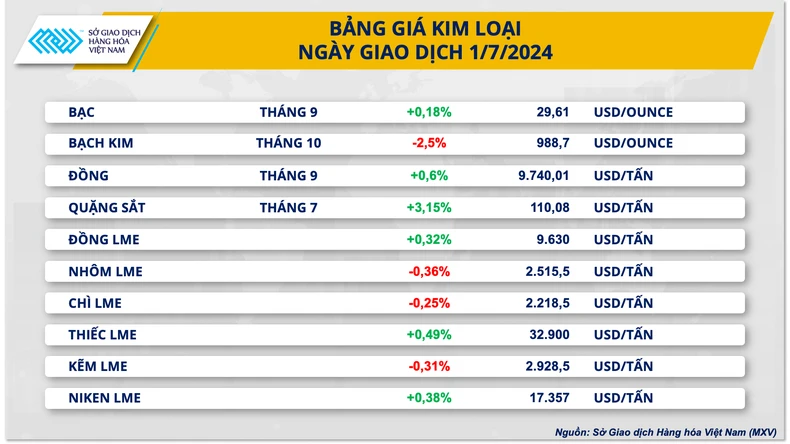

Right from the opening, the prices of these two commodities were under pressure as investors showed caution as the market received a series of important macro data this week, including the manufacturing purchasing managers index (PMI), the minutes of the June interest rate meeting and the US non- farm payroll report.

The weakness in silver and platinum prices continued into the evening session, dominated by the strengthening US dollar. Despite weak economic data, as shown by the US manufacturing PMI index contracting for the third consecutive month, the US dollar still rose strongly in the evening session on the optimistic signal from the case of former President Donald Trump.

Specifically, the US Supreme Court has ruled that he will have some immunity from criminal prosecution. This move is considered beneficial for Mr. Trump. Meanwhile, investors are now expecting that if Mr. Trump wins the election in November, the US economy will benefit. Therefore, this information has had a "bullish" impact on the USD, causing the Dollar Index to increase sharply from 105.6 to 105.9 points. The price of precious metals is therefore also under pressure.

|

For base metals, COMEX copper prices rose 0.6% to $9,740.01 a tonne following a series of optimistic forecasts from analysts.

Specifically, industry experts believe that copper has the potential to increase prices strongly in the second half of this year, due to continued tight supply while demand improves in China. According to forecasts, the copper concentrate market could have a deficit of about 500,000 tons by 2025, up from the expected deficit of 200,000 tons this year.

Accordingly, Citi Research forecasts that copper prices will stabilize at $9,500 in the third quarter and increase to $12,000 by the end of this year to the first quarter of next year.

In the same trend, iron ore prices increased by more than 3% to 110.08 USD/ton, the highest level in the past two weeks. Iron ore is a commodity sensitive to China's economic stimulus. Therefore, the expectation that China will continue to launch measures to support the economy at the Central Conference (July 15-18) helped iron ore prices receive strong buying pressure in yesterday's session.

Source: https://nhandan.vn/gia-quang-sat-tang-hon-3-nho-ky-vong-trung-quoc-kich-thich-kinh-te-post817142.html

Comment (0)