Domestic gold price today April 1, 2025

At the time of survey at 4:30 a.m. on April 1, 2025, domestic gold prices temporarily stood still at a high level, gold ring prices rose to nearly 101 million VND/tael, and gold bar prices exceeded 100 million VND. Specifically:

DOJI Group listed the price of SJC gold bars at 99.5-101.8 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for both buying and selling compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 99.5-101.8 million VND/tael (buy - sell), an increase of 1.1 million VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 99.3-101 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 900 thousand VND/tael for buying and 1.2 million VND/tael for selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 99.5-101.8 million VND/tael (buying - selling, up 1 million VND/tael for buying - up 1.1 million VND/tael for selling compared to yesterday.

SJC gold price in Phu Quy is traded by businesses at 99.2-101.8 million VND/tael (buy - sell), gold price increased by 800 thousand VND/tael for buying - increased by 1.1 million VND/tael for selling compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 99.2-101.7 million VND/tael (buy - sell); an increase of 800 thousand VND/tael for buying - an increase of 1 million VND/tael for selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 99.6-101.9 million VND/tael (buy - sell); increased 700 thousand VND/tael for buying - increased 1 million VND/tael for selling.

The latest gold price list today, April 1, 2025 is as follows:

| Gold price today | April 1, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 99.5 | 101.8 | +1100 | +1100 |

| DOJI Group | 99.5 | 101.8 | +1100 | +1100 |

| Red Eyelashes | 99.3 | 101 | +900 | +1200 |

| PNJ | 99.5 | 101.8 | +1100 | +1100 |

| Vietinbank Gold | 101.8 | +1100 | ||

| Bao Tin Minh Chau | 99.5 | 101.8 | +1000 | +1100 |

| Phu Quy | 99.2 | 101.8 | +800 | +1100 |

| 1. DOJI - Updated: April 1, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 99,500 ▲1100K | 101,800 ▲1100K |

| AVPL/SJC HCM | 99,500 ▲1100K | 101,800 ▲1100K |

| AVPL/SJC DN | 99,500 ▲1100K | 101,800 ▲1100K |

| Raw material 9999 - HN | 99,000 ▲600K | 100,800 ▲1100K |

| Raw material 999 - HN | 98,900 ▲600K | 100,700 ▲1100K |

| 2. PNJ - Updated: April 1, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,500 ▲1100K | 101,800 ▲1100K |

| HCMC - SJC | 99,500 ▲1100K | 101,800 ▲1100K |

| Hanoi - PNJ | 99,500 ▲1100K | 101,800 ▲1100K |

| Hanoi - SJC | 99,500 ▲1100K | 101,800 ▲1100K |

| Da Nang - PNJ | 99,500 ▲1100K | 101,800 ▲1100K |

| Da Nang - SJC | 99,500 ▲1100K | 101,800 ▲1100K |

| Western Region - PNJ | 99,500 ▲1100K | 101,800 ▲1100K |

| Western Region - SJC | 99,500 ▲1100K | 101,800 ▲1100K |

| Jewelry gold price - PNJ | 99,500 ▲1100K | 101,800 ▲1100K |

| Jewelry gold price - SJC | 99,500 ▲1100K | 101,800 ▲1100K |

| Jewelry gold price - Southeast | PNJ | 99,500 ▲1100K |

| Jewelry gold price - SJC | 99,500 ▲1100K | 101,800 ▲1100K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,500 ▲1100K |

| Jewelry gold price - Jewelry gold 999.9 | 99,200 ▲1100K | 101,700 ▲1100K |

| Jewelry gold price - Jewelry gold 999 | 99,100 ▲1100K | 101,600 ▲1100K |

| Jewelry gold price - Jewelry gold 99 | 98,280 ▲1090K | 100,780 ▲1090K |

| Jewelry gold price - 916 gold (22K) | 90,760 ▲1010K | 93,260 ▲1010K |

| Jewelry gold price - 750 gold (18K) | 73,930 ▲830K | 76,430 ▲830K |

| Jewelry gold price - 680 gold (16.3K) | 66,810 ▲750K | 69,310 ▲750K |

| Jewelry gold price - 650 gold (15.6K) | 63,760 ▲720K | 66,260 ▲720K |

| Jewelry gold price - 610 gold (14.6K) | 59,690 ▲670K | 62,190 ▲670K |

| Jewelry gold price - 585 gold (14K) | 57,150 ▲650K | 59,650 ▲650K |

| Jewelry gold price - 416 gold (10K) | 39,960 ▲460K | 42,460 ▲460K |

| Jewelry gold price - 375 gold (9K) | 35,790 ▲410K | 38,290 ▲410K |

| Jewelry gold price - 333 gold (8K) | 31,210 ▲360K | 33,710 ▲360K |

| 3. SJC - Updated: 4/1/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 99,500 ▲1100K | 101,800 ▲1100K |

| SJC gold 5 chi | 99,500 ▲1100K | 101,820 ▲1100K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 99,500 ▲1100K | 101,830 ▲1100K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 99,000 ▲800K | 101,200 ▲800K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 99,000 ▲800K | 101,300 ▲800K |

| Jewelry 99.99% | 99,000 ▲800K | 100,900 ▲800K |

| Jewelry 99% | 96,900 ▲791K | 99,900 ▲791K |

| Jewelry 68% | 65,768 ▲543K | 68,768 ▲543K |

| Jewelry 41.7% | 39,229 ▲333K | 42,229 ▲333K |

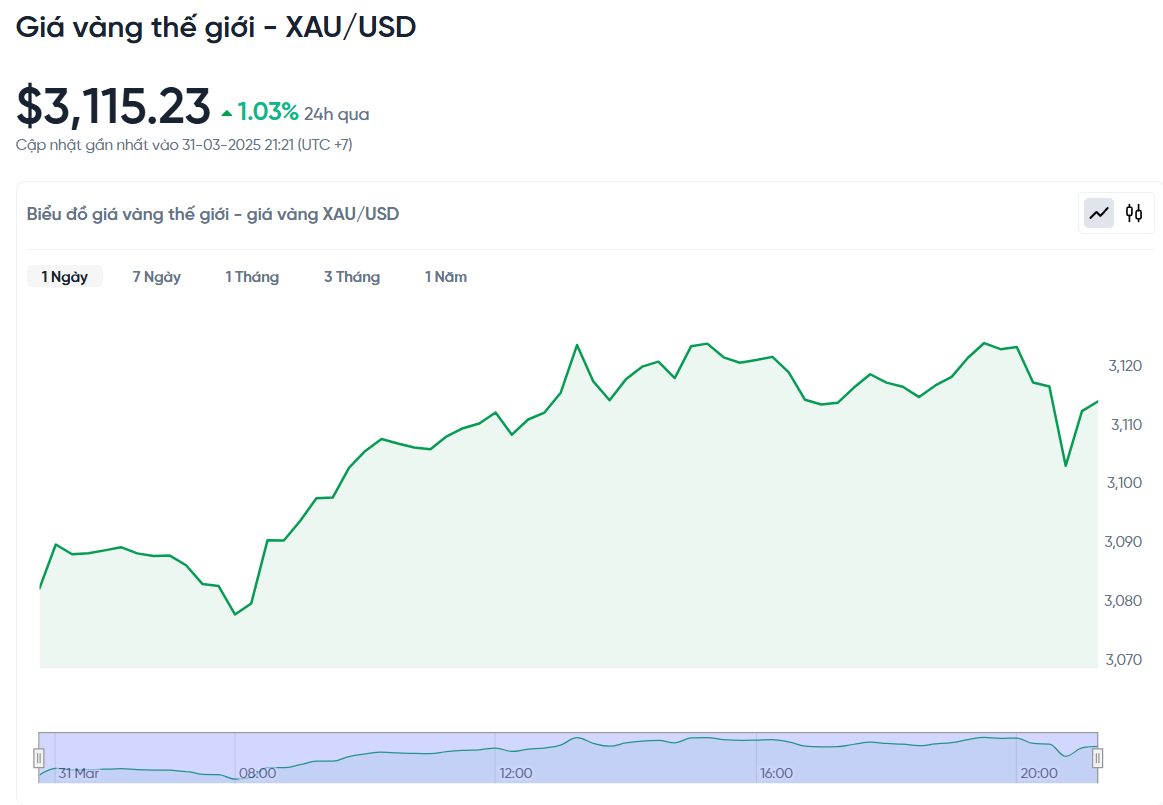

World gold price today April 1, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was 3,115.26 USD/ounce. Today's gold price increased by 31.84 USD/ounce compared to yesterday. Converted according to the USD exchange rate, on the free market (25,960 VND/USD), the world gold price is about 98.56 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 3.24 million VND/tael higher than the international gold price.

The world gold price continued to increase sharply, surpassing the threshold of 3,100 USD/ounce for the first time, setting a new record high. The main reason came from concerns about inflation due to the possibility of the US imposing import tariffs, causing many investors to rush to buy gold as a safe haven.

In the first quarter of 2024 alone, gold is experiencing its strongest increase since 1986. Specifically, the price of gold in the session reached a peak of 3,128.06 USD. Meanwhile, the price of gold futures for June delivery on the Comex floor reached an all-time high of 3,159.30 USD/ounce. This is the second consecutive year of strong gold growth, with an increase of about 18% since the beginning of 2024, after having increased by more than 27% in 2023.

Despite technical indicators showing the market is overbought, gold prices continue to rise, defying conventional wisdom. The rally reflects concerns about US tariffs, which could stifle economic growth and prompt investors to seek safe havens, according to Nitesh Shah of WisdomTree.

Since taking office, Mr. Trump has proposed a number of new tariffs aimed at protecting American industry and reducing the trade deficit, including a 25% tariff on imported cars and parts, and an additional 10% tariff on Chinese goods.

The tariff issue will continue to push gold prices higher until there is a definitive solution to the trade war, said Edward Meir, a consultant at Marex. In addition, strong demand from central banks and inflows into ETFs are also factors supporting gold's rise this year.

US President Donald Trump is expected to announce retaliatory tariffs on April 2, while import tariffs on cars will take effect on April 3. In light of this situation, many major financial institutions have adjusted their forecasts for gold prices to increase sharply.

Goldman Sachs raised its 2025 target to $3,300 an ounce and warned that in extreme market conditions, prices could exceed $4,200 or even $4,500 in the next 12 months. Bank of America also forecasts an average gold price of $3,063 in 2025 and $3,350 in 2026.

Gold could hit $3,500 by this time next year, Shah said, thanks to positive sentiment and lingering geopolitical risks. Another factor is tensions between the U.S. and Russia, with Trump vowing to impose 25-50% tariffs on Russian oil if Moscow interferes with efforts to end the war in Ukraine.

Besides gold, silver prices fell slightly by 0.4% to $33.96 an ounce, while platinum and palladium both rose by 0.8% to $991.55 and $979, respectively. All three precious metals recorded gains in March.

Gold Price Forecast

Alex Kuptsikevich, an analyst at FxPro, said that gold is still in a strong uptrend. He explained that the new tariff war has boosted demand for safe-haven assets such as gold. The weaker US dollar, combined with the decline in US stocks, has increased the appeal of gold.

Kuptsikevich predicts that gold prices will reach $3,180 in the next few weeks and could rise further to $3,400 an ounce by the end of this summer.

Technically, the trend in June gold futures remains very positive. Bulls have a clear advantage. The next target for buyers is to push prices up and close above the key resistance level at $3,200/ounce.

Conversely, if the price declines, the technical support level to watch is $3,031/ounce. Currently, the nearest resistance level is $3,124.40, followed by $3,150. The nearest support level is $3,096.30, followed by $3,075. Gold's market strength index is very high at 9.5 points (out of 10).

Jesse Colombo, an independent precious metals analyst, said he is watching the $100 price levels as key support and resistance levels in gold's trend.

According to him, gold prices peaked at $2,800 an ounce in late October last year. This level was broken in late January this year. By late February, gold prices returned to test the $2,800 level and quickly rebounded to $2,900, then surpassed $3,000 an ounce. Currently, $3,000 is acting as a new support level.

Colombo assessed that the current gold price trend is clearly bullish. He expects gold to close above $3,100/ounce in the coming time. However, if gold returns to test the $3,000 mark, there is no need to worry too much because this is a natural part of the upward trend.

Associate Professor, Dr. Nguyen Huu Huan commented that the gold price has increased too quickly, so the possibility of adjustment in the near future is very high. However, he said that the market has established a new price level, and it will be very difficult for gold to return to the previous price range of 70-80 million VND/tael.

Sharing the same view, Dr. Le Xuan Nghia said that the gold market often has a cycle of strong increases and then adjustments. However, he said that with the gold price exceeding 101 million VND/tael, the possibility of a deep drop back to the 70-80 million VND/tael range is very unlikely in the current context.

Source: https://baonghean.vn/gia-vang-hom-nay-1-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-len-ky-luc-moi-10294167.html

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] Discover the beautiful scenery of Wulingyuan in Zhangjiajie, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/1207318fb0b0467fb0f5ea4869da5517)

Comment (0)