- Update gold price today 4/10/2025 latest in domestic market

- Update gold price today April 10, 2025 latest on the world market

- News, gold price trends today April 10, 2025 domestic and world gold prices

Update gold price today 4/10/2025 latest in domestic market

At the time of survey at 10:30 on April 10, 2025, domestic gold prices recorded a strong increase, reaching a new peak with an increase of up to 2 million VND/tael. Specifically:

DOJI Group listed the price of SJC gold bars at 100.9-103.9 million VND/tael (buy - sell); an increase of 1.2 million VND/tael for buying and 2 million VND/tael for selling compared to yesterday. The difference between buying and selling prices is 3 million VND/tael.

At the same time, the price of SJC gold bars at SJC Hanoi was listed at 100.9-103.9 million VND/tael (buy - sell); an increase of 1.2 million VND/tael for buying and 2 million VND/tael for selling compared to the previous day. The difference between buying and selling prices reached 3 million VND/tael.

The price of SJC gold bars at Bao Tin Minh Chau Company Limited is listed at 100.9-103.9 million VND/tael (buy - sell); an increase of 1.1 million VND/tael for buying and 2 million VND/tael for selling compared to yesterday. The difference between buying and selling prices is 3 million VND/tael.

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 100.4-103.4 million VND/tael (buy - sell); an increase of 700 thousand VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 100.5-103.5 million VND/tael (buy - sell); an increase of 600 thousand VND/tael for buying and an increase of 1.5 million VND/tael for selling compared to early this morning. The difference between buying and selling prices is at 3 million VND/tael.

The latest gold price update table today, April 10, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 100.9 | ▲1200 | 103.9 | ▲2000 |

| DOJI Group | 100.9 | ▲1200 | 103.9 | ▲2000 |

| Red Eyelashes | 101.2 | ▲1200 | 103.2 | ▲1300 |

| PNJ | 99.8 | ▲300 | 101.9 | - |

| Vietinbank Gold | 103.9 | ▲2000 | ||

| Bao Tin Minh Chau | 100.9 | ▲1100 | 103.9 | ▲2000 |

| Phu Quy | 100.6 | ▲1700 | 103.9 | ▲2000 |

| 1. DOJI - Updated: April 10, 2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 100,900 ▲1200 | 103,900 ▲2000 |

| AVPL/SJC HCM | 100,900 ▲1200 | 103,900 ▲2000 |

| AVPL/SJC DN | 100,900 ▲1200 | 103,900 ▲2000 |

| Raw material 9999 - HN | 99,500 ▲2000 | 101,000 ▲1700 |

| Raw material 999 - HN | 99,400 ▲2000 | 100,900 ▲1700 |

| 2. PNJ - Updated: April 10, 2025 10:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,800 ▲300K | 101,900 |

| HCMC - SJC | 100,900 ▲1200K | 103,900 ▲2000K |

| Hanoi - PNJ | 99,800 ▲300K | 101,900 |

| Hanoi - SJC | 100,900 ▲1200K | 103,900 ▲2000K |

| Da Nang - PNJ | 99,800 ▲300K | 101,900 |

| Da Nang - SJC | 100,900 ▲1200K | 103,900 ▲2000K |

| Western Region - PNJ | 99,800 ▲300K | 101,900 |

| Western Region - SJC | 100,900 ▲1200K | 103,900 ▲2000K |

| Jewelry gold price - PNJ | 99,800 ▲300K | 101,900 |

| Jewelry gold price - SJC | 100,900 ▲1200K | 103,900 ▲2000K |

| Jewelry gold price - Southeast | 99,800 ▲300K | 101,900 |

| Jewelry gold price - Jewelry gold 999.9 | 99,400 ▲100K | 101,900 ▲100K |

| Jewelry gold price - Jewelry gold 999 | 99,300 ▲100K | 101,800 ▲100K |

| Jewelry gold price - 750 gold (18K) | 74,080 ▲80K | 76,580 ▲80K |

| Jewelry gold price - 585 gold (14K) | 57,260 ▲60K | 59,760 ▲60K |

| Jewelry gold price - 416 gold (10K) | 40,040 ▲40K | 42,540 ▲40K |

| 3. SJC - Updated: 10/04/2025 10:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 100,900 ▲1200 | 103,900 ▲2000 |

| SJC gold 5 chi | 100,900 ▲1200 | 103,920 ▲2000 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 100,900 ▲1200 | 103,930 ▲2000 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 100,300 ▲800 | 103,300 ▲1600 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 100,300 ▲800 | 103,400 ▲1600 |

| Jewelry 99.99% | 100,300 ▲800 | 103,000 ▲1600 |

| Jewelry 99% | 98,980 ▲1584 | 101,980 ▲1584 |

| Jewelry 68% | 67,108 ▲1088 | 70,197 ▲1088 |

| Jewelry 41.7% | 40,105 ▲667 | 43,105 ▲667 |

Update gold price today April 10, 2025 latest on the world market

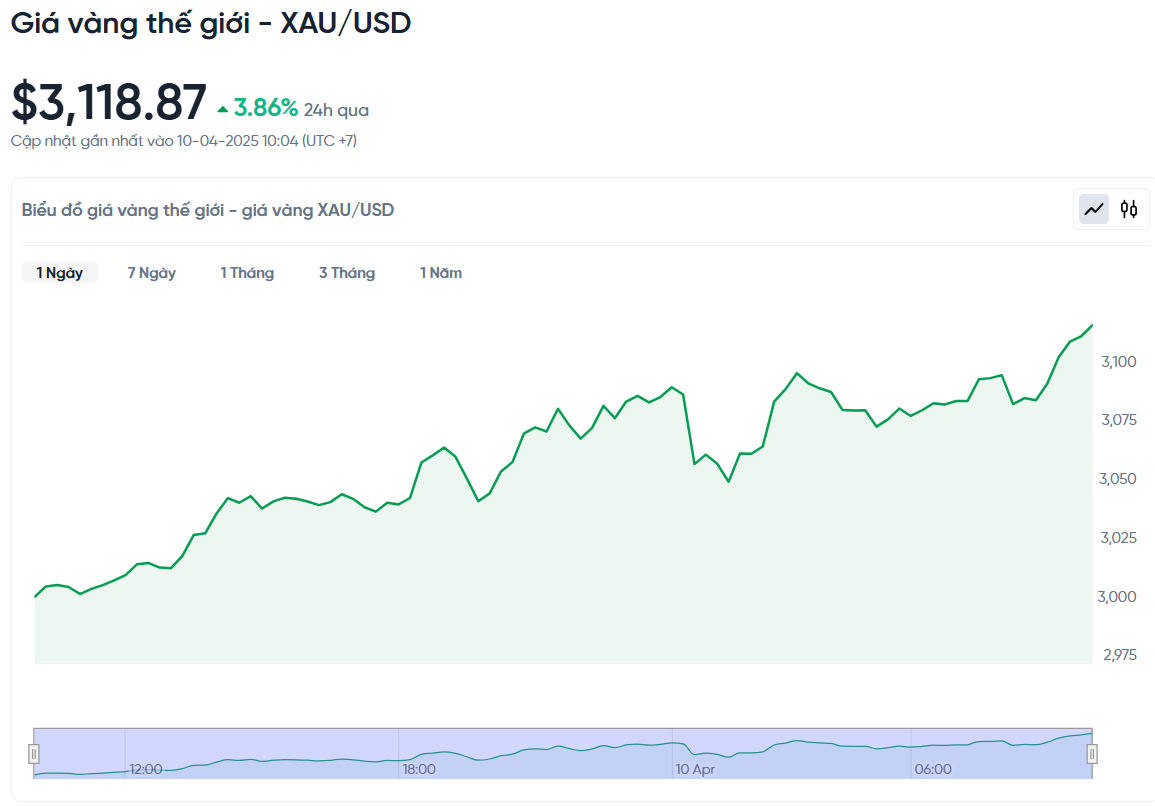

At the time of trading at 10:00 a.m. on April 10, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,118.87 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 98.67 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (100.9-103.9 million VND/tael), the SJC gold price is currently about 5.2 million higher than the international gold price.

Global financial markets were rocked on April 10 after US President Donald Trump announced a temporary rollback of the heavy tariffs he had imposed on a number of countries. The global stock market had already plummeted, wiping out trillions of dollars and shaking US government bonds and the dollar. But on Wednesday, Trump unexpectedly announced a 90-day pause on many new tariffs. The decision sent major stocks on Wall Street, especially the “Magnificent Seven,” soaring, adding more than $1.5 trillion in market value overnight. Major indexes such as the S&P 500 and Nasdaq also recorded their biggest daily percentage gains in more than a decade.

But by Thursday, markets were showing signs of slowing down. Nasdaq futures were down 0.7%, while S&P 500 futures were down 0.3%, suggesting investors were still not entirely reassured. The US dollar, which had risen sharply against the Japanese yen and Swiss franc the day before, lost some of its value in Asia on Thursday, reflecting uncertainty about longer-term forecasts, especially as the trade war between the US and China shows no signs of abating. Khoon Goh, an expert at ANZ Bank, said the initial market reaction was just a temporary recovery from the sell-off. Now that things have calmed down, investors are trying to figure out where to go next.

In Asia, news of the tariff delay was still received positively. Japan’s Nikkei index rose as much as 8%, while European futures also rallied. The EUROSTOXX 50 and DAX, for example, both rose around 8%, while the FTSE rose 5.5%. Still, Mr. Trump’s decision is not a complete retreat. The White House said that the general 10% tariff on most imports into the US would remain in place, and that existing tariffs on cars, steel, and aluminum would not be affected. In particular, Mr. Trump put pressure on China, announcing a tariff increase on its goods from 104% to 125%. In response, China raised tariffs on US products to 84% and restricted 18 US companies, mainly in the defense sector.

Despite the escalating trade pressure, Chinese stocks rallied on Thursday. The CSI300 Index rose 1.6%, while Hong Kong’s Hang Seng jumped 3.3%. At least global trade won’t come to a complete standstill, said Wong Kok Hoong of Maybank. Companies now have 90 days under the 10% tariff to adjust their supply chains and find alternatives. But the yuan told a different story, falling to its lowest level since December 2007 at 7.3518 per dollar. The People’s Bank of China also set its reference rate at its lowest level since September 2023, indicating continued economic pressure.

In the bond market, this week's sharp sell-off eased on Thursday. The yield on the 10-year US Treasury note fell to 4.2889%, after hitting a high of 4.5150% earlier. Yields rise as investors sell bonds, which typically happens when they worry about inflation or economic uncertainty. Lawrence Gillum of LPL Financial explained that a number of factors are pushing yields higher, including persistent inflation, the Federal Reserve's cautious stance, and some foreign investors pulling back. The Fed also said it would not rush to cut interest rates, as higher tariffs could raise prices, even though Mr. Trump's trade policies threaten to slow economic growth.

Overall, the market is expecting the Fed to cut interest rates by about 80 basis points (0.8%) by the end of the year, less than the previous forecast of more than 100 basis points. This means that the cost of borrowing money – like when you borrow money from a bank to buy a house or a car – will not fall as quickly as many people expected. Against this backdrop, oil prices fell on concerns about US-China trade tensions, while gold – a safe-haven asset – rose slightly to $3,097.52 per ounce. All of this shows that global financial markets are still in a volatile and unpredictable period.

News, gold price trends today April 10, 2025 domestic and world gold prices

Gold prices are rising sharply as many seek it as a safe haven amid rising US bond yields due to concerns about bond market volatility. According to Kitco, gold futures for June delivery rose $115.90 to $3,106.10 an ounce, while silver futures for May delivery also rose $0.699 to $30.40 an ounce. This comes as US-China trade tensions escalate and the US bond market is at risk, causing investors to turn to gold.

Typically, U.S. bonds and gold compete for safe haven status. When bond yields are high, they tend to be more attractive. But if investors lose confidence in the U.S. bond market, gold becomes an alternative. SP Angel, a brokerage, said gold has also benefited from China’s strong buying. They also noted that when the Fed made an emergency 100 basis point rate cut in March 2020, gold prices rose about 30% for the rest of the year.

Trade tensions have also prompted China and Japan to sell off US bonds. A headline from Barron’s read: “Trump Tariffs Rock Bond Markets.” This sent the dollar index tumbling, Nymex crude oil prices to a four-year low of around $57 a barrel, while the 10-year US Treasury yield was at 4.38%. The market is worried about large hedge funds adjusting positions, partly because expectations of easing policies from the Trump administration have not materialized.

Technically, gold prices in June have the short-term advantage. Buyers are aiming for $3,201.60 an ounce, while sellers want to push prices below $2,970.40 an ounce. Experts predict that gold prices will continue to fluctuate strongly and may increase in the coming time, especially when geopolitical tensions, such as the risk of a US-Iran conflict in the Middle East, become more serious. Tehran's acceleration of its nuclear program has further increased concerns about the crisis.

A weaker US dollar on expectations that the Fed will soon cut interest rates is also supporting gold prices. If geopolitical tensions continue to heat up and the US dollar fails to recover, gold could surpass $3,100 an ounce, or even hit $3,150. However, if the Fed keeps interest rates high to control inflation, gold prices could fall. Conversely, if the economy declines or instability escalates, gold will rise sharply thanks to its role as a safe-haven asset. Investors are waiting for the US CPI report to better understand inflation and the next direction of the market.

Source: https://baoquangnam.vn/gia-vang-hom-nay-10-4-2025-moi-nhat-chinh-thuc-lap-ky-luc-moi-tien-sat-nut-104-trieu-3152448.html

![[Photo] Prime Minister Pham Minh Chinh and Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra attend the Vietnam-Thailand Business Forum 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/1cdfce54d25c48a68ae6fb9204f2171a)

![[Photo] President Luong Cuong receives Prime Minister of the Kingdom of Thailand Paetongtarn Shinawatra](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/16/52c73b27198a4e12bd6a903d1c218846)

Comment (0)