Steel prices in the North

According to SteelOnline.vn, Hoa Phat steel brand, with CB240 coil steel line at 13,480 VND/kg; D10 CB300 ribbed steel bar is priced at 13,580 VND/kg.

Viet Y steel brand, CB240 steel coil line is at 13,430 VND/kg; D10 CB300 ribbed steel bar is priced at 13,400 VND/kg.

Viet Duc Steel, with CB240 coil steel line at 13,430 VND/kg, D10 CB300 ribbed steel bar priced at 13,690 VND/kg.

Viet Sing Steel, with CB240 coil steel priced at 13,300 VND/kg; D10 CB300 ribbed steel bar priced at 13,600 VND/kg.

VAS steel, with CB240 coil steel line at 13,350 VND/kg; D10 CB300 ribbed steel bar is priced at 13,600 VND/kg.

Steel prices in the Central region

Hoa Phat Steel, with CB240 coil steel down to 13,480 VND/kg; D10 CB300 ribbed steel bar priced at 13,580 VND/kg.

Viet Duc Steel, currently CB240 coil steel is at 13,740 VND/kg; D10 CB300 ribbed steel bar is priced at 13,990 VND/kg.

VAS Steel currently sells CB240 coil steel at 13,650 VND/kg; D10 CB300 ribbed steel bar is priced at 13,450 VND/kg.

Pomina steel, with CB240 coil steel line at 14,180 VND/kg; D10 CB300 ribbed steel bar is priced at 14,180 VND/kg.

Steel prices in the South

Hoa Phat Steel, CB240 rolled steel at 13,640 VND/kg; D10 CB300 rebar steel decreased to 13,580 VND/kg.

VAS steel, CB240 coil steel line is at 13,350 VND/kg; D10 CB300 ribbed steel bar is priced at 13,600 VND/kg.

Pomina steel, CB240 coil steel line is at 13,970 VND/kg; D10 CB300 ribbed steel bar is priced at 13,970 VND/kg.

Steel prices on the exchange

Rebar on the Shanghai Futures Exchange (SHFE) for May 2025 delivery rose 236 yuan to 3,618 yuan per tonne.

The iron ore market has undergone complex and dynamic changes in late September, responding to economic news and actions by the Chinese government.

As of September 27, the January iron ore futures contract, the most traded on the Dalian Commodity Exchange, had recovered 9% from September 20 to $106.94 a tonne. On the Singapore Exchange, the underlying October futures contract rose 10.9% to $103.10 a tonne, thus recovering to early September levels.

Iron ore prices have been on a downward trend for most of September, hitting their lowest levels in recent years due to a number of factors, including China's weak economic recovery, causing uncertainty in the steel market and reducing iron ore consumption by steelmakers.

The Chinese government announced new incentives to support the economy. In response, iron ore prices jumped more than 7% in one day, their biggest one-day gain in a year. The rise was fueled by hopes that the new support measures would spur infrastructure projects and increase demand for steel, and therefore iron ore.

Currently, the Chinese government continues to offer financial and tax incentives to support both domestic markets and foreign investment. These measures are aimed at boosting economic growth, which has slowed due to a weak real estate market and general industrial problems.

Analysts stressed that the iron ore market situation in 2024 is uncertain due to geopolitical challenges and economic uncertainty. At the same time, the measures taken by China create opportunities for further growth. Investors are closely monitoring market trends and expect China to continue to introduce new measures to support the economy in the coming months.

ANZ Research expects iron ore prices to be in the $90-$100/tonne range by the end of 2024 amid China’s weak fundamentals. In a worst-case scenario, prices could fall to $60-$80/tonne.

HSBC Holdings, a British international commercial bank, expects iron ore prices to reach $100 a tonne by 2024. Capital Economics predicts prices for the raw material will hover between $99 and $100 a tonne. By the end of next year, iron ore prices will fall to $85 a tonne.

Source: https://kinhtedothi.vn/gia-thep-hom-nay-2-10-tang-do-nhu-cau-duoc-cai-thien.html

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

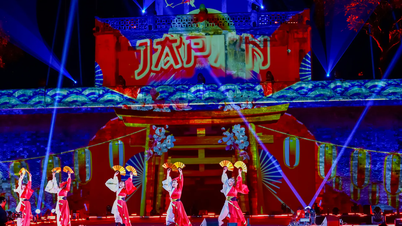

![[Photo] Nhan Dan Newspaper launches “Fatherland in the Heart: The Concert Film”](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/16/1760622132545_thiet-ke-chua-co-ten-36-png.webp)

Comment (0)