LIVE UPDATE TABLE OF GOLD PRICE TODAY 6/19 AND EXCHANGE RATE TODAY 6/19

| 1. SJC - Updated: June 17, 2023 08:31 - Website supply time - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| SJC 1L, 10L | 66,500 | 67,100 |

| SJC 5c | 66,500 | 67,120 |

| SJC 2c, 1C, 5 phan | 66,500 | 67,130 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 55,600 | 56,550 |

| SJC 99.99 gold ring 0.5 chi | 55,600 | 56,650 |

| 99.99% Jewelry | 55,450 | 56,150 |

| 99% Jewelry | 54,394 | 55,594 |

| Jewelry 68% | 36,336 | 38,336 |

| Jewelry 41.7% | 21,567 | 23,567 |

World gold prices ended in neutral territory last week, after bouncing from a three-month low following the Fed's decision. Analysts said they do not expect to see any significant price fluctuations in the near future.

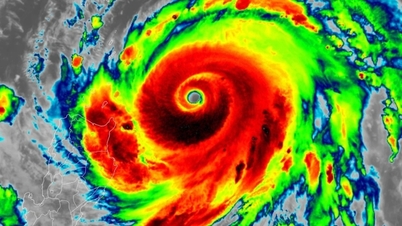

At the end of this week's trading session (June 16) on the Kitco floor, the gold price closed at 1,958.20 USD/ounce, a slight increase of 0.2 USD compared to the previous session, down about 0.4% compared to the closing price of last week .

The weekly Kitco News gold survey shows that both Wall Street analysts and retail investors are bearish on gold as the market continues to digest the latest monetary policy decision from the US Federal Reserve after it kept interest rates unchanged at its June rate hike but signaled the possibility of two more rate hikes later this year.

Ole Hansen, head of commodity strategy at Saxo Bank, said that gold's rebound ahead of the weekend shows there is strong buying interest in gold; however, the precious metal "lacks the fire" to trigger a more significant rally.

|

| Gold price today June 19, 2023: Gold price is still stuck below 2,000 USD, investors are disappointed, what is the gold price forecast for this week? (Source: Kitco) |

Domestic gold prices continued to fluctuate last week, not following the world market trend. SJC gold prices continued to increase for the third consecutive session last weekend and currently the closing price of the week is about 12 million VND/tael higher than the world gold price.

Summary of SJC gold prices at major domestic trading brands at the closing time of last weekend's trading session (June 16):

Saigon Jewelry Company listed SJC gold price at 66.55 - 67.17 million VND/tael.

Doji Group currently lists SJC gold price at: 66.55 - 67.15 million VND/tael.

Phu Quy Group listed at: 66.50 - 67.10 million VND/tael.

PNJ system listed at: 66.50 - 67.10 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 66.50 - 67.02 million VND/tael; Rong Thang Long gold brand is traded at 55.63 - 56.48 million VND/tael; jewelry gold price is traded at 55.30 - 56.30 million VND/tael.

Converting world gold price according to USD exchange rate at Vietcombank : 1 USD = 23,670 VND, world gold price is equivalent to 55.12 million VND/tael, 11.93 million VND/tael lower than SJC gold selling price at the same time.

Of the 24 Wall Street analysts participating in the Kitco News Gold Survey this week, only 10 analysts (42%) are bullish on gold in the near term; five analysts (21%) predict lower prices; the remaining nine (38%) see sideways prices this week. Of just 487 votes cast online, 258 small investors (52%) predicted gold would rise this week; another 126 (26%) predicted lower; the remaining 103 (21%) were neutral. |

Gold price forecast this week

Analyst Ole Hansen said the market needs to get back above $1,985 before some bullish sentiment returns to gold. "Right now, gold is supported by investors showing disbelief in the Fed's decisions as the yield curve continues to highlight the threat of a recession. But there is no trigger for a larger rally to $2,000 an ounce," he said.

Darin Newsom, senior market analyst at Barchart , reminded investors that, “sideways is still a technical direction.”

“The August gold daily chart is showing a generally sideways pattern. With this in mind, I expect the contract to trade between the recent high of $1,986 and the low of $1,953 and continue to wait for a clear breakout,” said Darin Newsom, an expert.

In the investment trend analysis, the proportion of retail investors who are bullish on gold is still higher this week, but market sentiment has fallen to its lowest level since May. Many retail investors also see limited upside for gold, with prices expected to end this week at around 1,982/ounce.

While most analysts remain cautiously optimistic, some see a bounce off support around $1,930 an ounce as a strong bullish signal.

Michele Schneider, director of research and trading education at MarketGauge , said she is bullish on gold as inflation remains a threat. “After the bearish signal emerged and gold briefly tested below $1,950 (around 1930 low) and held, we see higher potential for gold prices.”

"Drought is affecting food prices; sugar prices are consolidating near highs. Gold prices could eventually break through $1,980 and then $2,000," believes expert Michele Schneider.

James Stanley, senior market strategist at Forex.com , said he still sees room for gold prices to move higher.

"I think the market will see another test - gold will go above $2,000 in August. That support reaction to the $1,936 level around the Fed decision was intense and has not yet shown signs of easing. There are a lot of factors that can push gold higher, so there will be some resistance for gold to overcome, potentially a retest of $2,000 next week," said James Stanley, an expert. speak.

“The bigger question is whether the bulls will show up to bid above $2,000. I think that’s possible, given how active the market is on the back of the Fed’s pause,” the Forex.com strategist added.

Regarding the possibility of gold falling, expert James Stanley said that while most analysts still see gold in a long-term uptrend, gold could be sold off in the short term as the Fed maintains its strong hawkish monetary policy stance.

Naeem Aslam, chief investment officer at Zaye Capital Markets, forecasts gold prices to fall as technical downside momentum appears to be building.

Source

![[Photo] The 1st Congress of Party Delegates of Central Party Agencies, term 2025-2030, held a preparatory session.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/e3a8d2fea79943178d836016d81b4981)

![[Photo] Prime Minister Pham Minh Chinh chairs the 14th meeting of the Steering Committee on IUU](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/a5244e94b6dd49b3b52bbb92201c6986)

![[Photo] General Secretary To Lam meets voters in Hanoi city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/d3d496df306d42528b1efa01c19b9c1f)

Comment (0)