncertainties are controlled, the gold price may stop at $3,550 as money flows back to other investment channels. However, the general trend is still inclined towards the possibility of gold prices continuing to increase.

Gold prices may have some short-term corrections after the sharp rise, but this does not change the overall uptrend, said Rich Checkan, president and COO of Asset Strategies International. He said gold currently has a clear momentum advantage.

Daniel Pavilonis of RJO Futures said the recent rise in gold has been largely driven by the US bond market. Rising concerns have pushed gold to the top of the list after the US-China tit-for-tat tariffs took effect on April 2. He also warned that if long-term bond yields fall sharply, gold could correct in the short term, but the long-term uptrend remains solid.

Source: https://baonghean.vn/gia-vang-hom-nay-15-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-len-ky-luc-moi-nhung-du-bao-quay-dau-giam-nhe-10295121.html

![[Photo] Prime Minister Pham Minh Chinh receives Country Director of the World Bank Regional Office for Vietnam, Laos, Cambodia](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/2c7898852fa74a67a7d39e601e287d48)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Thai Prime Minister Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/15/e71160b1572a457395f2816d84a18b45)

Comment (0)