Domestic gold price this afternoon April 2, 2025

As of 3:30 p.m. this afternoon, April 2, 2025, domestic gold shops slightly decreased both buying and selling prices, domestic gold simultaneously lost the 102 million VND mark, specifically:

At Saigon Jewelry Company (SJC), the price of gold bars was listed at VND99.1 million/tael (buy) and VND101.8 million/tael (sell). The price of gold this afternoon decreased by VND300,000/tael in both buying and selling directions compared to the end of yesterday's trading session.

DOJI system listed SJC gold at buying price of 99.1 million VND/tael and selling price of 101.8 million VND/tael. This price decreased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the buying price of SJC gold is 98.9 million VND/tael and the selling price is 100 million VND/tael. Thus, compared to yesterday's session, the gold price decreased by 1.1 million VND/tael in buying price and decreased by 1.5 million VND/tael in selling price.

Bao Tin Minh Chau Company Limited listed the price of SJC gold at 99.1 million VND/tael (buy) and 101.8 million VND/tael (sell). This price decreased by 300 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, April 2, 2025 is as follows:

| Today (April 2, 2025) | Yesterday (March 31, 2025) | |||

| Purchase price | Selling price | Purchase price | Selling price | |

| SJC | 99,100 ▼300K | 101,800 ▼300K | 99,400 | 102,100 |

| DOJI HN | 99,100 ▼300K | 101,800 ▼300K | 99,400 | 102,100 |

| DOJI SG | 99,100 ▼300K | 101,800 ▼300K | 99,400 | 102,100 |

| BTMC SJC | 99,100 ▼300K | 101,800 ▼300K | 99,400 | 102,100 |

| Phu Quy SJC | 98,800 ▼600K | 101,700 ▼300K | 99,400 | 102,100 |

| PNJ HCMC | 99,100 ▼300K | 101,800 ▼300K | 99,400 | 102,100 |

| PNJ Hanoi | 99,100 ▼300K | 101,800 ▼300K | 99,400 | 102,100 |

| 1. DOJI - Updated: April 2, 2025 15:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 99,100 ▼300K | 101,800 ▼300K |

| AVPL/SJC HCM | 99,100 ▼300K | 101,800 ▼300K |

| AVPL/SJC DN | 99,100 ▼300K | 101,800 ▼300K |

| Raw material 9999 - HN | 98,500 ▼900K | 100,500 ▼700K |

| Raw material 999 - HN | 98,400 ▼900K | 100,400 ▼700K |

| 2. PNJ - Updated: April 2, 2025 15:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| HCMC - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Hanoi - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Hanoi - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Da Nang - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Da Nang - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Western Region - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Western Region - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - PNJ | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - Southeast | PNJ | 99,100 ▼300K |

| Jewelry gold price - SJC | 99,100 ▼300K | 101,800 ▼300K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,100 ▼300K |

| Jewelry gold price - Jewelry gold 999.9 | 99,100 ▼300K | 101,600 ▼300K |

| Jewelry gold price - Jewelry gold 999 | 99,000 ▼300K | 101,500 ▼300K |

| Jewelry gold price - Jewelry gold 99 | 98,180 ▼300K | 100,680 ▼300K |

| Jewelry gold price - 916 gold (22K) | 90,670 ▼270K | 93,170 ▼270K |

| Jewelry gold price - 750 gold (18K) | 73,850 ▼230K | 76,350 ▼230K |

| Jewelry gold price - 680 gold (16.3K) | 66,740 ▼200K | 69,240 ▼200K |

| Jewelry gold price - 650 gold (15.6K) | 63,690 ▼200K | 66,190 ▼200K |

| Jewelry gold price - 610 gold (14.6K) | 59,630 ▼180K | 62,130 ▼180K |

| Jewelry gold price - 585 gold (14K) | 57,090 ▼170K | 59,590 ▼170K |

| Jewelry gold price - 416 gold (10K) | 39,920 ▼120K | 42,420 ▼120K |

| Jewelry gold price - 375 gold (9K) | 35,750 ▼110K | 38,250 ▼110K |

| Jewelry gold price - 333 gold (8K) | 31,180 ▼100K | 33,680 ▼100K |

| 3. SJC - Updated: 4/2/2025 15:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 99,100 ▼300K | 101,800 ▼300K |

| SJC gold 5 chi | 99,100 ▼300K | 101,820 ▼300K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 99,100 ▼300K | 101,830 ▼300K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 98,900 ▼300K | 101,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 98,900 ▼300K | 101,600 |

| Jewelry 99.99% | 98,900 ▼300K | 101,200 |

| Jewelry 99% | 97,198 | 100,198 |

| Jewelry 68% | 65,972 | 68,972 |

| Jewelry 41.7% | 39,354 | 42,354 |

The current buying price of SJC 9999 gold rings is 98.9 million VND/tael and the selling price is 101.5 million VND/tael. The buying price of gold rings decreased by 300 thousand VND/tael - unchanged in the selling price compared to the end of yesterday's trading session.

For Hung Thinh Vuong 9999 gold ring (DOJI), the buying price is 98.7 million VND/tael and the selling price is 101.4 million VND/tael, a decrease of 900 thousand VND/tael in buying price - a decrease of 700 thousand VND/tael in selling price compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings close to 101 million VND, at 99.2-101.9 million VND/tael (buy - sell); the price decreased by 600 thousand VND/tael for buying - decreased by 400 thousand VND/tael for selling.

World gold price this afternoon April 2, 2025

As of 3:30 p.m. this afternoon, April 2, the world gold price was listed at 3,133.03 USD/ounce, up 0.7 USD/ounce compared to the close of yesterday's trading session.

Gold prices were steady after hitting a record high in the previous session as investors cautiously awaited details of US President Donald Trump’s tax plans. US gold futures also rose 0.4% to $3,159.10.

Gold continues to be a safe investment choice amid economic and geopolitical uncertainty. It is now up more than $400 since before Trump took office in January and hit a record $3,148.88 on Tuesday.

President Trump has repeatedly referred to April 2 as “Liberation Day” and is expected to announce new tariffs on several countries at the White House event. Experts say the measures could slow economic growth and escalate trade tensions.

Gold is getting strong support from geopolitical and macroeconomic factors, and if Trump’s tariffs become more aggressive, gold prices could continue to rise, according to Soni Kumari, commodity strategist at ANZ.

Separately, a survey from the Institute for Supply Management (ISM) showed that business conditions in the US are showing signs of deterioration, with the manufacturing sector contracting in March after two months of growth.

The market is also waiting for the ADP employment report released today and non-farm payrolls data on Friday to assess the policy direction of the US Federal Reserve (Fed). Experts from BMI said that gold will continue to be the outstanding asset in the metal group, unless the Fed decides to raise interest rates.

Meanwhile, spot silver prices rose 0.5% to $33.90 an ounce, platinum prices fell slightly 0.2% to $977.97, and palladium prices rose 0.2% to $985.70.

Gold Price Forecast

UBS's baseline forecast for gold this year is $3,200 an ounce, but if the economy weakens sharply, gold could hit $3,500, according to UBS analyst Giovanni Staunovo.

Many forecasts suggest that gold prices could continue to rise, even reaching $3,500 an ounce by the end of the year. However, such a rapid increase also carries risks. A correction is entirely possible if current support factors soften.

If the US reaches a ceasefire in Ukraine, or the Trump administration does not continue to push ahead with its tax policies, gold prices could fall sharply. Some have even warned that gold prices could fall as much as 38% over the next five years, returning to around $1,820 an ounce – the equivalent of 2022. However, history shows that gold rarely falls more than 15% in major corrections.

At the PDAC 2025 conference in Toronto, Canada, Mr. Tavi Costa – macro strategist of Crescat Capital – made a remarkable comment. He said that if the US re-evaluates the ratio between the amount of national gold reserves and the total number of government bonds in circulation, gold could be revalued at a very high level.

David Morrison of Trade Nation said the market is currently in a state of “uncertainty.” Normally, after a dismal first quarter, investors would expect an upturn, but this year is different. Mr. Trump’s tax policy is a major reason for the market’s unsettled sentiment.

Global markets are now awaiting the official announcement of the reciprocal tariff package that Mr. Trump is expected to announce on April 2, also known as “liberation day.” According to Vietnam time, the announcement will be released at 2:00 a.m. on April 3.

Experts warn that if this policy is implemented, US trading partners could retaliate strongly, escalating global trade tensions to a new level. In that context, investors, speculators and even central banks are increasing their purchases of gold to hedge against risks.

Source: https://baonghean.vn/gia-vang-chieu-nay-ngay-2-4-gia-vang-trong-nuoc-va-the-gioi-quay-dau-giam-truoc-gio-phan-quyet-10294292.html

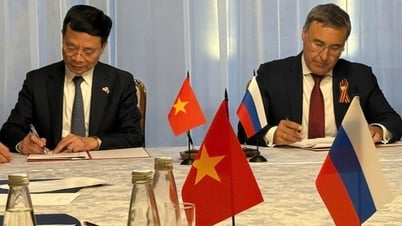

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

Comment (0)