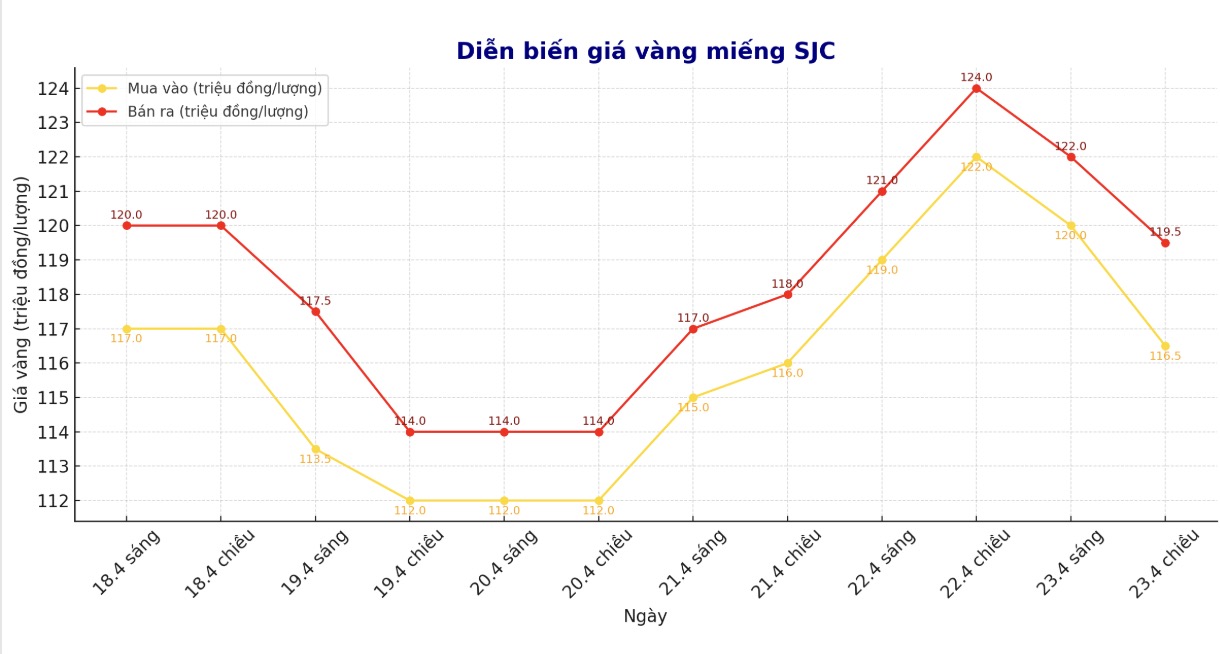

Specifically, updated at 4:20 p.m., at Saigon Jewelry Company SJC, DOJI Group listed the price of gold bars at 116.5 - 119.5 million VND/tael (buy - sell), down 3.5 million VND/tael for buying and down 2.5 million VND/tael for selling compared to the beginning of this morning's session; down 5.5 million VND/tael for buying and down 4.5 million VND/tael for selling compared to the closing price yesterday.

Bao Tin Minh Chau Company listed the price of gold bars and gold rings at 115 - 118 million VND/tael (buy - sell), down 1 million VND/tael in both buying and selling compared to the beginning of this morning's session; down 4 million VND/tael in both buying and selling compared to yesterday's closing session.

Phu Nhuan Jewelry Joint Stock Company listed the price of gold bars at 112.7 - 115.9 million VND/tael (buy - sell), down 3.3 million VND/tael for buying and down 3.2 million VND/tael for selling compared to the beginning of this morning's session; down 4.3 million VND/tael for buying and down 4.1 million VND/tael for selling compared to yesterday's closing price.

Saigon Jewelry Company (SJC) listed the price of gold rings at 112.5 - 115.5 million VND/tael (buy - sell), down 1.5 million VND/tael in both buying and selling compared to the beginning of the session this morning; down 3.5 million VND/tael in both buying and selling compared to the close of yesterday's session.

In the world market, JP Morgan Bank believes that gold prices are likely to exceed the threshold of 4,000 USD/ounce by 2026.

The reason is due to growing concerns about economic recession amid many changes in US tariff policy and ongoing US-China trade tensions.

JP Morgan expects gold prices to average $3,675 an ounce in the fourth quarter of 2025, then surpass $4,000 an ounce in the second quarter of 2026. The bank also believes that gold prices could rise faster than expected if actual demand is higher.

“Supporting our forecast of $4,000 an ounce by 2026 is continued strong demand from investors and many central banks, with average purchases of around 710 tonnes per quarter this year,” JP Morgan noted.

Spot gold has surged 29% and set 28 new records since the beginning of the year, hitting $3,500 an ounce for the first time on April 22. Goldman Sachs recently raised its gold price forecast from $3,300 to $3,700 an ounce by the end of 2025, and said that in an "extreme scenario" gold could trade near $4,500 an ounce by the end of 2025.

Regarding potential risks to gold prices, JP Morgan said the biggest risk is a sudden drop in demand for gold from central banks.

JP Morgan analysts also noted that a more negative scenario could emerge if US economic growth remains surprisingly resilient despite the tariffs. This could prompt the Federal Reserve to be more aggressive in dealing with inflation risks, leading markets to expect interest rate hikes even before inflation becomes a real concern.

Source: https://baoninhbinh.org.vn/gia-vang-chot-phien-23-4-tiep-da-giam-manh-025831.htm

![[Photo] More than 17,000 candidates participate in the 2025 SPT Competency Assessment Test of Hanoi National University of Education](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/e538d9a1636c407cbb211b314e6303fd)

![[Photo] Readers line up to visit the photo exhibition and receive a special publication commemorating the 135th birthday of President Ho Chi Minh at Nhan Dan Newspaper](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/85b3197fc6bd43e6a9ee4db15101005b)

![[Photo] Nearly 3,000 students moved by stories about soldiers](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/21da57c8241e42438b423eaa37215e0e)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on science and technology development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/17/ae80dd74c384439789b12013c738a045)

Comment (0)