| Commodity market today, September 20th: MXV-Index extends its winning streak to the 7th session. Commodity market today, September 24th: Coffee and agricultural product prices reverse course and rise sharply. |

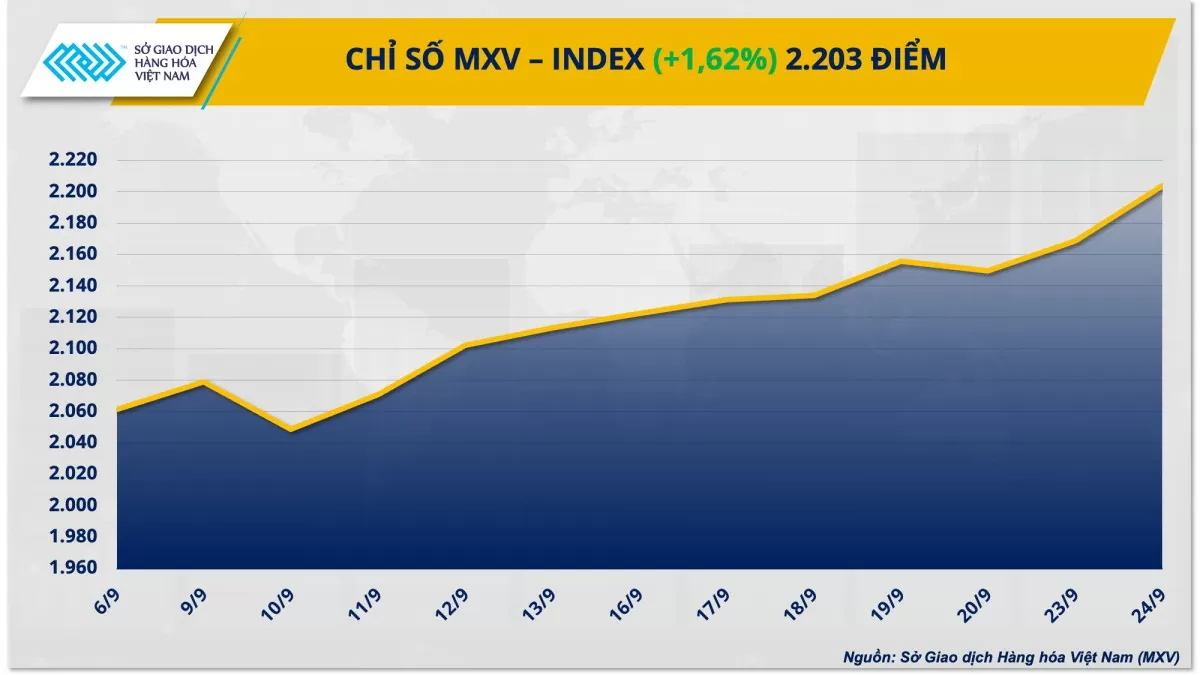

The Vietnam Commodity Exchange (MXV) reported that buying pressure continued to dominate the global raw materials market yesterday (September 24), pushing the MXV-Index up more than 1.5% to 2,203 points. Notably, prices of all metal commodities surged after China launched its largest economic stimulus package since the Covid-19 pandemic and tensions escalated in the Middle East. In contrast, many agricultural commodities such as corn and wheat reversed course and weakened after a strong start to the week.

|

| MXV-Index |

Metal prices surge across the board.

At the close of trading on September 24th, all metal commodities rose in price, supported by macroeconomic factors, particularly China's economic stimulus measures. For precious metals, silver and platinum prices both recovered, rising by 4.33% and 2.69% respectively, closing at $32.43/ounce and $987.7/ounce.

|

| Metal price list |

Money continued to flow into precious metals as the market reacted to the Federal Reserve's 50-basis-point interest rate cut last week. Additionally, silver and platinum continued their recent gains as escalating tensions in the Middle East prompted investors to seek safe-haven assets. Concerns about a new conflict involving Iran are growing after Israel targeted Hezbollah positions in southern Lebanon.

For base metals, commodities in the group surged across the board following economic stimulus measures by China, the world's largest consumer of industrial metals. Most notably, COMEX copper prices rose 3.31% to $9,902 per ton, reaching their highest closing price in over two months. Iron ore prices also recovered from a one-year low, rising 5.9% to $94.74 per ton.

Specifically, yesterday morning, the People's Bank of China (PBOC) announced plans to launch the largest and most significant economic stimulus package since the Covid-19 pandemic began, the latest move by the government to revive the struggling economy.

This stimulus package includes a 50 basis point reduction in the reserve requirement ratio (RRR), a 20-30 basis point reduction in the medium-term lending facility (MLF) and the loan prime rate (LPR), along with a range of other interest rates. In addition, the PBOC also announced a support package for the struggling real estate market, including a reduction in borrowing costs of up to $5.3 trillion for mortgages and easing of regulations on second home purchases.

Although policymakers announced the stimulus package later than market expectations, it was still seen as a positive sign that helped boost public confidence, thereby helping the economy escape deflation and regain growth momentum. As a result, the prices of copper and iron ore, commodities sensitive to China's economic stimulus measures, surged sharply from yesterday morning and closed the session with significant gains.

Corn and wheat prices both weakened.

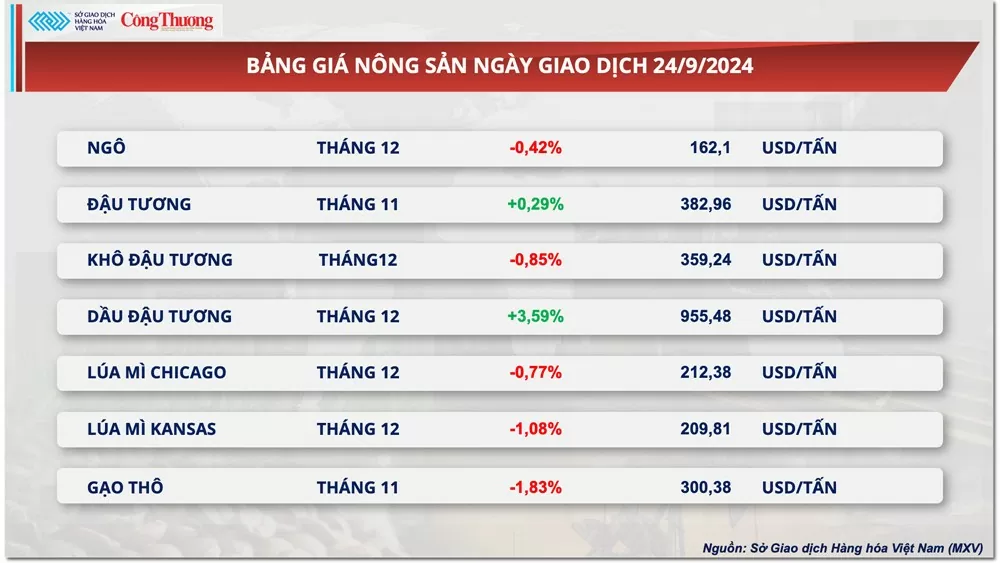

December corn futures fluctuated during the trading session on September 24th, closing with a slight decrease of 0.42%. On one hand, sellers were driven by positive crop conditions in the US. On the other hand, corn prices continued to receive support from the country's favorable export results in the shipment report earlier this week.

|

| Agricultural product price list |

In its Crop Progress report yesterday, the U.S. Department of Agriculture (USDA) stated that the percentage of good/excellent quality corn reached 65% last week, unchanged from the previous week and higher than the market's expectation of 64%. Furthermore, harvesting has accelerated, with approximately 14% of the acreage completed as of September 22nd, lower than analysts' predictions of 17%, but still higher than historical data. These figures indicate that the U.S. crop is still progressing favorably, putting significant pressure on corn prices.

Similar to corn, December wheat futures prices also fluctuated sharply yesterday, with sellers dominating and closing down 0.77%. Selling pressure on wheat prices mainly stemmed from profit-taking by the market, amid lingering concerns about supply from the Black Sea region.

According to data from the Crop Progress report, 96% of the U.S. spring wheat acreage had been harvested as of September 22nd, up 4 percentage points from a week earlier and higher than the predicted 95%. For winter wheat, planting is progressing well, with approximately 25% of the expected acreage already planted, up 11 percentage points from a week earlier, but still lower than the market's expected 27%. Overall, this year's wheat crop in the U.S. is progressing favorably, contributing to downward pressure on prices.

Meanwhile, extreme weather in Russia is worsening the outlook for this year's grain production and disrupting new planting activities in the country, helping to support wheat prices. Heavy rains have flooded large areas of farmland, making production extremely difficult.

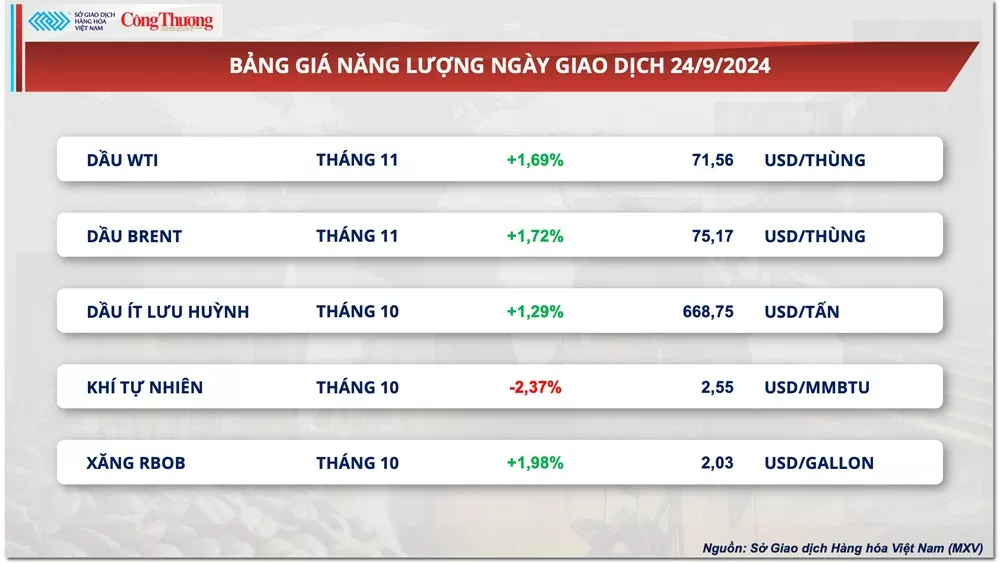

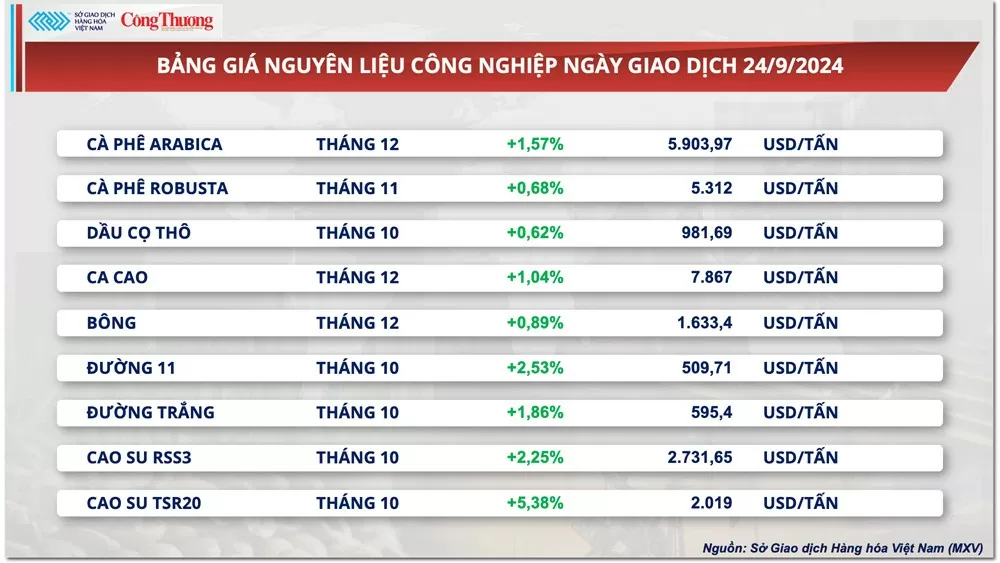

Prices of some other goods

|

| Energy price list |

|

| Industrial raw material price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-259-gia-ngo-va-lua-mi-dong-loat-suy-yeu-348214.html

![[Photo] Prime Minister Pham Minh Chinh attends the ceremony commemorating the 80th anniversary of the establishment of May 10 Garment Corporation.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2026%2F01%2F08%2F1767888283715_ndo_br_tttrao-jpg.webp&w=3840&q=75)

Comment (0)