Scenes of bustling gold trading on November 29th, the day gold prices peaked. ( Video : Minh Duc)

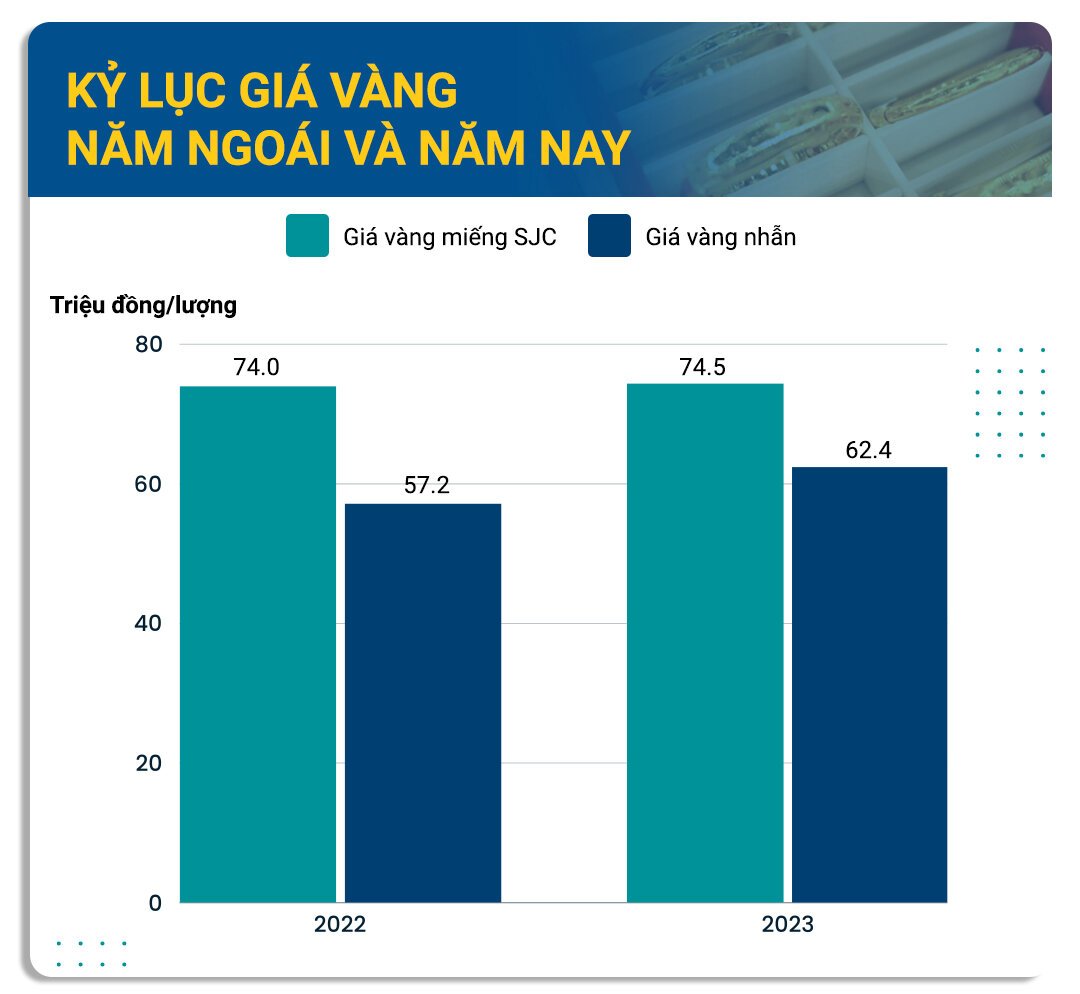

The final months of 2023 witnessed an incredible surge in gold prices in the Vietnamese market. On November 29, 2023, the price of SJC gold bars soared to 74.5 million VND/ounce, the highest in history, breaking the previous record of 74 million VND set in March 2022.

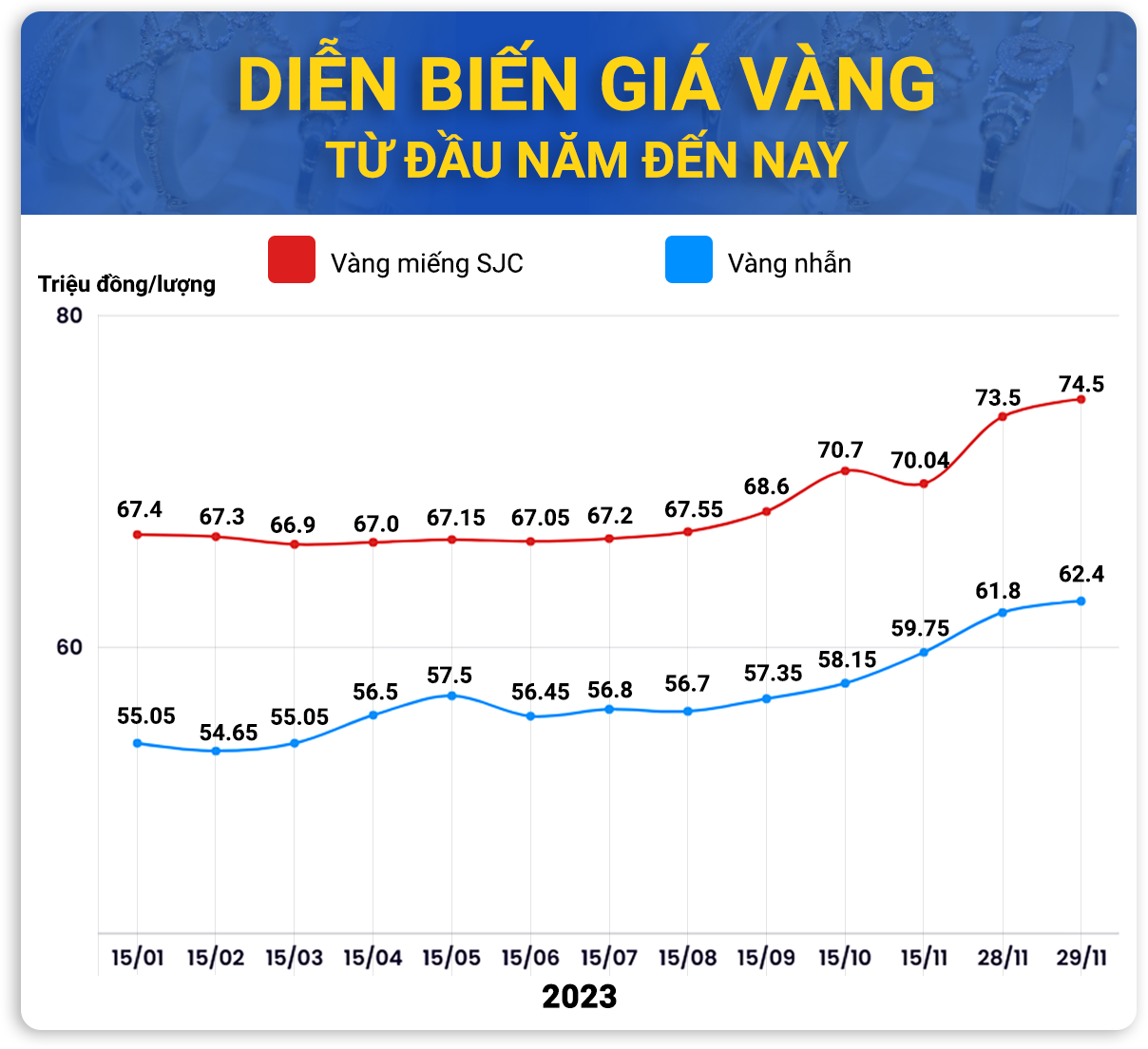

Comparing gold prices from the beginning of 2023 to the present reveals just how rapid the price of gold has become.

Specifically, from the beginning of January 2023 to November 29, 2023, the price of SJC gold bars increased by more than 7 million VND/ounce, from 67.4 million VND (on January 15, 2023) to 74.5 million VND/ounce on the morning of November 29. Meanwhile, the price of gold rings also increased by a corresponding 7.35 million VND/ounce, from 55.05 million VND/ounce to 62.1 million VND/ounce.

Gold prices have now surpassed their historical peak of 74 million VND/ounce, reached on March 8, 2022, and are at their highest level ever. The price of gold rings is also at an all-time high.

In 2023, after continuously increasing in January, at one point exceeding 69 million VND/ounce, domestic gold prices decreased and fluctuated within a narrow range of around 67 million VND/ounce for more than 5 months, from mid-February to the end of July.

However, from mid-September onwards, gold prices showed a remarkable trend, continuously rising to 69.35 million VND/ounce on September 19th, the highest level in a year.

By mid-October, the price of gold exceeded 70 million VND per tael. Since then, the price of gold has surged sharply. In just over a month, the price of gold has increased by more than 4 million VND per tael.

Domestic gold ring prices also recorded a corresponding increase compared to gold bars. In February 2023, the price decreased by 400,000 VND/ounce, to 54.65 million VND. From March 2023, gold rings traded around 56-57 million VND, lasting for six months.

By November, the price of gold rings had been continuously rising, exceeding 59 million VND/ounce, then 60 million VND/ounce, and has now surpassed 62 million VND/ounce, reaching its highest price in history.

Speaking to VTC News , economist Associate Professor Dr. Dinh Trong Thinh outlined three main reasons why domestic gold prices have been rising continuously, surprising consumers time and again.

Firstly, this stems from stricter management of gold transactions. After the State Bank of Vietnam issued Circular 12, amending and supplementing several articles of legal documents regulating the implementation of state foreign exchange reserve management tasks, rumors emerged that trading in gold bars would be prohibited. This led many people to believe that buying gold bars would be difficult. As a result, they rushed to buy, causing the price of gold to rise.

Although gold businesses have assured people that they can still buy gold as usual, gold prices remain high.

Secondly, interest rates have been continuously falling recently, making investment difficult. Some people who deposit money in banks are not earning much interest. Meanwhile, investment opportunities are limited due to businesses having fewer orders and scaling back. Although the last two months of the year are predicted to be a boom period for production and business, investors seem to lack confidence. Therefore, money tends to flow into precious metals like gold. The mentality of "buying gold because it retains its value" makes many people prefer to hoard gold.

Thirdly, with the year-end approaching, the demand for gold jewelry for weddings and engagements is increasing, which could drive up gold prices. The scarcity of raw materials, limited supply of SJC gold bars, coupled with the rising global gold prices, is causing domestic gold prices to become increasingly volatile.

Economist Dr. Nguyen Tri Hieu also analyzed that domestic gold prices are being affected by world gold prices. In addition, there are other contributing factors.

With the macroeconomic situation in a difficult state, investors are looking for an investment channel that offers high returns.

Furthermore, other investment markets have not shown any signs of improvement, giving gold an advantage.

“The stock market is sluggish, the real estate market is stagnant, while bank deposit interest rates are falling day by day, only foreign currency and gold are rising. When investors cannot choose stable and profitable investment channels, they will turn to gold,” commented Dr. Nguyen Tri Hieu.

Sharing the same view, Dr. Nguyen Minh Phong stated that the recent surge in world gold prices to over $2,000 per ounce, amidst escalating geopolitical tensions, has impacted domestic gold prices.

This morning, world gold prices also set a record. Specifically, the world gold price listed on Kitco today is $2,048 per ounce (at 8:40 AM), an increase of $35 per ounce compared to the beginning of yesterday morning.

Precious metal prices surged on expectations that the US Federal Reserve (Fed) had ended its interest rate hikes. These expectations were further heightened by recent comments from Fed officials. Less hawkish views put pressure on the US dollar and supported the precious metals market.

Global gold prices have risen sharply in recent weeks, after the US Federal Reserve (FED) signaled a halt to its interest rate hike cycle at its November meeting and in the coming months, and a possible start to a rate cut cycle from mid-2024. The FED's decision to stop raising interest rates indicates that the country's monetary policy has begun to shift towards greater easing, and the sharp drop in the US dollar index (DXY) has benefited gold prices.

The protracted Russia-Ukraine conflict shows no signs of abating, and more recently, the conflict between Israel and Hamas – despite a ceasefire, remains uncertain. This geopolitical tension will impact the global economy and oil prices, leading some banks and investment funds to adopt a more cautious approach and invest in gold.

Demand for gold jewelry also increases during the year-end season in several countries such as the US, Europe, and Asia, including China, India, and Vietnam, which is also in wedding season.

Equally important is the demand for gold purchases by central banks. As of the third quarter of 2023, central banks had purchased approximately 800 tons and this number could exceed 1,000 tons this year.

Stable or stagnant gold supply coupled with rising demand is driving gold prices to record highs. Many forecasts suggest that the price of the precious metal in the global market could continue its upward trend over the next 1-2 months, heading towards $2,050 per ounce or breaking the historical peak of $2,080 per ounce.

From the beginning of the year, many experts predicted that 2023 would bring gold to an all-time high. Eric Strand, manager of the AuAg ESG Gold Mining ETF (comprising 25 gold mining companies), stated: “A new bull market will begin, with prices exceeding $2,100 per ounce. By the end of 2023, gold will be at least 20% higher.”

Speaking to Kitco News, Thorsten Polleit, chief economist at Germany-based Degussa Bank, predicted that gold prices would end 2023 around $2,200 per ounce and remain a safe-haven asset amid a struggling bond market and a weakening US dollar.

In addition, there are complex developments in the banking sector of the world's number one economy. Precious metal prices will rise as the money supply strengthens, interest rates fall, and the banking troubles spill over into the broader economy.

Goldman Sachs forecasts the average gold price to be $2,078 per ounce in the third quarter of 2023, and then continue to rise to $2,108 per ounce in the fourth quarter of this year. Based on this forecast, gold is estimated to have an average price of approximately $2,021 per ounce in 2023.

Goldman Sachs even suggests that the upward trend in gold prices will not stop there, and the precious metal will record an average price of $2,175 per ounce in 2024. After that, the price will fall to $2,087 per ounce in 2025 and $2,000 per ounce in 2026.

In fact, the price of gold has now reached $2,045 per ounce and shows no signs of stopping.

Although gold prices are expected to continue rising, many experts still warn people to be cautious when investing.

Expert Nguyen Minh Phong believes that while gold prices are rising, this is certainly not a long-term trend. Recently, gold prices have frequently risen rapidly but also fallen just as quickly.

"Gold prices are unstable, so investors should not invest heavily, especially those who are short-term speculators should be extremely cautious," Mr. Phong said.

Associate Professor Dr. Dinh Trong Thinh also advised: "Gold buyers should be cautious when domestic gold prices continuously increase but do not completely synchronize with world gold prices. In the long term, domestic gold prices will also fluctuate up and down according to world prices, so a reversal is entirely possible."

Meanwhile, Dr. Nguyen Tri Hieu commented that the gold market is always unstable. The current increase in gold prices does not mean they will continue to rise steadily until the end of the year. “The important thing is never to borrow money from others to invest in gold. If the price of gold falls unexpectedly, gold buyers will face significant financial difficulties. If you have the financial means to invest in gold at this time, you should only invest one-third of your savings, not put all your eggs in one basket,” said Dr. Nguyen Tri Hieu.

"If we were to rate them on a scale of 10, I would say the gold market scores 7 points, the stock market 4 points, real estate 5 points, and banks, despite low interest rates, are the safest market and still generate consistent returns, so investing in bank deposits remains the highest-rated option, at 8 points," Mr. Hieu added.

Meanwhile, Mr. Huynh Trung Khanh, Vice President of the Vietnam Gold Business Association and senior advisor to the World Gold Council in Vietnam, believes that there may be a shift from savings deposits to gold, but not a significant one. Investors may only buy additional gold to diversify their assets, evidenced by the lack of a sudden surge in demand. Generally, global experts also recommend investing only 15-20% of assets in gold, depending on individual risk tolerance.

Some other gold experts believe that the sharp increase in SJC gold prices has widened the gap with world gold prices to 14 million VND/ounce, while gold rings and jewelry are about 2.3 million VND/ounce higher than world prices. Therefore, if you want to buy gold, you should buy 24K gold rings and jewelry, which will fluctuate more closely with world prices and mitigate the risk of SJC gold prices falling sharply again.

Source

Comment (0)